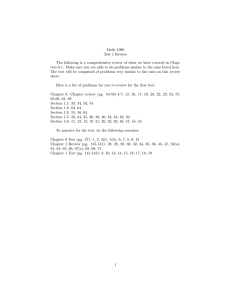

PRINCIPLES OF ACCOUNTING ACG 2011

advertisement

PRINCIPLES OF ACCOUNTING ACG 2011 Instructor: Julio C. Borges Phone: 305-237-1236 Messages: 305-237-1199 E-mail: jborges@mdc.edu Office: North Campus, Bldg. 3 Suite 3242, # 53 Office hours: to be announced in class “Whether you think you can do a thing or not, you are right” Henry Ford Dear students, With this thought I would like to welcome you to our class. It is our philosophy that in school as in life, attitude is as important as aptitude. If you are willing to come to our class with a positive can do attitude, and you are willing to work hard, you will succeed. Best of luck, and please let us know how we can be of help in achieving your goals. Have a great semester!!! Sincerely, J.Borges Required Text: Financial & Managerial Accounting, Warren, Reeve, & Fess, 8th Edition Working Papers: Chapters 1- 13. A calculator, preferably one with math functions is also required. (Study Guide is recommended) ***This class covers chapters 8-13 of the text. ACG 2001 is a pre-requisite of this course Additional Required Course Materials: Financial & Managerial Accounting Working Papers,” 8th Edition, by the same authors. General Ledger Software, BIZTEST Tutorial System, videos and internet access are available in the Business Resource Center, Room 3132, Building 3000. Attendance: Your attendance and participation are vital for the proper understanding and discussion of the material. Class roll will be taken at each session. It is your responsibility to make up work missed because of absences and to find out what material has been assigned for the day. Attendance and class participation is worth 10 points toward the final grade Objectives: You will review accounting principles, and the basic accounting cycle, covered in ACG 2001. In addition, you will obtain an understanding of inventories, fixed and intangible assets, current liabilities, organization of corporations, income taxes, and stockholders equity, investments in stocks, bonds payable and investment in bonds, and others. Lab: ACG 2011L (1 credit) is a co-requisite of this course. You must register at the accounting lab to satisfy the lab assignment, Comprehensive Problem 3. The problem is due upon the completion of Chapter 10, and is worth 10 points towards your final grade. The lab is located in Room 3231, North Campus. You must attend the lab a minimum of 15 hours this term. Tutors, text book solutions, videos, and Power Point presentations are available in the lab. Please bring your student ID and a paid schedule. The publisher provides the following website, httpp://warren.swcollege.com, which is very helpful. Please check it out. Homework: Please do your homework daily, do not fall behind. You must complete it in order to understand the material covered in class. Each homework problem will be collected on the day of the related exam and it is worth 1 point towards your final grade. Completion of homework is also needed for class participation Service learning project: A service learning project is required in this class. You will demonstrate proof that you have used your accounting skills to assist in the betterment of the community. Ie., help in preparation of income tax returns, bookkeeping assistance to a non-profit organizations, and others.. We will discuss this project in class. A one-page summary of the project will be submitted. This project is worth 10 points towards your final grade. The service project is due one week before your final exam Grading: Your final grade will determined as follows: Exam 1- Chapters 8 & 9- 100 points Exam 2- Chapters 10 & 11– 100 points Exam 3-Chapters 12 & 13- 100 points Exam 4- Final Exam (Chapters 8-13)100 points At the end of the course the total of all possible earned points in the class will be added. Your personal score will be divided by the total number of points to calculate your grade. Total points: Attendance & Participation Homework Comprehensive Problem Service Learning Project Exams Total 10 points 15 ” 10 ” 10 ” 400 ” 445 points Biztests: You can earn up to an additional 6 points by completing and scoring 80% or more in the Biztests for each topic. Biztests are found in the Business Resource Center Please make prior arrangements for make-up tests. Also, a cumulative make-up test (Chapters 8-13) will be given at the end of the term. That test will replace one of the regular tests. If you miss more than one test, the others will be replaced with a “0”. You may take the make-up test to replace any of the grades in the first three exams. The final exam cannot be replaced. Grading Scale: 90%-100% 80%-89% 70%-79% 60%-69% A B C D Academic Dishonesty Procedure: You are to work independently on tests. Please remember that talking or helping a fellow student during a test is prohibited, and may result in the implementation of the Academic Dishonesty Procedure. This Procedure reads as follows: “If a student is caught cheating in a test or work related in class, the student will receive one warning before the dishonesty procedure becomes effective. This procedure will be one of the following: (1) a lower grade for the course; (2) a grade of F for the course; or, (3) removal from the course.” Ethical Behavior and Classroom Conduct: All cell phones and beepers must be turned off during class time. Courteous, professional conduct is expected always. Course Withdrawal: If you decide to withdraw from the class, please turn in a drop card at the Registrar’s Office prior to the withdrawal date specified by the college for the current term. If your name appears on the class roll after the withdrawal date, a grade must be assigned by the instructor. An “Incomplete” will be given only for a serious, documented, long-term illness or accident. Only if you become disabled after the course drop date, and only if all work has been completed by the drop date, will you be eligible for an incomplete grade. Incomplete grades are not to be used to gain extra time to achieve a better grade or higher standards. The instructor has the ultimate decision to grant an incomplete grade. Assignment Sheet Overview of course Review of Chapters 1-7 Chapter 8-Inventories Self Examination Questions Exercises 4, 5, 7, 8, 13, 15, 18, 19 Problems 8-1A, 8-2A, 8-3A Chapter 9-Fixed, Intangible Assets Self Examination Questions Exercises 1, 5, 6, 7, 10, 18, 20, 21 Problem 9-2A, 9-4A Review Chapters 8 &9 Exam 1, Ch. 8 & 9 Chapter 10-Current Liabilities Self Examination Questions Exercises 2, 3, 4, 9, 11, 14, 16 Problem 10-2A, 10-3A COMPREHENSIVE PROBLEM 3- DUE Complete Chapter 10 Chapter 11- Corporations Self Examination Questions Exercises 2, 3, 5, 9, 11, 13, 14 Problems 11-1A, 3-A, 4-A Review Chapter 11 Review Chapters 10 & 11 Exam 2, Chapters 10 & 11 Ch. 12-Corp. Income and Taxes, Stockholders’ Equity & Inv. In Stocks Self-Examination Questions Exercises 1, 11 Problem 12-1A, 12-4A Chapter 13-Bonds Payable & Inv. in Bonds Self-Examination Questions Exercises 11, 12, 13 Problems 13-2A, 13-4A Review Chapters 12 & 13 Exam 3, Chapters 12 & 13 Review of Exam 3 SERVICE LEARNING PROJECT DUE General review, Chapters 8-13 Final Exam & Make-up Exam