Chapter 20 Worksheet

advertisement

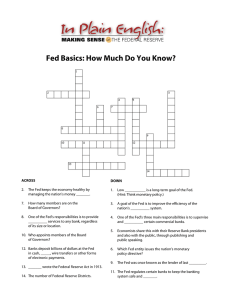

Chapter 20 Worksheet Section 1 1. What are the five rights of the Consumer Bill Of Rights? 2. What group warns consumers about dishonest business practices? 3. What is a warranty? 4. What term refers to people that buy products? 5. What two resources are involved in making a purchase? 6. What type of income is used for luxury items? Section 2 7. What do items bought with credit frequently cost the consumer a higher amount? 8. What do we call a record of money that is earned and spent? 9. What is bankruptcy? How long does it remain on a person’s credit rating? 10. What is credit? 11. What term means higher expenses than income? 12. Why would a lender require collateral? Section 3 13. How do CD’s compare to savings accounts? 14. What are the two most common stock indexes? 15. What do we call money earned on money put in a savings account? 16. What do we call partial ownership in a company? 17. What is a bounced check? 18. What is a dividend? 19. What protects money in a savings account? Section 4 20. What is making purchases because of feelings or emotions? Chapter 22 Section 2 9. Name and describe the two types of unions. 10. What agency oversees union elections? 11. What agreement involves a third party giving the final decision on how to settle a disagreement? 12. What are right to work laws? How many states have passed them? 13. What are two purposes of picketing? 14. What is a labor union? 15. What is mediation? 16. What term is referred to as an order by the court preventing an activity? 17. What term means a refusal to buy? 18. What type of arrangement required workers to join a union before they could be hired? Why do these no longer occur? Chapter 24 Section 1 1. How do economists define money? 2. What are three functions of money? 3. What do financial institutions do with the money placed into it by people and businesses? 4. What is the FDIC? 5. What two factors make the United States financial system so safe? 6. What type of financial institution works on a non-profit basis? 7. Why does money have value? Chapter 24 Section 2 8. How many members make up the Board of Governors? How do they get these positions? 9. What are the three ways that the Fed acts as the government’s bank? 10. What are three tools the Fed uses to manipulate the money supply? 11. What is monetary policy? 12. What is the central bank of the United States? How many districts is it divided in to? Section 3 13. What are checking accounts used for? 14. What is an advantage of savings accounts? 15. Who starts banks?