Document 17621747

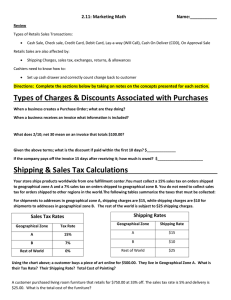

advertisement

Credit card fee (percent of sales based on a sliding scale) › Travel and entertainment cards is slightly higher than bank cards › 1.79% (MC/Visa) - 3.25% (Am Ex) Debit card fee (flat fee no matter how much purchase is) Purchase Discount – set amount of money that a business saves on a specific order if the payment is made within a certain period of time. › Ex: A purchaser brought a $100 item, with a purchase discount term 3/10, net 30. If he pays within 10 days, he will only need to pay $97. If not, the amount needs to be fully paid within 30 days. Bulk discounts – purchasing a large quantity and getting a discount on the price Your store ships products worldwide from one fulfillment center. You must collect a 15% sales tax on orders shipped to geographical zone A and a 7% sales tax on orders shipped to geographical zone B. You do not need to collect sales tax for orders shipped to other regions in the world. The following tables summarize the taxes that must be collected: Sales Tax Rates Geographical Zone Tax Rate A 15% B 7% Rest of World 0% You must also charge shipping for orders shipped to geographical zone A and geographical zone B. For shipments to addresses in geographical zone A, shipping charges are $15, while shipping charges are $10 for shipments to addresses in geographical zone B. The rest of the world is subject to $25 shipping charges. Shipping Rates Geographical Zone Shipping Rate A $15 B $10 Rest of World $25 Can increase the cost of items, overall, to cover credit card charges and frequent discounts Retailers want to make money, so they pass the charges/loss of revenue because of discount down to the customer Don’t have to figure “in your head” or by hand calculations of charges and/or discounts Cash register/POS (point of sale) terminal/Register does it for you, so you don’t have to make change › Ex: $6.65 sale. You are given a $10 bill. How will you make change? Lessens the time taken to double check figures. Drawer/register doesn’t balance Costs the retailer money May cost the retailer a customer › Ex: Overcharging the customer › Ex: Customer loses confidence in store, as the transaction wasn’t correct Takes time to redo the sale/void out the previous transaction Books/accounting don’t reconcile