Lecture VI Country Risk Assessment Methodologies: the Qualitative, Structural Approach to Country Risk

advertisement

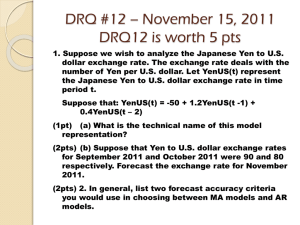

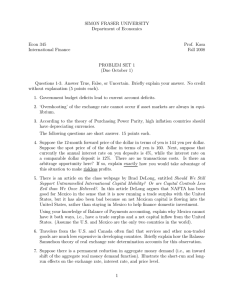

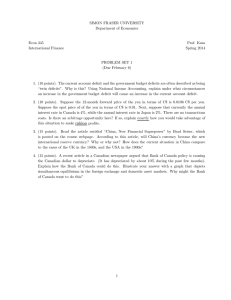

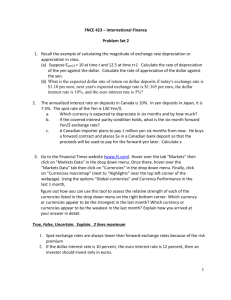

Lecture VI Country Risk Assessment Methodologies: the Qualitative, Structural Approach to Country Risk - The Macroeconomic Fundamentals - The Qualitative Approach A robust qualitative approach leads to comprehensive country risk report that tackle the following six elements: Social and welfare dimension of the development strategy; Macroeconomic fundamentals; External indebtedness evolution, structure and burden; Domestic financial system situation; Assessments of the governance and transparency issues; Evaluation of the political stability. Global GDP Contraction Country-Specific Economic risk Macroeconomic Risks: •Inflation and Hyperinflation; •Exchange rate; •Terms of Trade; •Debt Service. GDP in value and in volume The Inflation Rate Inflation = increase in the general level of prices; How to measure inflation? Consumer Price Index; Producer’s input and output prices Index; GDP deflator. Causes of Inflation: Demand Pull the Economic Cycle! Supply Shocks; OPEC I (1970s) oil prices from 3$ a barrel to 11.65$; OPEC II (1980s) over 36$ a barrel; Nowdays. The Inflation Rate (2) The Inflation Rate (3) The Cost of Inflation Real Interest Rate; Inflation tax; Menu costs; Relative Price VS General Price Level ↓ Economic Efficiency; Volatitlity of Inflation: Reduces investment; Income Redistribution. Nominal Illusion. Deflation DEF: Decrease in the general level of prices Japan since 1999 The Cost of Deflation: Effect on Real Interest Rate, Savings and Investment; Effect on the real burden of debt. Hyperinflation Inflation is running at more than 50% at month; CAUSE: large fiscal deficit that, without tax or bond issues, led govs to finance their activities through the inflation tax and by printing money. Unless the gov reforms its fiscal position it has to print money and create inflation. It has origin in fiscal policy (government’s decision about spending and taxation) and not monetary policy (gov’s decision for investing and loaning money); Hyperinflation (2) WHERE: Latin America and Central East Europe (1920s and 1914-1918); Government issues to finance the debt: Hungary = 48%; Poland = 62%; Germany = 88%. End of Hyperfinflation when: New currency issue; Fiscal reform; Return to fiscal surplus; Establishment of an indipendent central bank ignore the demand of the fiscal authority! The Qualitative Approach Country-Specific Economic risk Macroeconomic Risks: •Inflation and Hyperinflation; •Exchange rate; •Terms of Trade; •Debt Service. Exchange Rate Types of Exch rates: Nominal Exchange rate determinats: Bilateral and effective Exch rate Nominal VS real Exch rate. CIP UIP Risk Adverse Investor Currency Crisis and the Exchange Rate System Exchange Rate: different Types BILATERAL: rate at which you can swap the money of one country for that of another: Indirect Approach: how many yen (amount foreign currency) to get 1$ (unit of local currency); Example: yen*/dollar = 93.01 yen Devaluation if we need less yen to buy 1$ the value of the ER decreases; Appreciation if we need more yen to buy 1$ the value of the ER increases; Exchange Rate: different Types (2) Direct Approach: how many dollar (amount local currency) to get 1 yen (unit of foreign currency)! Example: dollar/yen*=0.0107 $; Devaluation if we need more dollar to buy 1yen the value of the ER increase; Appreciation if we need less dollar to buy 1yen the value of the ER decreases. We would follow the INDIRECT APPROACH! Exchange Rate: different Types (3) EFFECTIVE: measure the average appreciation/depreciation of a currency in comparison to different countries! Trade weighted basis (see charts pag 498); EX: Jap yen appreciate by 1% against the $ and 1% againt the Thai Baht and remain unchanged versus other currency = increase in the yen EER; Usually expressed using an index = 100. Exchange Rate: different Types (4) NOMINAL ER: rate at which you can swap two currencies (as above); REAL ER: how expensive commodities are in different countries and reflect the competitiveness of a country’s export. Exchange Rate: different Types (5) Example: Cup of coffee = 200 yen in JPN and 1$ in USA; Nominal Exchange rate = 100 yen per $ (Yen/$); BUT real exchange rate = 0.5 you can only buy half as much with your money in Japan as you can in the US; Yen-US dollar RER is low! Goods in the US are cheaper than in Japan! Exchange Rate: different Types (6) RER is based on a basket of commodities and not just 1!!! RER=NER * domestic price level overseas price level; Example: - 1$ in US buy the same amount of goods as 3 pesos in Argentina; - NER: 3 pesos/$ RER = 3 * 1US$/3pesos = 1 If price increases in Argentina (1$ in US buy the same amount of goods as 5 pesos in Argentina): RER = 3 * 1US$/5pesos = 0.6 i.e with 1$ in Argentina you can buy only the 60% of goods that you could buy in US. Nominal Exchange rates Determinants Converted Interest Parity: Value of foreign investment (yen) in local currency (dollar) at the end of the period: Yen(1+r*)(F(0)/S(0)) S(0) = spot exchange rate (current exchange rate); F(0) = forward exchange rate (exchange rate in the future) forward exchange rate is prefectly forecast in the CIP; Nominal Exchange rates Determinants (2) Equilibrium (i.e the investor is indifferent between yen and dollar investment): Yen(1+r*)(F(0)/S(0)) = $(1+r) If we put F(0)/S(0) = 1+ fp Where fp is the forward premium (proportion by which a country’s gorward exchange rate exceeds its spot rate) we get: (1+iJPN)(1+fp) = (1 + iUSA) = iJPN - iUSA = fp OR iJPN +fp = iUS i.e. as a result of arbritage, the return on the dollar investment will equal the return on the yen investment when evaluated using the forward rate! Nominal Exchange rates Determinants (3) Uncovered Interest Parity: The investor takes a risk because he doesn’t cover his position by a forward transition F(0) = Se(1); Expected Appreciation of the dollar = interest rate gap; [Se(1) – S(0)]/S(0)=iJPN- iUS What drives the Exhange rate? Change in the overseas interest rate; Change in the domestic interest rate; Change in expectation of the dollar. Nominal Exchange rates Determinants (4) Risk Adverse investor: Premium at risk; US return = iUS+expected dollar apprec = ijpn+ risk premium Change in the risk premium would impact on the NER! Reference Bouchet, Clark and Groslambert (2003): “Country Risk Assessment”, Wiley finance (Chapter 4). Colombo, E. and Lossani, M. (2009): “Economia dei Mercati Emergenti”, Carocci Editore. Miles, D. and Schott, A. (2005): “Macroeconomics. Understanding the Wealth of Nations”, eds. Wiley (Chapter 11,19, 20). The Economist (2009): “Guide to Economic Indicators. Making Sense of Economics”, eds. The Economist.