Chapter 31: Money and Banking MI

advertisement

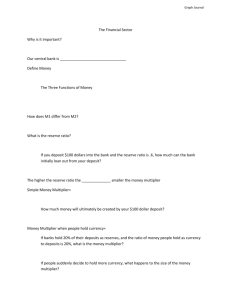

Chapter 31: Money and Banking 1. Money serves three functions: medium of exchange, unit of account, and store of value. 2. MI is the more liquid category of money and includes currency checkable deposits. 3. M2 includes MI and near monies (e.g. savings, time deposits, and money market mutual funds). 4. The purchasing power of money is the amount of goods/services money will buy. Higher prices lower the value of the dollar because more dollars will be needed to buy a particular amount of goods/services. 5. The public demands money for two reasons: to make purchases with it (transaction demand) and to hold it as an asset. The total demand curve for money includes two components: a) The assets demand for money varies inversely with the rate of interest. When the interest rate (i.e. the opportunity cost of holding money) is low, the public will choose to hold a large amount of money as assets whereas when the interest rate is high, people will hold less money as assets. Thus, the demand curve for money is downward sloping. b) The transactions demand for money varies directly with nominal GDP. If higher prices increase nominal GDP, the transaction demand for money will shift the total money demand curve to the right at all levels of interest. 6. Money market equilibrium occurs where the vertical supply curve of money intersects the downward sloping demand curve: Change in $ supply: Change in $ Demand: Change in Equilibrium Interest: Increase no change decrease Decrease no change increase No change increase increase No change decrease decrease Chapter 32: How Banks Create Money 1. A balance sheet is a statement of what the bank owns (assets) and what the bank owes (liabilities). Bank assets include cash reserves, bonds, and loans. Bank liabilities include demand deposits (checking) and savings accounts. 2. The Federal Reserve requires that banks keep a specified percentage of its own deposit liabilities on reserve The reserve ratio = Commercial bank’s required reserves Commercial bank’s demand-deposit liabilities 3. Excess reserves = actual reserves – required reserves 4. The money multiplier indicates the maximum amount of new demand-deposit money, which can be created in the banking system by a single dollar of excess reserves. As a formula, M= 1 RR (where M = money multiplier and R = required reserve ratio) Maximum demand-deposit creation = excess reserves x m If, for example, the required reserve ratio was 0.2, $100 billion of excess reserves would multiply to $500 billion. Higher reserve ratios mean lower money multipliers and therefore cost less creation of new deposit money via loans whereas smaller reserve ratios mean higher money multipliers and thus more creation of new deposit money via loan. Two limitations that reduce the full effect of the money multiplier include: a) money received by a borrower may not be re-deposited in the banking system b) bankers may hold excess reserves above the required reserve ratio