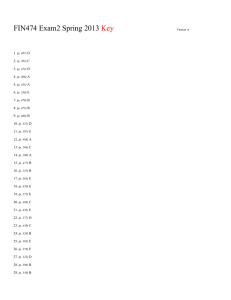

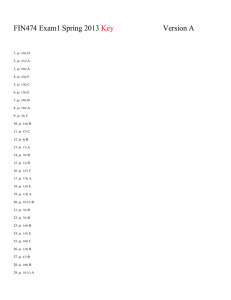

FIN474 Exam2 Spring 2013 Summary

advertisement

FIN474 Exam2 Spring 2013 Summary Category # of Questio ns Blooms: Analyze 4 Blooms: Apply 17 Blooms: Remember 22 Blooms: Understand 27 Difficulty: 1 Easy 15 Difficulty: 2 Medium 46 Difficulty: 3 Hard 9 Kapoor - Chapter 08 10 Kapoor - Chapter 09 10 Kapoor - Chapter 10 10 Kapoor - Chapter 11 10 Kapoor - Chapter 12 10 Kapoor - Chapter 13 10 Kapoor - Chapter 14 10 Learning Objective: 08-01 Identify types of risks and risk management methods and develop a risk management plan. 4 Learning Objective: 08-02 Assess the insurance coverage and policy types available to homeowners and renters. 2 Learning Objective: 08-03 Analyze the factors that influence the amount of coverage and cost of home insurance. 1 Learning Objective: 08-04 Identify the important types of automobile insurance coverage. 2 Learning Objective: 08-05 Evaluate factors that affect the cost of automobile insurance. 1 Learning Objective: 09-01 Recognize the importance of health insurance in financial planning. 2 Learning Objective: 0902 Analyze the costs and benefits of various types of health insurance coverage as well as major provisions in health insurance polic y. 6 Learning Objective: 09-04 Evaluate the differences among health care plans offered by private companies and by the government. 2 Learning Objective: 10-01 Define life insurance and determine your life insurance needs. 6 Learning Objective: 1002 Distinguish between the types of life insurance companies and analyze various life insurance policies these companies issue. 4 Learning Objective: 11-01 Explain why you should establish an investment program. 3 Learning Objective: 11-02 Describe how safety; risk; income; growth; and liquidity affect your investment program. 3 Learning Objective: 11-03 Identify the factors that can reduce investment risk. 2 Learning Objective: 11-04 Understand why investors purchase government bonds. 1 Learning Objective: 11-06 Evaluate bonds when making an investment. 1 Learning Objective: 12-01 Identify the most important features of common and preferred stock. 4 Learning Objective: 12-02 Explain how you can evaluate stock investments. 3 Learning Objective: 12-03 Analyze the numerical measures that cause a stock to increase or decrease in value. 3 Learning Objective: 13-01 Explain the characteristics of mutual fund investments. 7 Learning Objective: 13-02 Classify mutual funds by investment objective. 1 Learning Objective: 13-03 Evaluate mutual funds. 2 Learning Objective: 14-01 Analyze your current assets and liabilities for retirement and estimate your retirement living costs. 2 Learning Objective: 1402 Determine your planned retirement income and develop a balanced budget based on your retirement income. 4 Learning Objective: 14-04 Distinguish among various types of wills and trusts. 4 Topic: Automobile Insurance Costs 1 Topic: Automobile Insurance Coverages 2 Topic: Classifications of Mutual Funds 1 Topic: Common and Preferred Stock 4 Topic: Conservative Investment Options: Government Bonds 1 Topic: Evaluating a Stock Issue 3 Topic: Factors Affecting the Choice of Investments 3 Topic: Factors That Reduce Investment Risk 2 Topic: Health Insurance and Financial Planning 2 Topic: Health Insurance Coverage 6 Topic: Home and Property Insurance 2 Topic: Home Insurance Cost Factors 1 Topic: How to Make a Decision to Buy or Sell Mutual Funds 2 Topic: Insurance and Risk Management 4 Topic: Legal Aspects of Estate Planning 4 Topic: Numerical Measures That Influence Investment Decisions 3 Topic: Planning for Retirement: Start Early 2 Topic: Preparing for an Investment Program 3 Topic: Private Health Care Plans and Government Health Care Programs 2 Topic: The Decision to Buy or Sell Bonds 1 Topic: Types of Life Insurance Companies and Policies 4 Topic: What Is Life Insurance 6 Topic: Why Investors Purchase Mutual Funds 7 Topic: Your Retirement Income 4