FIN474 Exam1 Spring 2013 Version A Key

advertisement

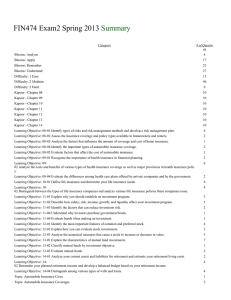

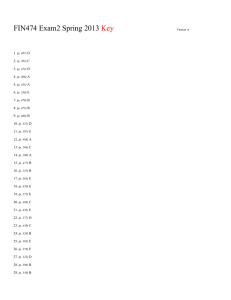

FIN474 Exam1 Spring 2013 Key 1. (p. 188) D 2. (p. 222) A 3. (p. 198) A 4. (p. 220) E 5. (p. 116) C 6. (p. 158) E 7. (p. 190) B 8. (p. 190) A 9. (p. 78) C 10. (p. 144) B 11. (p. 47) C 12. (p. 6) B 13. (p. 17) A 14. (p. 79) B 15. (p. 13) D 16. (p. 147) C 17. (p. 170) A 18. (p. 110) E 19. (p. 119) A 20. (p. 50-51) B 21. (p. 78) B 22. (p. 78) B 23. (p. 149) B 24. (p. 145) E 25. (p. 190) C 26. (p. 110) B 27. (p. 47) B 28. (p. 190) B 29. (p. 10-11) A Version A 30. (p. 4) B 31. (p. 193) E 32. (p. 158) A 33. (p. 78) B 34. (p. 123) D 35. (p. 203) C 36. (p. 140) A 37. (p. 226) E 38. (p. 6) A 39. (p. 228) E 40. (p. 83) D 41. (p. 7) E 42. (p. 52) B 43. (p. 222) B 44. (p. 131) E 45. (p. 52) D 46. (p. 6) C 47. (p. 118) D 48. (p. 49) D 49. (p. 151) E 50. (p. 154) A 51. (p. 193) D 52. (p. 188-190) B 53. (p. 196) B 54. (p. 79) D 55. (p. 84) B 56. (p. 110) E 57. (p. 47) A 58. (p. 150) B 59. (p. 225) D 60. (p. 51) B FIN474 Exam1 Spring 2113 Summary Category # of Questions Blooms: Analyze 4 Blooms: Apply 13 Blooms: Remember 17 Blooms: Understand 26 Difficulty: 1 Easy 12 Difficulty: 2 Medium 35 Difficulty: 3 Hard 13 Kapoor - Chapter 01 8 Kapoor - Chapter 02 8 Kapoor - Chapter 03 8 Kapoor - Chapter 04 8 Kapoor - Chapter 05 11 Kapoor - Chapter 06 11 Kapoor - Chapter 07 6 Learning Objective: 01-01 Identify social and economic influences on personal financial goals and decisions. 5 Learning Objective: 01-02 Develop personal financial goals. 1 Learning Objective: 01-03 Calculate time value of money situations associated with personal financial decisions. 1 Learning Objective: 01-04 Implement a plan for making personal financial and career decisions. 1 Learning Objective: 02-01 Identify the main components of wise money management. 3 Learning Objective: 02-02 Create a personal balance sheet and cash flow statement. 5 Learning Objective: 03-01 Identify the major taxes paid by people in our society. 4 Learning Objective: 03-02 Calculate taxable income and the amount owed for federal income tax. 4 Learning Objective: 04-01 Identify commonly used financial services. 3 Learning Objective: 04-03 Assess various types of savings plans. 4 Learning Objective: 04-04 Evaluate different types of payment methods. 1 Learning Objective: 05-01 Analyze advantages and disadvantages of using consumer credit. 3 Learning Objective: 05-02 Assess the types and sources of consumer credit. 4 Learning Objective: 05-03 Determine whether you can afford a loan and how to apply for credit. 3 Learning Objective: 05-05 Develop a plan to protect your credit and manage your debts. 1 Learning Objective: 06-01 Identify strategies for effective consumer buying. 6 Learning Objective: 06-02 Implement a process for making consumer purchases. 4 Learning Objective: 06-03 Describe steps to take to resolve consumer problems. 1 Learning Objective: 07-01 Assess costs and benefits of renting. 3 Learning Objective: 07-02 Implement the home-buying process. 3 Topic: A Plan for Personal Financial Planning 1 Topic: A Successful Money Management Plan 3 Topic: Applying for Credit 3 Topic: Comparing Payment Methods 1 Topic: Comparing Savings Plans 4 Topic: Consumer Buying Activities 6 Topic: Developing and Achieving Financial Goals 1 Topic: Evaluating Renting and Buying Alternatives 3 Topic: Home-Buying Activities 3 Topic: Major Consumer Purchases-Buying Motor Vehicles 4 Topic: Making Financial Decisions 5 Topic: Opportunity costs and the Time Value of Money 1 Topic: Personal Financial Statements 5 Topic: Planning Your Use of Financial Services 3 Topic: Protecting Your Credit 1 Topic: Resolving Consumer Complaints 1 Topic: Taxes in Your Financial Plan 4 Topic: The Basics of Federal Income Tax 4 Topic: Types of Credit 4 Topic: What Is Consumer Credit 3