Econ 522 Economics of Law Dan Quint Spring 2010

advertisement

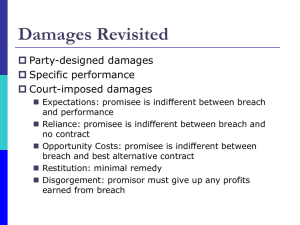

Econ 522 Economics of Law Dan Quint Spring 2010 Lecture 14 Logistics See Fran if you’re missing midterm or HW1 HW2 due next Wednesday (2:30 p.m. sharp) Second midterm following Wednesday 1 Monday, we considered remedies, and the incentives they create Expectation damages; reliance damages; opportunity cost damages; specific performance Breach: if promisor’s liability = promisee’s benefit, we “automatically” get efficient breach; if not, we don’t (or efficient breach requires renegotiation) Signing: if liability for breach is too severe, may preclude signing contract in the first place 2 Monday, we considered remedies, and the incentives they create Example of investment in reliance: If damages are increased to include added value of performance due to reliance investments, promisee will rely more than the efficient amount If damages exclude added value of performance, promisee will rely the efficient amount Example of investment in performance: If promisor’s liability = promisee’s anticipated benefit, promisor will invest the efficient amount in preventing breach If liability < benefit, promisor will underinvest in performance 3 All of these effects can also be understood through language of externalities If liability < anticipated benefit, promisor’s choice to breach imposes negative externality on promisee So he’ll breach more than efficient amount, and invest too little in preventing breach If liability = benefit, the externality is eliminated, and promisor will act efficiently If liability = anticipated benefit (including added benefit from reliance), promisee’s reliance imposes negative externality on promisor So promisee will rely more than efficient amount If damages exclude this added benefit, externality is absent, reliance will be efficient 4 Paradox of compensation Expectation damages include benefit from reliance investments Expectation damages exclude benefit from reliance investments • Efficient breach • Inefficient breach • Efficient investment in performance • Underinvestment in performance • Over-reliance • Efficient reliance Is there a way to get efficient behavior by both parties? 5 We already saw one possible solution Have expectation damages include benefit from reliance… …but only up to the efficient level of reliance, not beyond That is, have damages reward efficient reliance investments, but not overreliance Promisee has no incentive to over-rely efficient reliance Promisor still bears full cost of breach efficient performance Problem: this requires court to calculate efficient level of reliance after the fact 6 Another clever (but unrealistic) solution The problem: Damages promisor pays should include gain from reliance if we want to get efficient performance Damages promisee receives should exclude gain from reliance if we want to get efficient reliance Solution: make damages promisor pays different from damages promisee receives! How do we do this? Need a third party 7 “Anti-insurance” You (promisee) and I (promisor) offer Bob this deal: If you rely and I breach, I pay Bob value of promise with reliance (airplane plus hangar) Bob pays you value of promise without reliance (airplane alone) Bob keeps the difference You receive damages without benefit from reliance; I pay damages with benefit from reliance 8 “Anti-insurance” You (promisee) and I (promisor) offer Bob this deal: If you rely and I breach, I pay Bob value of promise with reliance (airplane plus hangar) Bob pays you value of promise without reliance (airplane alone) Bob keeps the difference You receive damages without benefit from reliance; I pay damages with benefit from reliance Offer the deal to two people, make them pay up front for it 9 Reminder: what do courts actually do? Foreseeable reliance Include benefits reliance that promisor could have reasonably anticipated 10 Another experiment: is trust a problem? 11 A two-player game, similar to the investment/agency game Player A starts with $10 Chooses how much of it to give to player B That money is tripled Player B has $10, plus 3x whatever A gave him/her Chooses how much (if any) to give back to player A We’ll try the game three ways: Anonymously – A and B don’t know who each other are Face to face – A and B know who each other are, and can discuss the game before playing, but their actions remain private In public – A and B play out loud in front of the whole class 12 Repeated interactions 13 Repeated games 14 Repeated games Player 1 (you) Don’t Trust me Player 2 (me) (100, 0) Share profits (150, 50) Keep all the money (0, 200) Suppose we’ll play the game over and over After each game, 10% chance relationship ends, 90% chance we play at least once more… 15 Repeated games Suppose you’ve chosen to trust me Keep all the money: I get $200 today, nothing ever again Share profits: I get $50 today, $50 tomorrow, $50 day after… Value of relationship = 50 500 50 50 .9 50 .9 50 .9 ... 1 .9 2 3 Since this is more than $200, we can get cooperation 16 Repeated games Suppose you’ve chosen to trust me Keep all the money: I get $200 today, nothing ever again Share profits: I get $50 today, $50 tomorrow, $50 day after… Value of relationship = 50 500 50 50 .9 50 .9 50 .9 ... 1 .9 2 3 Since this is more than $200, we can get cooperation 17 Repeated games and reputation Diamond dealers in New York (Friedman) “…people routinely exchange large sums of money for envelopes containing lots of little stones without first inspecting, weighing, and testing each one” “Parties to a contract agree in advance to arbitration; if… one of them refuses to accept the arbitrator’s verdict, he is no longer a diamond merchant – because everyone in the industry now knows he cannot be trusted.” 18 Repeated games and reputation The first purpose of contract law is to enable cooperation, by converting games with noncooperative solutions into games with cooperative solutions The sixth purpose of contract law is to foster enduring relationships, which solve the problem of cooperation with less reliance on courts to enforce contracts Law assigns legal duties to certain long-term relationships Bank has fiduciary duty to depositors McDonalds franchisee has certain duties to franchisor 19 Repeated games and the endgame problem Suppose we’ll play agency game 60 times $50 x 60 = $3,000 > $200, so cooperation seems like no problem But… In game #60, reputation has no value to me Last time we’re going to interact So I have no reason not to keep all the money So you have no reason to trust me But if we weren’t going to cooperate in game #60, then in game #59… 20 Repeated games and the endgame problem Endgame problem: once there’s a definite end to our relationship, no reason to trust each other Example: collapse of communism in late 1980s Communism believed to be much less efficient than capitalism But fall of communism led to decrease in growth Under communism, lots of production relied on gray market Transactions weren’t protected by law, so they relied on long-term relationships Fall of communism upset these relationships 21 Couple other odds and ends 22 Efficient bearer of risk Rule we saw: when performance becomes impossible, assign liability to party who can bear risk at least cost How do we know who this is? Friedman offers several bases for this decision… Spreading losses across many transactions Moral hazard: who is in better position to influence outcome? 23 Efficient bearer of risk Rule we saw: when performance becomes impossible, assign liability to party who can bear risk at least cost How do we know who this is? Friedman offers several bases for this decision… Spreading losses across many transactions Moral hazard: who is in better position to influence outcome? Adverse selection: who is more aware of risk, even if he can’t do anything about it? “…The party with control over some part of the production process is in a better position both to prevent losses and to predict them. It follows that an efficient contract will usually assign the loss associated with something going wrong to the party with control 24 over that particular something.” Hadley v Baxendale Suppose… 80% of millers are low-damage – suffer $100 in losses from delay 20% of millers are high-damage – suffer $200 in losses from delay Shipper liable for actual damages Average miller would suffer $120 in losses Shipper makes efficient investment for average type But not efficient for either type Shipper liable for foreseeable damages Shipper makes efficient investment for low-damage millers High-damage millers have strong incentive to negotiate around default rule 25 One other bit I like from Friedman 26 One other bit I like from Friedman 27 That’s it for contract law Purposes for contract law: Encourage cooperation Encourage efficient disclosure of information Secure optimal commitment to performance Secure efficient reliance Provide efficient default rules and regulations Foster enduring relationships End of material on second midterm Next week, we begin tort law 28