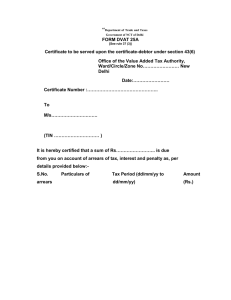

Form DVAT 26

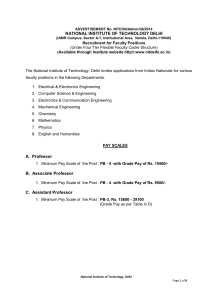

advertisement

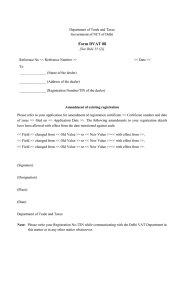

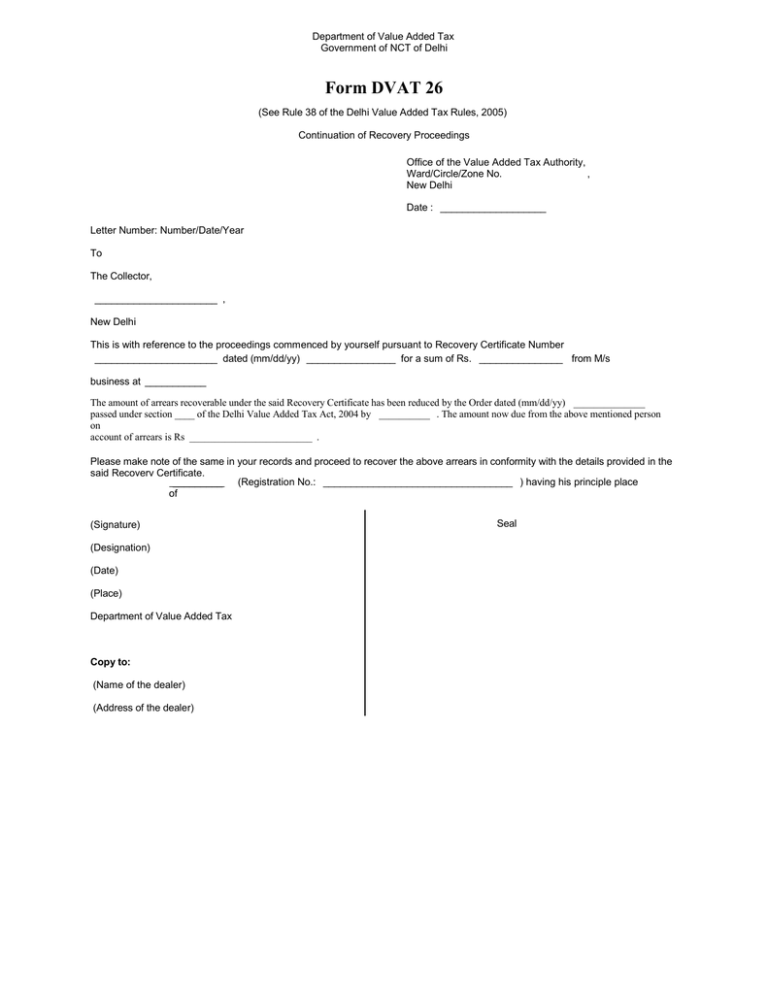

Department of Value Added Tax Government of NCT of Delhi Form DVAT 26 (See Rule 38 of the Delhi Value Added Tax Rules, 2005) Continuation of Recovery Proceedings Office of the Value Added Tax Authority, Ward/Circle/Zone No. , New Delhi Date : ___________________ Letter Number: Number/Date/Year To The Collector, ______________________ , New Delhi This is with reference to the proceedings commenced by yourself pursuant to Recovery Certificate Number ______________________ dated (mm/dd/yy) ________________ for a sum of Rs. _______________ from M/s business at ___________ The amount of arrears recoverable under the said Recovery Certificate has been reduced by the Order dated (mm/dd/yy) ______________ passed under section ____ of the Delhi Value Added Tax Act, 2004 by __________ . The amount now due from the above mentioned person on account of arrears is Rs ________________________ . Please make note of the same in your records and proceed to recover the above arrears in conformity with the details provided in the said Recovery Certificate. _________ (Registration No.: __________________________________ ) having his principle place of (Signature) (Designation) (Date) (Place) Department of Value Added Tax Copy to: (Name of the dealer) (Address of the dealer) Seal 1