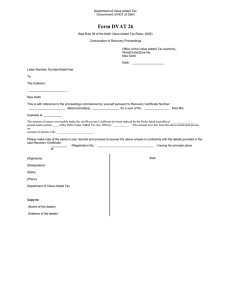

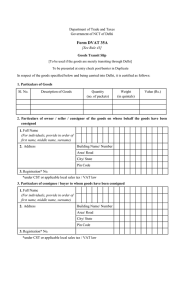

“ FORM DVAT 25A

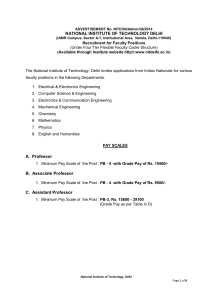

advertisement

“Department of Trade and Taxes Government of NCT of Delhi FORM DVAT 25A [See rule 37 (3)] Certificate to be served upon the certificate-debtor under section 43(6) Office of the Value Added Tax Authority, Ward/Circle/Zone No…………………… New Delhi Date:…………………… Certificate Number :……………………………………….. To M/s…………………………. (TIN ………………………… ) It is hereby certified that a sum of Rs…………………….. is due from you on account of arrears of tax, interest and penalty as, per details provided below:S.No. arrears Particulars of Tax Period (dd/mm/yy to Amount dd/mm/yy) (Rs.) You are directed to pay the above mentioned amount of Rs…………. and furnish proof of such payment to the undersigned on or before the date mentioned in the Writ of Demand, which is attached herewith. Place Signature Date Designation SEAL”;