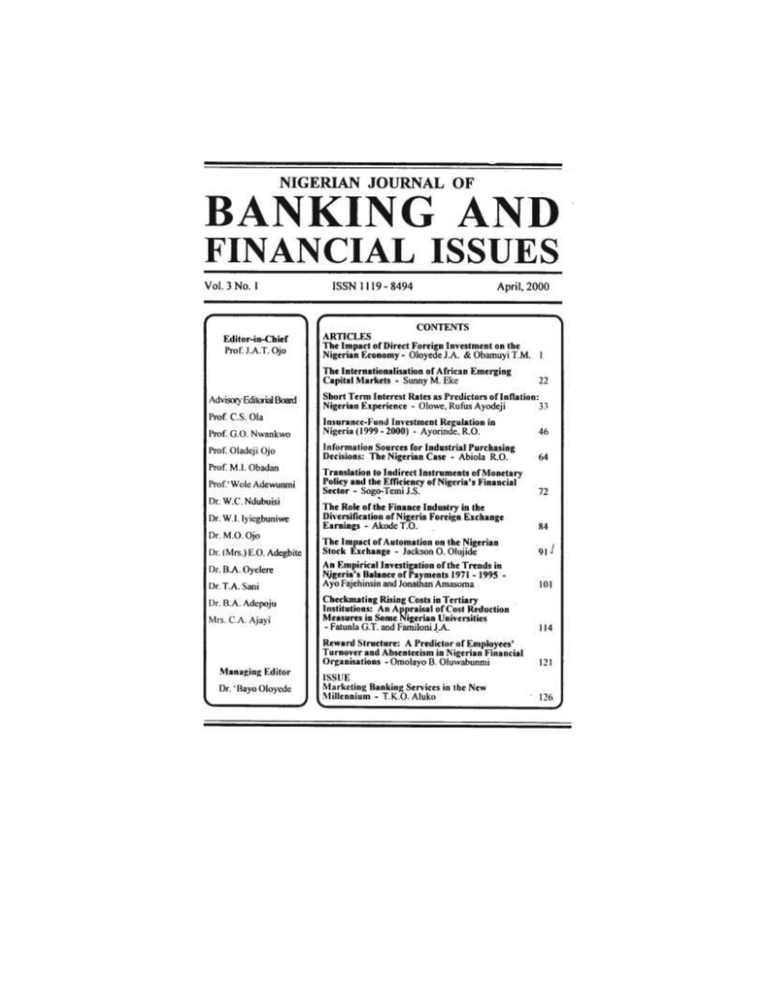

©Department of Banking and Finance

University of Ado-Ekiti, 2000

Published for

Department of Banking and Finance

University of Ado-Ekiti.

by

Forthright Educational Publishers

(A Division of Forthright Consult Limited)

4, Majaro Street, Onike, Yaba.

c/o P.O. Box 166

Unilag P.O., Akoka

NIGERIA.

The Nigerian Journal of Banking and Financial Issues '(NJBFI) provides a

unique forum for the articulation and dissemination of applied research by

academics and professionals in the field of Banking and Finance or related

disciplines. It is bi-annual journal published by the Department of Banking and

Finance University of Ado-Ekiti, Nigeria.

The Journal contains analysis of banking and financial issues relevant to the

Nigerian economic experience and financial policies. Opinions expressed herein

are those of the authors and not necessarily those of the Department of Banking

and Finance or Forthright Consult Limited.

All rights reserved. No part of the publication may be reproduced or transmitted

in any form or by any means electronic, mechanical, photocopying, recording or

otherwise or stored by any retrieval system of any nature, without tht prior

written permission of the copyright bolder.

ISSN 1119-8494

Subscription Rate:

Nigeria:

Students - N300.00

Others

- N500.00

Foreign:

- US$10

Printed in Nigeria by Forthright Educational Publishers, Lagos.

Nigerian Journal of Banking and Financial Issues Vol 3 No. 1.91-100

THE IMPACT OF AUTOMATION ON THE NIGERIAN

STOCK EXCHANGE

Jackson O. Olujide*

Introduction

The Nigerian Stock Exchange' has made strong strides in the last

decade as a result of key financial reform decisions taken in the last few years

and the increasingly positive steps towards good governance. Furthermore, some

infrastructure continues to be laid for favourable operation of the stock exchange

nation-wide. These efforts and successes to date have, already begun to

demonstrate that dividends are payable from system wide reduction of financial

repression, removal of financial asphyxiation and from the exercise of financial

and fiscal disciplines in the management of the country's economy and

resources..

As a result of the reforms of the last few years, the Nigerian Stock

Exchange has no doubt achieved remarkable growth within the last two decades

of its existence, there has also been enormous expansion hi its operations in

terms of wider operational coverage. These developments have increased

substantially the volume of transactions and range of services offered to the

public. In addition, the Stock Exchange in concert with other facilitating

institutions provide employment opportunities for Nigerians as well as

encouraging the acquisition of knowledge, skill and professionalism in stock

brokerage. The Stock Exchange therefore represents a veritable vehicle So the

continued operation and attraction of foreign capital for life nation &

development.

But in spite of the string of aforementioned achievements, there is the

general feeling that the Nigerian Stock Exchange is still underdeveloped

therefore not yet "in a position-to contribute effectively to the development

needs of the economy. The underdeveloped nature of the Stock Exchange is

reflected in its system of trading. The Nigerian Stock Exchange operated the

"call-cover" system of trading from inception to 1997 due to the paucity of

securities dealt in. and the comparatively small size of the market.

In this call-over system, securities are called individually and members

(stock brokers) indicate interest whether to buy or sell.

During the call-over-days of trading, it took investors an average of six

months to get share certificates from Registrars to quoted companies. This

situation has made it possible for an investor to maximise possible opportunities

in the market arising from price fluctuations.

Dr. Jackson O. Olujide is of the Dept of Business Administration. University of llorin.

Automation and the Nigerian Stock Exchange

92

However, in April 1997 a new trading system called the Central

Securities Clearing System (CSCS) was introduced. This system makes it

possible for an investor to deal on securities bought five days after the

transaction day (i.e., T + 5 = transaction day plus five days). Thus this

automated trading system which makes it imperative for the CSCS to clear and

settle all transactions on the stock exchange within T+5 days has eliminated all

manual processes of trading on the exchange.

The manual system of trading causes a lot of delay in the issuance of

share certificates by company Registrars to investors consequent on a secondary

market transaction. Therefore, most Nigerian investors are obliged to be content

with dividend payment and bonus issues rather than earning more income from

price fluctuations.

The situation has led to a very low volume of trade over the years as

reported by the Nigerian Stock Exchange in its fact book 1999. This is a

consequence of the manual clearing system. Other drawbacks of the manual

trading system include;

delay in issuing share certificates to shareholders

cancellation of share certificates of selling shareholders and issuance of

new share certificates for a buying shareholder per transaction.

Constant signature verification before sales is allowed.

Dealing members were short-selling

Failed transaction

Loss of share certificates, and so on.

From the foregoing therefore, this study is designed to examine tit

impact of automation on the volume of trading on the Nigerian Stock

Exchanges' Specifically, the study intends to achieve the following objectives:

(a)

To determine the average annual volume of shares traded on the

Nigerian Stock Exchange during the call-over system of trading.

(b)

To determine the average annual volume of shares traded on the

Nigerian Stock Exchange after the introduction of CSCS.

(c)

From (a) and (b) above, to determine the impact of automatic on the

traded volume of shares on the Nigerian Stock Exchange.

Institutional framework

The Central Securities Clearing System

The last decade saw monumental changes in economic environment

propelled by major technological innovations in telecommunications and

information technology resulting in integrated world financial markets with the

emergence of globalisation or cross-border investments. In 1988. the Federation

of International Stock Exchange (FIBE) of which the Nigeria Stock Exchange is

a member, commission a group of thirty (G 30) experts to undertake a study of

world stock markets. The nine (9)

Nigerian Journal of Banking and Financial Issues

93

key recommendations of the G-30 have become global stock market yard stick

for clearing, settlement, depository, registry and custodian systems.

In view of the foregoing, the Nigerian Stock Exchange on July 29,

1992 incorporated a subsidiary company called Central Securities Clearing

System Limited with a mission to speed up the delivery system of the Nigerian

Capital Market through the introduction of efficient, effective securities,

clearing, settlement and custodian mechanisms with minimum risk.

This was to be achieved by the implementation of the Stock Exchange

Management System (SEMS) software application package. The SEMS is a four

(4) module package:

•

Clearing/Settlement: Depository/registry (CDS) system: Custodian services

• Board and automated trading and market control and surveillance

• Broker management and licensing and stockbrokers banks

• Corporate profile management and statistics including INDEX.

The Central Securities Clearing Systems Limited was commissioned on April 8

1997 and commenced operations on April 14 1997.

The CSCS, in addition to clearing and settling trades, functions as:

- Central depository for share certificates of companies quoted on the

Nigerian Stock Exchange.

- Sub-registry for all quoted securities (in conjunction with registrars of

quoted companies).

- Issuer of central securities identification numbers to stock holders

- Custodian (in conjunction with members) for local and foreign instruments.

The system operates a T + 5 settlement cycle for transaction on the

exchange, in conformity with the FIBE standard for emerging market to which

Nigerian Stock Exchange market belongs. The T + 5 (transaction plus five days)

settlement cycle is facilitated by the immobilisation of share certificates in a

central location which in turn enables transaction to be processed in an

electronic book entry form.

Thus, physical delivery of share certificates for secondary market

transactions to fulfill settlement obligations has been replaced by electronic

credits and debits to shareholders stock positions.

Benefits of the CSCS include among others:

- Reduction in incidence of loss or stolen share certificates

- Elimination of late delivery of share certificates

- Reduction in the cost of maintaining register of share holders

- Increased liquidity of stock

- Increased transparency of market

- Increased market turnover

- Encourages foreign investments

- Ensures prompt inter-broker money and stock settlements

Automation and the Nigerian Stock Exchange

94

-

Increased efficiency and profitability of stockbroking firms

Reduction of operating costs.

To maximise the gain of the Central Securities Clearing Systems Limited,

the call-over trading system was in April 1999 replaced with the automated

trading system with bids and offers of securities no\v matched by stockbrokers

on. the trading floors of the Stock Exchange .through a network of computers.

Secondary market transactions are now consummated by stock brokers

through the use of computers within the hours of 11.00a.m. till all bids and

offers have been executed (about 1.30p.m. on the average).

Research methodology

The Nigerian Stock Exchange is not the only institution in the capital

market, but it is the only capital market institution in which both the. central

securities clearing systems limited (CSCS) and Automated Trading System

(ATS) are relevant, being the only market in which transactions on quoted

securities are perfected. It then •fits in perfectly into the objectives of this study.

And therefore, represents the study sample.

The main source of data for the study is the secondary source.

Information was obtained from both internal publications of the Nigerian Stock

Exchange, such as:

the Nigerian Stock Exchange Factbooks

the daily official list of the Nigerian Stock Exchange: and also

from external sources such as

Publications by the central securities clearing system limited.

Data obtained were analysed by the use of simple percentages in order to

highlight trends and summarise result;

The parameters considered in this analysis include:

Market capitalization

Number of shares traded

Daily average volume

Number of stock broking firms

Number of listed companies

Number of listed securities

Data analysis and discussion of results

The results of our data analysis based on the above parameters are presented as

follows:

'

95

Table 1

Market Capitalisation

Year

Post ATS 1999

Pre ATS 1998

Market Capitalisation

287.2 billion

260.8 billion

% Change

10

Table 1 shows a pre-ATS market capitalisation of N260.8 billion in 1998 rising

to N288.2 billion during the six months post-ATS in 1999. This represents an

increase of 10%.

Table 2

Percentage Changes in Market Capitalisation

Year

Market Cap. (N Billion) % Increase

1998

263.3

461

1997

292.0

523

1996

285.6

509

1995

171.1

265

1994

65.5

40

1993

46.9

~

1993 was taken as the base year for the purpose of this analysis.

Figure 1: Market capitalisation (N billion)

96

Table 3

Number of Shares Traded

Year

Number of Shares Traded (N Billion)

% Increase

1998

2.1

343

1997

1.3

174

1996

0.882

86

1995

0.397

-16

1994

0.524

10

1993

0.473

The percentage increase was obtained using 1993 as the base year.

Figure 2: Number of Shares (in billions)

It is evident from Table 3 that the volume of shares traded increased

substantially in 1996 following the de-regulation of the market and much more

in 1997 after the introduction of the Central Securities Clearing System.

The study also considered the total number of shares traded on the

exchange in the half-year period (January - June) 1998 and 1999

Table 4

Percentage Changes in Number of Shares Traded

1

/2Year (Jan-Jun) No. of Shares Traded (Million)

Post ATS 1999

965.9

Pre ATS 1998

738.3

Percentage Change

30

--

Nigerian Journal of Banking and Financial Issues

97

Turnover on the exchange during the six months ended June 1999 stood

at 965.9 million shares, up by 30% due to the successful transition to the

Automated Trading System (ATS).

Table 5

Year

1998

1997

1996

1995

1994

1993

D.A.V. Million

8.4

5.3

3.5

1.6

2.1

1.9

% Increase

342

179

84

16

16

-

Figure 3: Daily Average Volume

Table 5 shows that there was a significant increase in the average

number of shares traded on the floors of the exchange in 1997 and 1998

following the deregulation of the market and introduction of the Central

Securities Systems Limited. The pre-CSCS rate of increase ranges from 10% to

84% between 1993 and 1996 while for the post CSCS years it was between

179% and 342% in 1998.

Year

1998

1997

1996

1995

1994

1993

Table 6

Number of Stock broking Firms

No. of Stock broking Firms

226

217

162

162

140

140

% Increase

61

55

15

15

0

-

Automation and the Nigerian Stock Exchange

1993

1994

1995

1996

98

1997

1998

Years

Figure 4: Number of Stock Broking Firms

Table 6 shows an improvement of between 55% and 61% in the

number of stockbroking firms involved in daily market transactions on the floors

of the Nigerian Stock Exchange in 1997 and 1998 respectively sequel to

automation introduced in 1997.

Year

1998

1997

1996

1995

1994

1993

Table 7

Number of Listed Companies

No. of Listed Companies

% Increase

186

6.7

182

4.6

183

5.1

181

4.0

177

1.7

174

-

MR. AWE,

DRAW COMPLETE

GRAPH

1993 1994 1995 1996 1997 1998 Years

Figure 5: Number of Listed Companies

Nigerian Journal of Banking and Financial Issues

99

Table 7 shows that there were no significant changes in the number of

companies listed on the Nigerian Stock Exchange for the period under review

both "Pre and Post" automation.

Table 8

Number of Listed Securities

Year

1998

1997

1996

1995

1994

1993

Govt.

Stocks % Change

19

22

24

28

35

37

-49

-41

-35

-24

-5

-

Industrial

Loans

59

60

69

67

64

71

% Change

-17

-16

-3

-6

-10

-

Equities

% Change

186 7

182 5

I53 5

181 4

177 2

174 -

Whilst the number of government stocks and industrial loans decreased

progressively over the years, largely due to maturity, redemption and eventual

de-listing, the number of equities (ordinary shares) increased progressively due

lo new listing of securities.

Results obtained from the analysis of data for this study show that the

introduction of automation in the Nigeria Stock Market acted as a catalyst to

both the volume of trade consumated on the floors of the exchange from 473

million shares in 1993 to 2.1 billion shares in 1998. It also shows an increase in

the number of stockbroking firms from 140 in 1993 to 226 in 1998.

Conclusion

The introduction of the CSCS and the ATS have increased the tempo of

trading activities on the Nigerian Stock Market. They have increased

substantially the following indices: market turnover, transparency: investor's

confidence: foreign investments: liquidity and vibrancy of the market: and

prompt inter-broker money and stock settlement..

In concluding, this study wants to make the following

recommendations so that the Nigerian Stock Market can enjoy fully the

dividends of automation. These include the following:

i) The CSCS and the ATS should accommodate all quoted securities. For now

only equities are traded through the CSCS and ATS: other securities such as

government stocks, industrial loans, bonds and preference stocks are yet to

be accommodated in the current automation process,

ii) The transaction cycle currently T + 5 for settlement of cash and stock

should be reduced further to T + 1 through the use of a single settlement

Automation and the Nigerian Stock Exchange

100

bank as opposed to several settlement banks being used now.

iii) The trading hours should be extended beyond the present closing time of

1.30p.m.

iv) Remote trading where stock brokers would be able to trade from the

conveniences of their offices should commence soonest, this would involve

in the introduction of computer networking,

v) Licensing of stock broking firms should be liberalised,

vi) There should be a separation of functions between jobbers and dealers and

finally the Federal Government of Nigeria should float new development

stocks for capital projects instead of other forms of borrowing.

These recommendations, it is hoped, would further improve on the

automation process already commenced thereby enhancing the capital

mobilising capabilities of the Nigerian Stock Exchange.

Reference:

Adetunji. W. (199X). "The Nigerian Capital Market. The Task Before Market

Operators." A paper presented at the 2nd Annual Conference of the

Chartered Institute of Stock Brokers. Lagos Nigeria.

-(1997): Foreign Investment Opportunities. Potentials and Rimers in

Capital Markets- A Paper Presented at the Alriean Conference of Stock

Brokers: Registrars. Investment Bankers and Fund Managers. Lagos.

Nigeria.

Alile. H.I. (1997): -Financing Public Project through the Capital Market." A

Paper Presented at the International Conference on Promoting Capital.

Market in Africa Lagos Nigeria

-(1992): Establishing a Stock Market: The Nigerian Experience. A paper

presented at the International Conference on Promoting Capital

Markets in Lagos Nigeria

Nigerian Stock exchange (1999): Fact book.

Nigerian Stock exchange (1999): Daily Official List.

Olowe. R.A (1998) Effective Pricing of Securities in the Secondary Market."

Chartered Institute of Stockbrokers. Lagos - Nigeria.

Wall Street Trade Co. Ltd. (1999): Custom Street Review: A Newsletter. Vol.

I, Issue 2.

Ying. C.C. (199f,): "Stock Market Prices and the Volume of Sales." Economic Africa, "volume 34.