CHAPTER 13 AN INTRODUCTION TO DERIVATIVE SECURITIES

advertisement

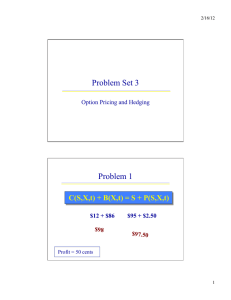

Solutions for Chapter 13: Questions and Problems CHAPTER 13 AN INTRODUCTION TO DERIVATIVE SECURITIES Answers to Questions 1. Since call values are positively related to stock prices while put values are negatively related, any action that causes a decline in stock price (e.g., a dividend) will have a differential impact on calls and puts. Specifically, an impending dividend will boost put values and depress call values. Another way to consider the situation is to represent the difference between the theoretical price of a call option (C) and the theoretical price of a put option (P) as C-P. This is the same as a portfolio that is long a call option and short a put option. For a firm that pays dividends, we expect that the price of its stock will decline by the amount of the dividend on the last day before the stock goes ex-dividend. A decline in stock price makes a call less valuable and a put more valuable, so C-P will decrease. This portfolio has the same payoff as being long a forward contract with a contract price equal to the strike price. Since there is no guarantee that the strike price is the forward price, this forward contract will typically have a non-zero value (i.e. the call and put will have different prices). A dividend will decrease the up-front premium for a long position in a forward contract because the expected stock price at expiration decreases. Consequently, C-P is decreased by dividends. Another way to view this relationship is that holders of stock receive dividends whereas call buyer do not. The call pricing relationship reduces the current stock price by the present value of the dividend. 2. It is generally true that futures contracts are traded on exchanges whereas forward contracts are done directly with a financial institution. Consequently, there is a liquid market for most exchange traded futures whereas there is no guarantee of closing out a forward position quickly or cheaply. The liquidity of futures comes at a price, though. Because the futures contracts are exchange traded, they are standardized with set delivery dates and contract sizes. If having a delivery date or contract size that is not easily accommodated by exchange traded contracts is important to a future/forward end user then the forward may be more appealing. If liquidity is an important factor then the user may prefer the futures contract. Another consideration is the mark-to-market property of futures. If a firm is hedging an exposure that is not marked-to-market, it may prefer to not have any intervening cash flows, hence it will prefer forwards. - 92 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems 3. For forwards, calls and puts, what the long position gains, the short position loses, and vice versa. However, while payoffs to forward positions are symmetric, payoffs to call and put positions are asymmetric. That is to say, long and short forwards can gain as much as they can lose, whereas long calls and puts have a gain potential dramatically greater than their loss potential. Conversely, short calls and puts have gains limited to the option premium but have unlimited liability. For example, if the price of wheat declines by 10%, the losses to a long position in a futures contract on wheat would be the same as the gains if the price were to increase by 10%. For an at-the-money call option, there would be an asymmetric change in value. A long position in an at-the-money call option on wheat would decline in value less for a 10% fall in wheat prices than it would increase from a 10% rise in wheat prices. Position Long Forward Short Forward Long Call Short Call Long Put Short Put 4. Loss Potential 100% unlimited Call premium unlimited Put premium X - premium Gain Potential unlimited 100% unlimited Call premium X – premium Put Premium Symmetry symmetric symmetric asymmetric asymmetric asymmetric asymmetric The important distinction is whether the option is a covered or uncovered position. If the option is added to a portfolio that already contains the underlying asset (or something highly correlated), then the option will frequently be a covered position and, consequently, lower overall risk. For example, selling a call without owning the underlying asset leaves the seller open to unlimited liability and (probably) increases portfolio price fluctuation (risk). But if the seller of the call owns the underlying asset, then selling the call neutralizes the portfolio from price changes above the strike price and (probably) decreases risk. Because options are bets that an asset’s price will be above or below some level (the strike price), they represent a way of leveraging one’s subjective view on the asset’s future price. Options always cost less than the underlying asset and consequently can change in price more (on a percentage basis) than the underlying asset does. This provides the same effect as borrowing money to buy the asset or selling the asset short and investing the proceeds in bonds. (In fact, this is how option pricing theory values options, by replicating the price of an option using the underlying asset and bonds.) 5. Call options differ from forward contracts in that calls have unlimited upside potential and limited downside potential, whereas the gains and losses from a forward contract are both unlimited. Therefore, since call options do not have the downside potential of forwards, they represent only the “good half” (the upside potential) of the forward - 93 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems contract. The “bad half” of the long forward position is the unlimited downside potential that is equivalent to being short a put. This is consistent with put-call parity where being long a call and short a put yields the same payoff as a forward contract. 6. Since options have nonlinear (kinked) payoffs, broad market movements may have different relative effects on the value of a portfolio with options depending on whether the market moves up or down. For example, a portfolio that is put-protected may not move down much if the market declines 10% but may move up nearly 10% if the market rises 10%. Consequently, the returns are asymmetric or skewed. This makes standard deviation a less informative statistic because it reveals information only about the degree of variation and not the “direction” of the variation. Since investors usually care about downside risk (standard deviation), investors probably will not care as much if all of the variation is in the upside return. The standard deviation statistic could be modified to only measure the variation in negative returns (the so-called semi-variance) so that it was a measure of downside risk only. 7. A synthetic off-market forward contract with a forward price of $25 could be created using put-call parity. Buying a call struck at $25 and selling a put struck at $25 assures the investor of buying the stock at the expiration date for $25. This portfolio then has the same requirements as the off-market forward at $25. C-P is one-half of the put-cal1 parity relationship, and we know it has to equal S-PV(exercise price). Since S = $32 and the risk free-rate can be calculated as (35-32)/32 = 9.375%, we can calculate that the off-market forward is worth S-P($25) = $32-$25 / (1 + .09375) = $9.14. 8. A long straddle consists of a long call and a long put on the same stock and profits from dramatic price movement by the stock. A short straddle involves the sale of a call and a put on the same stock and profits from little or no stock price change. Investors going long would anticipate volatility in excess of that discounted by the options’ prices while investors going short would expect volatility below that already discounted. Since volatility enhances option prices, long straddles would tend to pay higher premiums for more volatile options, whereas short straddles must accept lower premiums for less volatile options. 9. A range forward is actually an option strategy that combines a long call and a short put (or vice versa) through a costless transaction. Because the options will not have the same striking price, the combination is classified as a range forward as opposed to an actual forward, created by combining long and short options with the same striking price. It is fair to view actual forwards as a special case (or zero-cost version) of range forwards. - 94 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems CHAPTER 13 Answers to Problems l(a). (i). A long position in a forward with a contract price of $50. Expiration Date Osprey Stock Price (S) Long Forward (X=$50) Payoff=S-50 25 30 35 40 45 50 55 60 65 70 75 ($25.00) ($20.00) ($15.00) ($10.00) ($5.00) $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 Initial Long Forward Premium $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Net Profit ($25.00) ($20.00) ($15.00) ($10.00) ($5.00) $0.00 $5.00 $10.00 $15.00 $20 00 $25.00 (ii). A long position in a call option with a exercise price of $50 and a front-end premium expense of $5.20. Expiration Date Osprey Stock Price (S) 25 30 35 40 45 50 55 60 65 70 75 Long Call (X=$50) Payoff = max (0,S-50) Initial Long Call Premium $0.00 $0.00 $0 00 $0.00 $0 00 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 ($5.20) ($5.20) ($5.20) ($5.20) ($5.20) ($5 20) ($5 20) ($5.20) ($5.20) ($5.20) ($5.20) - 95 Copyright © 2010 by Nelson Education Ltd. Net Profit ($5.20) ($5.20) ($5.20) ($5.20) ($5.20) ($5 20) ($0.20) $4.80 $9.80 $14.80 $19.80 Solutions for Chapter 13: Questions and Problems (iii). A short position in a call option with an exercise price of $50 and a front-end premium receipt of $5.20. Expiration Date Osprey Stock Price (S) 25 30 35 40 45 50 55 60 65 70 75 Short Call (X=$50) Payoff = -max (0,S-50) $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) ($25.00) Initial Short Call Premium $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 Net Profit $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $0.20 ($4.80) ($9.80) ($14.80) ($19.80) l(b). (i). A long position in a forward with a contract price of $50. Long Forward $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) 25 ($10.00) ($15.00) ($20.00) 50 75 ($25.00) (ii.) A long position in a call option with an exercise price of $50 and a front-end premium expense of $5.20: Long Call $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) 25 50 55 75 ($10.00) ($15.00) ($20.00) ($25.00) - 96 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems (iii.) A short position in a call option with an exercise price of $50 and a front-end premium receipt of $5.20 Short Call $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) 25 50 55 75 ($10.00) ($15.00) ($20.00) ($25.00) THE BREAKEVEN POINT FOR THE CALL OPTIONS IS $55.20. l(c). The long position in a forward with a contract price of $50: The purchaser believes that the price of Osprey Enterprises stock will be above $50. The long position in a call option with an exercise price of $50 and a front-end premium expense of $5.20: The purchaser believes the price will be above $55.20. The short position in a call option with an exercise price of $50 and a front-end premium receipt of $5.20: The seller believes the price of Osprey Enterprises stock will be below $55.20. 2(a). (i). A short position in a forward with a contract price of $50. Expiration Date Osprey Stock Price (S) 25 30 35 40 45 50 55 60 65 70 75 Short Forward (X=$50) Payoff= S-50 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) ($25.00) Initial Short Forward Premium $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 - 97 Copyright © 2010 by Nelson Education Ltd. Net Profit $25 00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) ($25.00) Solutions for Chapter 13: Questions and Problems (ii). A long position in a put option with a exercise price of $50 and a front-end premium expense of $3.23. Expiration Date Osprey Stock Price (S) Long Put (X=$50) Payoff= max (0,50-S) 25 30 35 40 45 50 55 60 65 70 75 $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Initial Long Put Premium Net Profit ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) $21.77 $16.77 $11.77 $6.77 $1.77 ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) ($3.23) (iii.) A short position in a put option with an exercise price of $50 and a front-end premium receipt of $3.23. Expiration Date Osprey Stock Price (S) Short Put (X=$50) Payoff= -max (0,50-S) Initial Short Put Premium Net Profit 25 30 35 40 45 50 55 60 65 70 75 ($25.00) ($20.00) ($15.00) ($10.00) ($5.00) $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 ($21.77) ($16.77) ($11.77) ($6.77) ($1.77) $3.23 $3.23 $3.23 $3.23 $3.23 $3.23 2(b). (i). A short position in a forward with a contract price of $50: Short Forward $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) 25 ($10.00) ($15.00) ($20.00) 50 75 ($25.00) - 98 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems (ii). A long position in put option with an exercise price of $50 and front-end premium expenses of $3.23: Long Put $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) 25 ($10.00) ($15.00) ($20.00) 50 75 ($25.00) (iii). A short position in a put option with an exercise price of $50 and a front-end premium receipt of $3.23: Short Put $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) 25 ($10.00) ($15.00) ($20.00) 50 75 ($25.00) THE BREAKEVEN POINT FOR BOTH PUT OPTIONS IS $46.77. 2(c). A short position in a forward with a contract price of $50: The seller believes the price of Osprey Enterprises will be below $50. A long position in a put option with an exercise price of $50 and front-end premium expense of $3.23: The buyer of the put believes the price will be below $46.77. A short position in a put option with an exercise price of $50 and a front-end premium receipt of $3.23: The seller of the put believes the price will be above $46.77. - 99 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems 3(a). (i). A short position in a forward option with a exercise price of $50. Expiration Date Osprey Stock Price (S) 25 30 35 40 45 50 55 60 65 70 75 Short Forward (X=$50) Payoff =max (0, S-50) $25.00 $20.00 $15.00 $10.00 $5.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) ($25.00) Initial Short Forward Premium $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 Net Profit $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 (ii). A long position in a put option with a exercise price of $50 and a front-end premium expense of $3.23. Expiration Date Osprey Stock Price (S) 25 30 35 40 45 50 55 60 65 70 75 Long Put (X=$50) Payoff = max (0,50-S) Initial Long Put Put Premium Net Profit $25 00 $20.00 $15.00 $10.00 $5.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 ($3 23) ($3.23) ($3.23) ($3 23) ($3 23) ($3.23) ($3 23) ($3.23) ($3 23) ($3.23) ($3.23) $46.77 $46.77 $46.77 $46.77 $46.77 $46.77 $51.77 $56.77 $61.77 $66.77 $71.77 (iii). A short position in a call option with an exercise price of $50 and a front-end premium receipt of $5.20. Expiration Date Osprey Stock Price (S) 25 30 35 40 45 50 55 60 65 70 Short Call (X=$50) Payoff = -max (0,S-50) $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) Initial Short Call Premium $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 $5.20 - 100 Copyright © 2010 by Nelson Education Ltd. Net Profit $30.20 $35.20 $40.20 $15.20 $50.20 $55.20 $55.20 $55.20 $55.20 $55.20 Solutions for Chapter 13: Questions and Problems 75 ($25.00) $5.20 3(b). (i). A short position in a forward with a contract price of $50: $55.20 Short Forward $80.00 $70.00 $60.00 $50.00 $40.00 $30.00 $20.00 $10.00 $0.00 25 50 75 (ii). A long position in a put option with an exercise price of $50 and a front-end premium expense of $3.23: Long Put $80.00 $70.00 $60.00 $50.00 $40.00 $30.00 $20.00 $10.00 $0.00 25 50 75 (iii). A short position in a call option with an exercise price of $50 and a front-end premium expense of $5.20: Short Call $80.00 $70.00 $60.00 $50.00 $40.00 $30.00 $20.00 $10.00 $0.00 25 3(c). 50 75 F0,T = Call - Put + PV(Strike) - 101 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems $50.00 = 5.20 - 3.23 + PV($50) $48.03 = PV ($50) PVIF = $48.03/$50 = 0.9606 S = F *(PV Factor) $50 = F * 0.9606 $52.05 = F The zero value contract price, $52.05, differs from the $50 contract price because the put and the call prices are not the same. If they were, the combination of the two would yield a zero-value forward price. 4(a). With $13,700 to spend, one could: (1) Purchase 100 shares of Breener Inc. stock (@ $137 per share); or (2) Purchase 1370 call options with exercise price of $140 Potential payoff is unlimited in both cases, however the leverage that options provide will translate into a higher percentage gain than purely purchasing stock. However, leverage works both ways. 4(b). (1) Stock price increases to $155 a. Stock return = ($155 - $137)/$137 = 13.14% b. Option return: Exercise option @ $140, sell stock at $155 Sell Stock@ $155 × 1370 = $212,350 Cost of stock @ $140 (191,800) Option purchase @ $10 ( 13,700) Profit $ 6,850 Rate of return = $6850/$13,700 = 50% (2) Stock price decreases to $135 a. Stock return = ($135 - $137)/$137 = -1.5% b. Option return: Option would not be exercised, lose entire option purchase price (-100%) 4(c). 5(a). Breakeven on this call option is $150. In other words, the writer of the call option will receive the premium of $10, that is, the maximum amount the seller will receive. If the seller does not currently own the stock, his/her loss is potentially unlimited. Given: Current Price of XYZ = $42 Put ($40) = $1.45 Call ($40) = $3.90 RFR = 8% (annual); 4% (semiannual) - 102 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems (i). Buy one call option Expiration Date XYZ Stock Price (S) Long Call (X=$40) Payoff = max (0,S-40) 20 25 30 35 40 45 50 55 60 $0.00 $0.00 $0.00 $0.00 $0.00 $5.00 $10.00 $15.00 $20.00 Initial Long Call Premium ($3.90) ($3.90) ($3.90) ($3.90) ($3.90) ($3.90) ($3 90) ($3.90) ($3.90) Net Profit ($3.90) ($3.90) ($3.90) ($3.90) ($3.90) $1.10 $6.10 $11.10 $16.10 Long Call $20.00 $15.00 $10.00 $5.00 0.00 20 40 60 ($5.00) (ii). Short one call option Expiration Date XYZ Stock Price (S) 20 25 30 35 40 45 50 55 60 Short Call (X=$40) Payoff =-max (0,S-40) $0.00 $0.00 $0.00 $0.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) Initial Short Call Premium $3.90 $3.90 $3.90 $3.90 $3.90 $3.90 $3.90 $3.90 $3.90 - 103 Copyright © 2010 by Nelson Education Ltd. Net Profit $3.90 $3.90 $3.90 $3.90 $3.90 ($1.10) ($6.10) ($11.10) ($16.10) Solutions for Chapter 13: Questions and Problems Short Call $5.00 $0.00 20 40 60 ($5.00) ($10.00) ($15.00) ($20.00) Both call positions will break even at a stock price of $43.90. 5(b). (i). Buy one put option Expiration Date XYZ Stock Price (S) Long Put (X=$40) Payoff =max (0,40-S) 20 25 30 35 40 45 50 55 60 $20.00 $15.00 $10.00 $5.00 $0.00 $0.00 $0.00 $0.00 $0.00 Initial Long Put Premium Net Profit ($1.45) ($1.45) ($1.45) ($1.45) ($1.45) ($1.45) ($1.45) ($1.45) ($1.45) $18.55 $13.55 $8.55 $3.55 ($1.45) ($1.45) ($1.45) ($1.45) ($1.45) Long Put $20.00 $15.00 $10.00 $5.00 0.00 20 40 ($5.00) - 104 Copyright © 2010 by Nelson Education Ltd. 60 Solutions for Chapter 13: Questions and Problems (ii). Short one put option Expiration Date XYZ Stock Price (S) Long Put (X=$40) Payoff =-max (0,40-S) 20 25 30 35 40 45 50 55 60 ($20.00) ($15.00) ($10.00) ($5.00) $0.00 $0.00 $0.00 $0.00 $0.00 Initial Long Put Premium Net Profit $1.45 $1.45 $1.45 $1.45 $1.45 $1.45 $1.45 $1.45 $1.45 ($18.55) ($13.55) ($8.55) ($3.55) $1.45 $1.45 $1.45 $1.45 $1.45 Short Put $5.00 $0.00 20 40 60 ($5.00) ($10.00) ($15.00) ($20.00) Both put positions will break even at a stock price of $38.55. 5(c). Does Call - Put = S - PV(exercise price)? $3.90 - $1.45 $42 - 40/(1.04) $2.45 $3.53 NO! Put-call parity does not hold for this European-style contract. - 105 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems 6(a). To solve this problem, express put call parity in the following form: C(exercise price) – P(exercise price) – PV(F) + PV(exercise price) = 0 Now we can equate put-call parity for two different options: C(40) - P(40) - PV(F) + PV(40) = C(50) - P(50) - PV(F) + PV(50) Note that the PV(F) on each side cancels. Then the only unknown is P(50). Solving for P(50) yields: P(50) = C(50) + PV(50) - C(40) + P(40) - PV(40) P(50) = 2.47 + 50/1.03 - 8.73 + .59 - 40/1.03 = 2.47 + 48.54 - 8.73 + .59 – 38.83 P(50) = $4.04 The same can be done to find the value of C(45): C(40) - P(40) - PV(F) + PV(40) = C(45) - P(45) - PV(F) + PV(45) C(45) = C(40) - P(40) + PV(40) +P(45) - PV(45) C(45) = 8.73 - .59 +40/1.03 + 1.93 - 45/1.03 C(45) = 8.73 - .59 +38.83 + 1.93 – 43.69 C(45) = $5.21 6(b). To solve this problem, express put call parity in the following form: C(exercise price) – P(exercise price) – PV(F) + PV(exercise price) = 0 Solve for the share price PV(F) or S = $48/1.03 = $46.60 The no arbitrage price differential, at an exercise price of $40, is: C(exercise price) – P(exercise price) = S - PV(exercise price) = 0 Differential = $46.60 - $40/1.03 = $46.60- $38.83 = $7.77 The actual put-call price differential at a strike price of $40 is ($8.73 – 0.59) = $8.14. Assuming the actual T-bill is priced correctly, the call price is overvalued relative to the put option. The arbitrage transaction requires the purchase of the put option while shorting the call option. 7. (a). Sum of T-bill, call & put Payoff 60 T-bill Call 0 60 Stock Price Put -60 - 106 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems 7(b). With a price of $97 for 6 month T-bills, the 6-month risk-free rate is 100/97 -1 = 3.09% Using put-call parity the “no arbitrage price” is S= PV(exercise price)+C-P S = $60/1.0309 + 3.18 - 3.38 S = $58.00 7(c). Since put-call parity indicates the “no arbitrage” price of the stock is $58 and the stock is selling at $60, the arbitrage would be to sell the over-valued portfolio (the stock) and use the proceeds ($60) to buy the undervalued portfolio (.6 t-bills, long 1 call, short 1 put). This set of trades yields $2 in arbitrage profits. Since by put-call parity we know that the two portfolios will have exactly offsetting terminal payoffs, the trade is riskless. 8(a). Expiration Date Long Put (X=$55) Initial Long Stock Price(S) Payoff = max(0,55-S) Put Premium Net Profit 35 40 45 50 55 60 65 70 75 $20.00 $15.00 $10.00 $5.00 $0.00 $0.00 $0.00 $0.00 $0.00 ($1.32) ($1.32) ($1.32) ($1.32) ($1.32) ($1.32) ($1.32) ($1.32) ($1.32) $53.68 $53.68 $53.68 $53.68 $53.68 $58.68 $63.68 $68.68 $73.68 Long Put 8(b). $80.00 $60.00 $40.00 $20.00 $0.00 35 50 75 Using put-call parity, the position could have been replicated by selling the portfolio, buying the call option at the ask price, and investing the balance in T-bills yielding 7%. - 107 Copyright © 2010 by Nelson Education Ltd. Solutions for Chapter 13: Questions and Problems 8(c). Expiration Date Stock Price(S) Short Call (X=$55) Payoff = max(0,S-55) 35 40 45 50 55 60 65 70 75 Initial Short Call Premium $0.00 $0.00 $0.00 $0.00 $0.00 ($5.00) ($10.00) ($15.00) ($20.00) $2.55 $2.55 $2.55 $2.55 $2.55 $2.55 $2.55 $2.55 $2.55 Net Profit $37.55 $42.55 $47.55 $52.55 $57.55 $57.55 $57.55 $57.55 $57.55 Short Call 8(d). $80.00 $60.00 $40.00 $20.00 $0.00 35 50 75 Using put-call parity, the position could have replicated by selling the portfolio, selling the put option at the bid price, and then investing the balance in T-bills yielding 7%. 9(a) Price of ARB Stock at Expiration 40 45 50 55 60 65 70 75 Initial Cost ($1.72) ($1.72) ($1.72) ($1.72) ($1.72) ($1.72) ($1.72) ($1.72) Profit on Call #1 Position $0.00 $0.00 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 Profit on Call #2 Position $0.00 $0.00 $0.00 $0.00 $0.00 ($10.00) ($20.00) ($30.00) - 108 Copyright © 2010 by Nelson Education Ltd. Net Profit on Total Position ($1.72) ($1.72) ($1.72) $3.28 $8.28 $3.28 ($1.72) ($6.72) Solutions for Chapter 13: Questions and Problems 9(b). $8.00 $4.00 $0.00 40 45 50 55 60 65 70 75 ($4.00) ($8.00) Breakeven points are $51.72 and $68.28. Maximum profit occurs at $60. Maximum profit occurs when the short calls are at-the-money; at prices above $60, the losses on the short calls reduce profit. Breakeven on the low side occurs at the long call strike price ($50) plus sufficient stock price increase to cover the position’s cost ($1.72). This equals $51.72. Breakeven on the high side occurs with the position’s cost ($1.72), profit on the call (P$50), and loss of the short calls 2($60-P) equal zero: (P-$50) + 2($60-P) - $1.72 = 0 which occurs when price = $68.28 9(c). The user of this position is betting on low volatility (that prices will stay between breakeven points). The holder has limited liability for substantial price declines and unlimited liability for substantial price increases. 10. Consider the following put option transactions: (i) long one put #1 (exercise price $35); (ii) short two puts #2 (exercise price $40), and (iii) long one put #3 (exercise price $45). From Exhibit 13.25, the net initial cost of this set of transactions is -$0.83 (= -1.70 + 3.67 + 3.67 - 6.47) and its terminal payoffs for a variety of potential expiration date SAS stock prices are: SAS Price Value of Value of Value of Cost of Net (Expiration) Put #1 Put #2 Put #3 Options Profit 20 15.00 -40.00 25.00 (0.83) -0.83 25 10.00 -30.00 20.00 (0.83) -0.83 30 5.00 -20.00 15.00 (0.83) -0.83 36 0.00 -10.00 10.00 (0.83) -0.83 40 0.00 0.00 5.00 (0.83) 4.17 45 0.00 0.00 0.00 (0.83) -0.83 50 0.00 0.00 0.00 (0.83) -0.83 55 0.00 0.00 0.00 (0.83) -0.83 60 0.00 0.00 0.00 (0.83) -0.83 Graphing these payoffs would lead to the same illustration as shown in Exhibit 13.37. - 109 Copyright © 2010 by Nelson Education Ltd.