The Profit Maximizing Cutoff in Observable Queues with State Dependent...

advertisement

The Profit Maximizing Cutoff in Observable Queues with State Dependent Pricing

Christian Borgs (MSR-NE) Jennifer T. Chayes (MSR-NE)

Sherwin Doroudi (CMU-Tepper) Mor Harchol-Balter (CMU-CS) Kuang Xu (MIT-LIDS)

Support provided by Microsoft Computational Thinking grant

1. Background & Motivation

4. Problem Statement & Approach

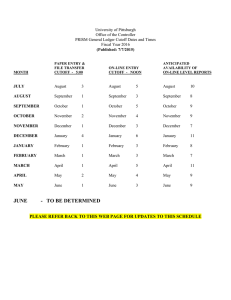

CHARGE ENTRY PRICE

OBSERVABLE

QUEUE

Hmm…

should

I join?

DELAY

SENSITIVE

CUSTOMERS

w/ LIMITED

BUDGET

INPUTS: fixed 𝜆 and 𝑉

OBJECTIVE: Find cutoff 𝑘 ∗ to maximize the

earning rate 𝑅(𝑘, 𝜆, 𝑉)

TECHNIQUE: use a “discrete derivative”

Define Δ𝑥 𝑓 𝑥 ≡ 𝑓 𝑥 + 1 − 𝑓 𝑥

Δ𝑥 is the forward difference operator

Solve Δ𝑘 [𝑅 𝑘, 𝜆, 𝑉 ] = 0 for 𝑘 ∈ 𝐑

Obtain optimal cutoff 𝑘 ∗ = ⌈𝑘⌉

CLOUD COMPUTING SERVICE

GOAL: Choose prices and admissions

policy to maximize profits

2. The Queueing Model

𝑀/𝑀/1 queue

𝜆→

𝜇=1

WLOG

5. The Analysis

ln(𝜆) 𝐺 𝜆, 𝑉 − 𝑘 𝑒 ln

All customers are identical with parameters:

𝑉

𝑣=1

Value for receiving service

Waiting cost per unit time

Solve: 𝑅 𝑘 + 1, 𝜆, 𝑉 − 𝑅 𝑘, 𝜆, 𝑉 = 0

1

Define: 𝑘 ≡ 𝑘 + 2 and 𝐺 𝜆, 𝑉 ≡ 1 − 𝜆 𝑉 +

1−𝜆

Question: How do we solve this for 𝑘?

(𝑛 + 1) + 𝑝 ≤ 𝑉

Now solve: 𝑥𝑒 𝑥 = 𝐶 for 𝑥

Answer: Lambert 𝑊 (product log) function

𝑊 𝑥 𝑒

𝑛 : # of customers in (state of) system

ln(𝜆)𝜆𝐺(𝑉,𝜆)

=

1−𝜆

Call both of

these 𝑥

𝑝: price customers must pay

I wait only if:

𝜆 𝐺 𝜆,𝑉 −𝑘

3. How to Price?

𝑊(𝑥)

=𝑥

Or equivalently

𝑊 𝑥𝑒 𝑥 = 𝑥

6. Conclusions

Charge as much as customers are willing to pay in each state:

𝑝 𝑛 = 𝑉 − (𝑛 + 1)

𝝀

0

𝝀

𝝀

1

𝝀

= ceil

𝝀

1

1

ln 𝜆 ⋅ 𝜆

1−𝜆 𝑉+

−

⋅𝑊

1 − 𝜆 ln 𝜆

1−𝜆

𝑘

𝑘−1

$𝑉 − 1 𝟏 $𝑉 − 2 𝟏

1−𝜆 𝑉+

𝑘∗

Cutoff at 𝑘

𝟏 $𝑉 − 𝑘 − 2 𝟏 $𝑉 − 𝑘 − 1𝟏

So what can the closed form do for us?

But… we use an explicit early cutoff at state 𝑘.

Why?

Asymptotic Results

For fixed 𝜆 < 1, as 𝑉 → ∞: 𝑘 ∗ ∼ 1 − 𝜆 𝑉

Answer: Cutoff shorter queue high prices more often

When 𝜆 = 1, as 𝑉 → ∞: 𝑘 ∗ ∼ 2𝑉

So how much do we make?

Probability:

(𝑘)

𝜋0

0

Price charged:

𝝀

(𝑘)

𝜋1

𝝀

𝝀

1

(𝑘)

𝜋𝑘−1

$𝑉 − 1 𝟏 $𝑉 − 2 𝟏

For fixed 𝜆 > 1, as 𝑉 → ∞: 𝑘 ∗ ∼ log 𝜆 ( 𝑉)

𝝀

𝑘

𝑘−1

𝟏 $𝑉 − 𝑘 − 2 𝟏

Earning rate = (arrival rate) x (average price charged)

Is the cutoff of practical use?

When 𝜆 > 1: high cutoff huge losses!

𝑘−1

(𝑘)

𝜋𝑛 : Probability that a new arrival

sees state 𝑛, given a cutoff of 𝑘

𝜆

1

𝑅(𝑘, 𝜆, 𝑉) =

⋅

𝑘+1

1−𝜆

1−𝜆

𝑘∗ = 7

⋅ 𝑝(𝑛)}

𝑝 𝑛 = 𝑉 − (𝑛 + 1)

1 − 𝜆𝑘 1 − 𝜆 𝑉 + 𝜆𝑘 1 + 𝑘 − 𝑘𝜆 − 1

Earning Rate

𝑅 𝑘, 𝜆, 𝑉 = 𝜆 ⋅

(𝑘)

{𝜋𝑛

𝑛=0

Call this

constant 𝐶

𝜆 = 1.2

𝑉 = 50

𝑘

1

1−𝜆

−2