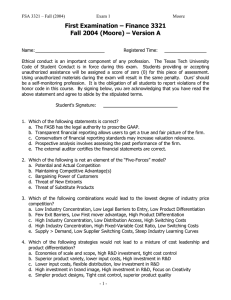

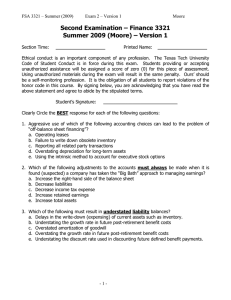

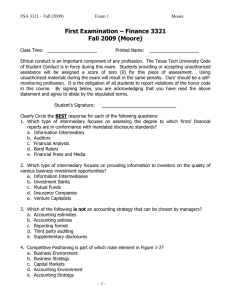

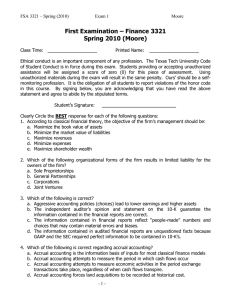

Second Examination – Finance 3321 Summer 2010 (Moore) – Version 1

advertisement

FSA 3321 – Summer (2010) Exam 2 – Version 1 Moore Second Examination – Finance 3321 Summer 2010 (Moore) – Version 1 Section Time: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. Which of the following strategies would lead to a mixture of cost leadership and product differentiation? a. Economies of scale and scope, simpler product design, Lower input costs b. Superior product variety, more flexible delivery, High Brand Advertising c. Lower input costs, Low-cost Distribution, Low investment in R&D d. High investment in brand image, High investment in R&D, Low Cost Distribution e. Complex product designs, Superior Product Quality, Superior customer service 2. Which of the following strategies would lead to pure cost leadership or pure product differentiation strategies? a. Economies of scale and scope, high R&D investment, tight cost control b. Superior product variety, lower input costs, High investment in R&D c. Lower input costs, flexible distribution, low investment in R&D d. Low investment in brand image, Low investment in R&D, Focus on Cost Control e. Simpler product designs, Tight cost control, superior product quality 3. Which of the following strategies would lead to pure product differentiation? a. Economies of scale and scope, simpler product design, tight cost control b. Superior product variety, more flexible delivery, Low investment in R&D c. Lower input costs, low-cost distribution, high investment in R&D d. High investment in brand image, High investment in R&D, Focus on Creativity e. Simpler product designs, Tight cost control, Lower Input Cost 4. Which of the following adjustments to the accounts must always be made when it is found (suspected) a company has taken the “Big Bath” approach to managing earnings? a. Increase the right-hand side of the balance sheet b. Decrease liabilities c. Increase retained earnings d. Increase total assets -1- FSA 3321 – Summer (2010) Exam 2 – Version 1 Moore 5. Which of the following must result in overstated asset balances? a. Delays in the write-down (expensing) of current assets such as inventory. b. Understating the growth rate in future post-retirement benefit costs c. Overstated amortization of goodwill d. Overstating the growth rate in future post-retirement benefit costs e. Understating the discount rate used in discounting future defined benefit payments. 6. Aggressive use of which of the following accounting choices can lead to the problem of “off-balance sheet financing”? a. Operating leases b. Failure to write down obsolete inventory c. Reporting all related party transactions d. Overstating depreciation for long-term assets e. Using the intrinsic method to account for executive stock options 7. What is the first step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies f. Evaluate the quality of disclosure 8. What is the fourth step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies f. Evaluate the quality of disclosure 9. Assume a company has been classified as belonging in a purely differentiated (specialty good) industry. Which one of the following disclosures would be considered a Type 1 key accounting policy? a. Discount rates on defined benefit plans b. Inventory is measured on a Lifo basis at lower of cost or market c. Disclosure regarding the amount of Goodwill impaired during the year d. Disclosure new customer service programs e. Disclosure regarding the strategic placement of new distribution centers -2- FSA 3321 – Summer (2010) Exam 2 – Version 1 Moore 10. Assume a company has been classified as belonging in a purely commodity product (cost leadership) industry. Which one of the following disclosures would be considered a Type 1 key accounting policy? a. Disclosure regarding product returns and warranties b. Disclosure regarding R&D outcomes leading to new patents c. Disclosure regarding cost cutting activities d. Disclosure regarding new investment in marketing programs e. Disclosure regarding new products introduced to the market Use the following information for questions 11-12 Net Sales/Cash from sales Changes in CFFO/OI Total Accruals/Change in Sales Net Sales/Net Accounts Receivable Net Sales/Warranty Liabilities Total Accruals/Change in Sales 2001 2002 2003 2004 0.99 0.88 0.50 12.0 104 0.50 0.98 0.81 .049 10.0 106 .049 1.01 0.82 0.62 11.0 107 0.62 1.00 0.65 0.58 16.0 108 0.58 11. Which of the expense diagnostic ratios would provide a “red flag” raising concerns that expenses may have been understated for the purpose of overstating net income in 2004? a. Net Sales/Cash from sales b. Net Sales/Warranty Liabilities c. Changes in CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) d. Changes in CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) e. Total Accruals/Change in Sales 12. Which of the revenue diagnostic ratios would provide a “red flag” raising concerns that revenues may have been overstated for the purpose of overstating net income in 2004? a. Net Sales/Cash from sales b. Net Sales/Net Accounts Receivable c. Net Sales/Warranty Liabilities d. Changes in CFFO/OI (Cash Flow from Operating Activities)/(Operating Income) e. Changes in CFFO/NOA (Cash Flow from Operating Activities)/(Net Operating Assets) -3- FSA 3321 – Summer (2010) Exam 2 – Version 1 Moore Questions 13-16 (Operating and Capital Lease Adjustments) Use the following information for questions 13-16 ABC Company is a startup company in an industry that exclusively uses capital leases for it’s expensive medical testing equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 15 years and that their annual cost of debt is 8.00%. The annual lease payments are $3,500,000. ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 30%. 13. Adjust ABC’s books to reflect the lease as being capitalized. Assume the appropriate interest expense in the second year would be $2,308,386. What amount should have been recognized as the adjusted capital lease liability in the contract signing year? a. $52,500,000 b. $30,000,000 c. $29,958,175 d. $28,854,829 e. $27,663,216 14. Now, assume the present value of the lease payments over the entire life of the contract was $30,000,000. Adjust ABC’s books to reflect the lease as being capitalized. The depreciation expense that should be charged against income in the 8th year is: a. $3,500,000 b. $2,871,700 c. $2,000,000 d. $1,758,804 e. $1,410,000 15. Adjust ABC’s books to reflect the lease as being capitalized. Maintain the $30,000,000 assumption. Compute the appropriate charge for interest expense in the third year. a. $2,400,000 b. $2,312,000 c. $2,308,386 d. $2,216,960 e. $2,114,317 16. Compute the overall effect on Net Income in the first year for ABC (had the lease been capitalized) would be (relative to the reported Net Income, net of tax). Keep the $30,000,000 assumption. a. $900,000 Lower b. $812,000 Lower c. $630,000 Lower d. $568,400 Lower e. $243,600 Lower -4- FSA 3321 – Summer (2010) Exam 2 – Version 1 Moore Use the following information for problems 17 through 20 You are performing an accounting analysis on ABC Company and noted excessive goodwill balances relative to reported PPE. The following table was constructed from ABC’s 10-K information. Assume all new goodwill is recognized at the end of the year for the purpose of restatement. Further, assume a tax rate of 30%. Finally, you are starting the restatement process from 2005’s financial statements. ABC has a December 31 fiscal year end. Assume goodwill has a 5-year useful life and that you are adjusting the account. Beginning Balance New Goodwill Goodwill Impaired Ending Goodwill 2006 15,000,000 5,000,000 0 20,000,000 2007 20,000,000 10,000,000 2,000,000 28,000,000 2008 28,000,000 8,000,000 1,000,000 35,000,000 2009 35,000,000 2,000,000 20,000,000 17,000,000 17. How much goodwill should be impaired in 2007? a. nothing b. $2,000,000 c. $3,000,000 d. $4,000,000 e. $5,000,000 18. How much additional impairment of ABC’s goodwill would be needed in 2008? a. $7,600,000 b. $6,000,000 c. $5,000,000 d. $4,000,000 e. $3,000,000 19.The adjusted Goodwill balance at the end of 2009 should be: a. $19,400,000 b. $25,000,000 c. $26,000,000 d. $29,400,000 e. $30,000,000 20. The overall decrease to Owners’ Equity in 2006 for ABC after adjustment would be? a. $900,000 b. $2,100,000 c. $1,200,000 d. $2,800,000 e. $3,000,000 -5- FSA 3321 – Summer (2010) Exam 2 – Version 1 Moore Problem 1 – Overs and Unders (20 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N) Assets 1 2 3 4 5 6 Equity Revenues Expenses Net Income The company used an unrealistically low bad debt expense ratio The company used too small a growth rate to estimate the present value of future medical benefit costs on a defined benefit pension healthcare plan The company took a "big bath" when recording restructuring expenses The company recognized revenues on customer deposits before they were earned The company , a car dealer, recorded the trade-in value of used cars at twice appraised value The company capitalized all research and development expenses for the year 8 The company failed to include the results of a lawsuit verdict rendered against them on December 29 since they planned and appeal the next year The company failed to recognize that a line of inventory had become obsolete and impaired 9 The company used the allowance method to account for bad accounts receivables instead of the specific identification method 10 The company used too large a discount rate for determining its defined pension benefit liabilities 7 Liabilities Question 5 should read: A Del Monte booked all newspaper grocery store coupons in 2009 as deferred advertising expense and made no adjusting entry at the end of the year. -6-