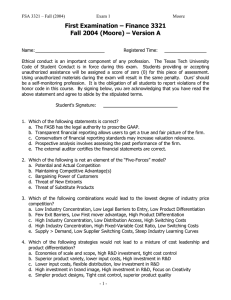

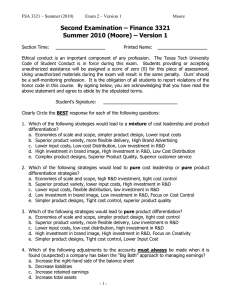

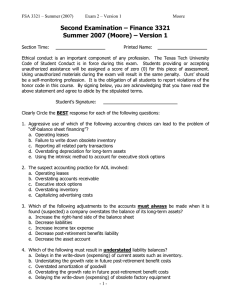

Second Examination – Finance 3321 Summer 2008 (Moore) – Version 1

advertisement

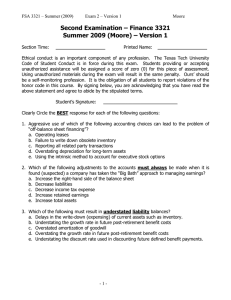

FSA 3321 – Summer (2008) Exam 2 – Version 1 Moore Second Examination – Finance 3321 Summer 2008 (Moore) – Version 1 Section Time: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Clearly Circle the BEST response for each of the following questions: 1. Aggressive use of which of the following accounting choices can lead to the problem of “off-balance sheet financing”? a. Operating leases b. Failure to write down obsolete inventory c. Reporting all related party transactions d. Overstating depreciation for long-term assets e. Using the intrinsic method to account for executive stock options 2. The suspect accounting practice for AOL involved: a. Operating leases b. Overstating accounts receivable c. Executive stock options d. Overstating inventory e. Capitalizing advertising costs 3. Which of the following adjustments to the accounts must always be made when it is found (suspected) a company overstates the balance of its long-term assets? a. Increase the right-hand side of the balance sheet b. Decrease liabilities c. Increase income tax expense d. Decrease post-retirement benefits liability e. Decrease the asset account 4. Which of the following must result in understated asset balances? a. Delays in the write-down (expensing) of current assets such as inventory. b. Understating the growth rate in future post-retirement benefit costs c. Overstated amortization of goodwill d. Overstating the growth rate in future post-retirement benefit costs e. Delaying the write-down (expensing) of obsolete factory equipment -1- FSA 3321 – Summer (2008) Exam 2 – Version 1 Moore Questions 5-8 (Operating and Capital Lease Adjustments) Use the following information for questions 5-8 ABC Company is a startup company in an industry that exclusively uses capital leases for it’s expensive medical testing equipment. ABC, however, used operating lease accounting in its first year of operations. Assume the average lifespan of ABC’s leased equipment is 10 years and that their annual cost of debt is 7.06%. The annual lease payments are $4,100,000. The present value of the future lease payments is $28,717,000 (rounded). ABC’s industry commonly uses straight-line depreciation and the effective tax rate is 30%. 5. Adjust ABC’s books to reflect the lease as being capitalized. The adjusted long term lease liability at the end of the third year would be: a. $41,000,000 b. $32,800,000 c. $28,717,000 d. $22,049,958 e. $23,084,042 6. Adjust ABC’s books to reflect the lease as being capitalized. The depreciation expense that should be charged against income in the 8th year is: a. $4,100,000 b. $2,871,700 c. $4,000,000 d. $758,804 e. $41,000,000 7. Adjust ABC’s books to reflect the lease as being capitalized. Compute the appropriate charge for interest expense in the second year. a. $2,072,580 b. $2,027,420 c. $2,218,904 d. $1,881,096 e. $1,724,441 8. Compute the overall effect on Net Income in the second year for ABC (had the lease been capitalized) would be (relative to the reported Net Income, net of tax). a. $4,752,796 Lower b. $3,326,957 Higher c. $652,796 Lower d. $559,384 Lower e. $456,957 Lower -2- FSA 3321 – Summer (2008) Exam 2 – Version 1 Moore 9. Channel Stuffing is defined as: a. Earnings Management b. Shipping unordered merchandise and recording the revenues c. Intense marketing plans d. Flexible Accounting e. Conservative Accounting 10. What is the first step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies f. Evaluate the quality of disclosure 11. What is the third step of the method for a structured accounting analysis (per text) a. Identify potential “red flags” b. Assess the degree of potential accounting flexibility c. Evaluate the actual accounting strategy d. Undo accounting distortions e. Identify key accounting policies f. Evaluate the quality of disclosure 12. Assume a company has been classified as belonging in a purely highly competitive (commodity) industry. Which one of the following disclosures would be considered a key accounting policy? a. Net Sales/Warranty Liabilities b. Inventory is measured on a Lifo basis at lower of cost or market c. Disclosure regarding new product development R&D expenses d. Disclosure regarding same store sales relative to prior year e. Disclosure regarding the revenue recognition principle used 13. Assume a company has been classified as belonging in a purely differentiated product (specialty) industry. Which one of the following disclosures would be not be considered a key accounting policy? a. Disclosure regarding product returns and warranties b. Disclosure regarding R&D outcomes leading to new patents c. Disclosure regarding cost cutting activities d. Disclosure regarding new investment in marketing programs e. Disclosure regarding new products introduced to the market -3- FSA 3321 – Summer (2008) Exam 2 – Version 1 Moore Use the following information for problems 14 through 20 ABC Company was established in 2007 and sells both household appliances and product warranty contracts on household appliances. These product service contracts last for 5 years. On June 30, 2007, ABC sold $15,000,000 of contract sales and credited all proceeds to 2007 to revenue. In 2008, the auditor caught the error in accounting and forced ABC to adjust its accounts to reflect service contract liabilities. Assume a tax rate of 30%. ABC has a December 31 fiscal year end. 14. Adjust ABC’s 2007 books to reflect the recognition future service contract liabilities. a. $15,000,000 increase to long-term liabilities and $15,000,000 decrease to revenues b. $13,500,000 increase to long-term liabilities and $13,500,000 decrease to revenues c. $9,000,000 increase to long-term liabilities and $12,000,000 decrease to revenues d. $3,000,000 increase to current liabilities and $13,500,000 decrease to revenues e. $3,000,000 increase to current liabilities and $9,000,000 increase to long-term liabilities 15. Adjust ABC’s 2007 books to properly reflect service contract liabilities. The adjustment to reduce net income would be: a. $12,000,000 b. $9,450,000 c. $9,000,000 d. $6,300,000 e. $3,000,000 16. How much 2007 service contract sales should be recognized in 2008? a. $9,000,000 b. $8,400,000 c. $6,000,000 d. $3,000,000 e. $1,500,000 17. The overall decrease to Owners’ Equity in 2007 for ABC after adjustment would be? a. $12,000,000 b. $9,450,000 c. $9,000,000 d. $6,300,000 e. $3,000,000 18. Which organization has been delegated the responsibility to establish US accounting standards? a. AICPA b. CPA c. FASB d. IASB e. SEC -4- FSA 3321 – Summer (2008) 19. In a. b. c. d. e. Exam 2 – Version 1 Moore the earnings management literature, income smoothing will only result in: Overstated reported earnings Understated earnings Companies taking the “big bath” Either understated or overstated earnings Cannot be answered 20. In the movie “The Control of Working Capital”, what type of business strategy (key success factors) did John Cleese (tall guy) apply to his business? a. Differentiated market strategies when operating in a commodity goods market b. Differentiated market strategies when operating in a specialty goods market c. Cost leadership market strategies when operating in a specialty goods market d. Cost leadership market strategies when operating in a commodity goods market e. Insufficient information to address question -5- FSA 3321 – Summer (2008) Exam 2 – Version 1 Moore Problem 1 – Overs and Unders (20 Points) Analyze the following transactions (omissions or incorrect accounting treatments) and assess whether the accounts are Overstated, Understated, or No Effect. Fill in the appropriate boxes as (O), (U), (N) Assets 1 The company recorded half the proceeds from 4-year service contracts sold in the current year 2 The company understated the writedown (impairment) of plant assets due to a corporate restructuring 3 The company took a big bath regarding the write-down obsolete inventory 4 The company used too small a growth rate in future medical costs in estimating "other" post-retirement benefits 5 The company improperly capitalized equipment maintenance costs 6 Google failed to write down impaired auction rate securities investments 7 The company improperly capitalized R&D costs 8 The company depreciated assets over a 5 year life when a 10 year life is appropriate. 9 The company failed to increase its allowance for doubtful accounts rate when customer credit quality declined 10 The company shipped unordered merchandise to a customer and recorded the shipment as a sale -6- Liabilities Equity Revenues Expenses Net Income