Exam 4 - Finance 3321 (Moore) – Summer 2008

advertisement

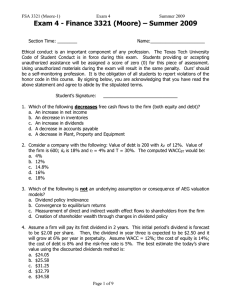

FSA 3321 (Moore-1) Exam 4 Summer 2008 Exam 4 - Finance 3321 (Moore) – Summer 2008 Section Time: ________ Name:______________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ 1. Which of the following increases free cash flows to the firm (both equity and debt)? a. An increase in gross margins b. An increase in inventories c. An increase in dividends d. A decrease in accounts payable e. A increase in Plant, Property and Equipment 2. Consider a company with the following: Value of debt is 200 with kd of 12%. Value of the firm is 600; ke is 18% and rf = 4% and T = 30%. The computed WACCAT would be: a. 4% b. 12% c. 12.93% d. 14.8% e. 18% 3. AEG valuation models require which of the following discount factors? a. WACC and the dividend growth rate b. Cost of Debt and Cost of Equity c. Cost of Debt and the dividend growth rate d. Cost of Equity and negative terminal value growth rates e. Cost of Equity and positive terminal value growth rates 4. Assume a firm will pay its first dividend in 3 years. This initial period’s dividend is forecast to be $3.00 per share and is expected to grow at 6% per year in perpetuity. Assume WACC = 12%; the cost of equity is 14%; the cost of debt is 8% and the risk-free rate is 5%. The best estimate the today’s share value using the discounted dividends method is: a. $12.40 b. $19.60 c. $25.31 d. $28.86 e. $37.50 Page 1 of 10 FSA 3321 (Moore-1) Exam 4 Summer 2008 5. The main benefit of the residual income valuation model (as compared to free cash flows and discounted dividends) is that: a. Dividend payments are too variable compared with price variability b. The implied investment horizon to recover value is unrealistically short. c. The price variability explained by residual income variability is relatively small. d. The valuation is not as sensitive to terminal value growth rates as compared to free cash flow and dividend valuation models. e. Residual income is easier to predict than the other measures. 6. The present value (today) of the terminal (continuation) value cash flow that begins in 7 years is $20,000,000 assuming a WACC equal to 11%. The year 7 free cash flow (beginning of the growing perpetuity) is $3,366,746. What is the growth rate required for the continuation value term? a. 1% b. 2% c. 3% d. 4% e. 5% 7. Assume the market return and risk-free rate remain unchanged. Which of the following must be true if the firm’s Beta suddenly changes from 0.9 to 1.8? a. The firms cost of equity increases by 50% b. The firm’s cost of debt decreases in direct proportion to the increase in the cost of equity because the WACC must remain constant c. The WACC of the firm decreases d. The market value of the equity increases e. The share price will decrease 8. Which is correct regarding the Abnormal Earnings Growth valuation model? a. Because the model incorporates cumulative dividend earnings, it is not appropriate for valuing firms that don’t pay dividends. b. A firm that, on average, has earned more than its Ke has negative AEG. c. During periods when Residual Income is declining, AEG is positive for those periods. d. A firm with forecast earnings growth less than Ke will increase shareholder value by decreasing dividends. e. During periods when Residual Income is declining, AEG is negative for those periods. 9. Assume a firm’s revenues and net income are projected to grow by 10% per year into the foreseeable future. What terminal value growth rate is most appropriate for the free cash flow valuation model when WACC is 11%? a. -40% b. -10% c. 0% d. 5% e. 15% Page 2 of 10 FSA 3321 (Moore-1) Exam 4 Summer 2008 10. Assume a firm’s revenues and net income are projected to grow by 10% per year into the foreseeable future. What terminal value growth rate is most appropriate for the AEG valuation model? a. -30% b. 0% c. 5% d. 15% e. 40% 11. Old Reliable Manufacturing Company's stock has a market price of $60 per share and the market’s assessment of its steady state return on equity is 25% per year. If its cost of equity capital is 10 percent and its book value is expected to grow at 5 percent per year indefinitely, what is the current book value per share? a. $15.00 b. $20.00 c. $28.86 d. $37.50 e. $60.00 12. You have just computed the Beta of a stock to be 2.5 and the estimate of the relevant risk-free rate is 5%. The expected market return next period is 12% and your estimate of Ke is 23%. What is the appropriate long-run market risk premium? a. 7.0% b. 7.2% c. 7.5% d. 8.0% e. 9.0% Page 3 of 10 FSA 3321 (Moore-1) Exam 4 Summer 2008 Computation of Valuations Models Section Use the following summary financial statement information and forecasts provided by TTU Value-Metrics to answer the valuation questions in this section about Hi-Flyer Corp. which has a December 31 fiscal year end. (in thousands except per share data) Net Income Total Dividends Paid Book Value of Equity Total Liabilities CFFO CFFI Dividends Per Share Shares Outstanding (12/31/07) Cost of Equity Cost of Debt WACC(bt) Actual Estimated Estimated 2007 2008 2009 225,000 250,000 300,000 48,000 50,000 55,000 1,500,000 1,000,000 400,000 500,000 600,000 -250,000 -300,000 -350,000 0.48 0.50 0.55 100,000 0.14 0.08 0.11 Estimated 2010 320,000 60,000 700,000 -400,000 0.60 13. Using the above forecasts, determine the intrinsic value of High Flyer shares. Use the discounted dividends model; assume the forecast dividend payment in 2011 is $0.65 and that it will growth by 5% per year in perpetuity. The appropriate intrinsic value is: a. $5.66 b. $6.14 c. $6.62 d. $8.49 e. $8.97 14. (Sensitivity Analysis). You know that dividend growth rates are estimated with error. In the previous problem, the dividend growth perpetuity was assumed to be 5% per year. What would be the impact on share price if the growth rate were assumed to be 8% (all other information remains the same). a. $2.44 higher b. $2.77 higher c. $3.61 higher d. $7.31 higher e. no impact 15. (Time Consistent Prices). Assume the valuation date is June 1, 2008 and that you computed a share price in Problem 31 of $7.00 per share. What is the time consistent price that would be compared with the observed price of $8.50. a. $7.23 b. $7.31 c. $7.39 d. $7.47 e. $8.23 Page 4 of 10 FSA 3321 (Moore-1) (in thousands except per share data) Net Income Total Dividends Paid Book Value of Equity Total Liabilities CFFO CFFI Dividends Per Share Shares Outstanding (12/31/07) Cost of Equity Cost of Debt WACC(bt) Exam 4 Summer 2008 Actual Estimated Estimated Estimated 2007 2008 2009 2010 225,000 250,000 300,000 320,000 48,000 50,000 55,000 60,000 1,500,000 1,000,000 400,000 500,000 600,000 700,000 -250,000 -300,000 -350,000 -400,000 0.48 0.50 0.55 0.60 100,000 0.14 0.08 0.11 16. (Free Cash Flow Valuation). Assume that free cash flow to the firm is forecast to be $400,000 in 2011 and that it is expected to grow by 5% per year thereafter. The estimated intrinsic value per share is (12/31/07): a. $44.77 b. $59.77 c. $61.27 d. $117.22 e. $54.77 17. (Residual Income). Compute the book value of equity at the beginning of 2010. a. $1,700,000 b. $1,895,000 c. $1,945,000 d. $2,145,000 e. $2,205,000 18. (Residual Income Valuation). Compute the normal income for 2009. a. $47,700 b. $62,000 c. $210,000 d. $238,000 e. $272,300 19. (Residual Income Valuation). Compute the intrinsic value of Hi-Flyer’s shares at the end of 2007. Assume residual income will be $35,000 in 2011 (perpetuity start) with a growth rate in the perpetuity of -30% per year. a. $1.69 b. $16.69 c. $16.95 d. $31.69 e. $53.69 Page 5 of 10 FSA 3321 (Moore-1) Exam 4 Summer 2008 (in thousands except per share data) Actual Estimated Estimated Estimated 2007 2008 2009 2010 Net Income 225,000 250,000 300,000 320,000 Total Dividends Paid 48,000 50,000 55,000 60,000 Book Value of Equity 1,500,000 Total Liabilities 1,000,000 CFFO 400,000 500,000 600,000 700,000 CFFI -250,000 -300,000 -350,000 -400,000 Dividends Per Share 0.48 0.50 0.55 0.60 Shares Outstanding (12/31/07) 100,000 Cost of Equity 0.14 Cost of Debt 0.08 WACC(bt) 0.11 20. (Residual Income Valuation - sensitivity). Assume the residual income perpetuity in the previous problem was changed to a -10% growth rate. By how much will this change the estimated share price computed in the previous problem? a. $0.44 higher b. $0.98 higher c. $1.46 higher d. $5.37 higher e. $5.91 higher 21. (AEG Valuation). Compute the dividend reinvestment income (DRIP) for 2010. a. $6,270 b. $7,000 c. $7,700 d. $8,400 e. $9,595 22. (AEG Valuation). Assume the dividend reinvestment income (DRIP) in 2009 is $7,000 compute the AEG for 2009. a. -$14,300 b. -$11,003 c. $0.00 d. $19,298 e. $22,000 23. (AEG Valuation). Assume that AEG is forecast to be -$10,000 in 2011 with a growth rate of negative 50% per year, onwards. Estimate the intrinsic value of Hi-Flyer’s shares at the end of 2007. a. $8.29 b. $15.63 c. $16.07 d. $17.59 e. $33.66 End of Valuation Model Computation Section Page 6 of 10 FSA 3321 (Moore-1) Exam 4 Summer 2008 Use the following information to solve the following three (3) problems Valuation with P/EBITDA, P/B and PEG multiples (Questions 24-26) Ball Corp. is a manufacturer of packaging materials that you are trying to value. Using the method of comparables, assess the value of Ball Corp. Information is provided concerning the current share price (PPS), forward earnings per share (EPS), the current book value of equity per share (BPS), EBITDA per share and the one-year ahead earnings growth rate for Ball Corp. and three of its listed competitors. Do not eliminate potential outliers in the following valuations. Sealed Air Corp Ball Corp PactIV Corp Crown Holdings PPS 32.91 51.54 34.68 24.69 EPS 1.74 3.54 1.84 1.37 BPS 11.01 11.64 6.22 <3.14> 24. Value Ball Corp Using the Price to Book Ratio. a. $2.72 per share b. $14.93 per share c. $49.85 per share d. $50.41 per share e. $51.54 per share 25. Value Ball Corp Using the Price to EBITDA Ratio. a. $7.27 per share b. $47.04 per share c. $48.16 per share d. $53.33 per share e. $54.22 per share 26. Value Ball Corp Using the PEG Ratio. a. $33.98 per share b. $43.98 per share c. $45.87 per share d. $51.20 per share e. $52.46 per share Page 7 of 10 EBITDA 4.83 7.46 4.49 5.64 1 Year ahead Earnings Growth 13.2% 9.6% 12.0% 20.5% FSA 3321 (Moore-1) Exam 4 Summer 2008 27. Old Reliable Manufacturing Company's stock has a book value of $15 per share and a long-run ROE = 25%. You have estimated its cost of equity capital to be 16% and its book value is expected to grow at 12% per year indefinitely. Compute Old Reliable’s intrinsic share value using the long run average residual income perpetuity method? a. $25.00 b. $25.56 c. $33.75 d. $48.75 e. $78.57 28. Old Reliable Manufacturing Company's stock has a market price of $52.40 per share and a book value of $15 per share. You have estimated its steady state ROE to be 20 percent per year and its expected growth rate in book value (in perpetuity) is 12%. What cost of equity supports the current stock price? a. 10.15% b. 12.33% c. 13.82% d. 14.29% e. 16.48% Page 8 of 10 FSA 3321 (Moore-1) Exam 4 Summer 2008 Consider the following information for Questions 29 through 31: You have just estimated β for XYZ Corp. using the Capital Asset Pricing Model. Your regression results follow. In addition, you also have performed research on the 10-K to get the balance sheet information below. Your goal is to estimate the relevant costs of capital for XYZ Corp. Assume that last year’s market return was 12% and the 10-year Treasury had a yield of 4%. Also, you found the market risk premium over the last 3-years to be 7% and that interest rates are not expected to change in the next 4 years. The Market Cap is $250 million and the tax rate is 30% Balance Sheet (Millions) Estimation R 2 Period β 5-Year 2.00 15.25% 3-Year 2-Year 1.50 1.30 18.45% 28.55% Published β 1.40 2007 Total Assets 180 Current Liabilities Long Term Liabilities Long-term Debt Pension Liabilities Capital Leases Book Value of Equity 10 4.00% 30 40 20 80 8.00% 12.00% 10.00% 29. Based on your analysis, compute the appropriate estimate of the cost of equity. a. 13.1% b. 13.8% c. 14.4% d. 14.5% e. 18.0% 30. 31. a. b. c. d. e. Compute the Before-Tax weighted average cost of debt 8.5% 9.6% 10.0% 7.4% 8.0% a. b. c. d. e. Compute the Before Tax Weighted average cost of capital. 10.86% 11.16% 12.60% 12.10% 13.10% Page 9 of 10 Average Interest Rate FSA 3321 (Moore-1) Exam 4 Summer 2008 Use the following Regression Output for Problems 32-33 This is the regression output for estimating Beta using CAPM. SUMMARY OUTPUT Regression Statistics Multiple R R Square Adjusted R Square Standard Error Observations Coefficients 0.079 1.30 Intercept X Variable 1 32. Standard Error 0.009 0.360 t Stat P-value Lower 95% 0.973 0.334 0.059 2.673 0.998 0.582 Upper 95% 0.09 2.02 Compute the upper and lower bounds on the cost of equity (95% confidence level). Use the information from problems 29-31 and the regression output above. a. b. c. d. e. 33. 0.2145 0.4603 0.2855 0.7152 60 4.63% 8.07% 8.07% 8.07% 4.63% < < < < < k k k k k < < < < < 10.86% 13.10% 10.81% 18.14% 18.14% What percentage of the firm’s return variability is not explained by the systematic risk component? a. b. c. d. e. 46.03% 28.55% 28.48 71.45% 0.20% Page 10 of 10