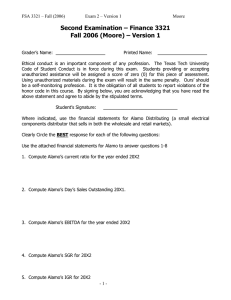

Second Examination – Finance 3321 Spring 2007 (Moore) – Version 1

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

Second Examination – Finance 3321

Spring 2007 (Moore) – Version 1

Printed Name: ____________________ Registered Section Time: ___________

Ethical conduct is an important component of any profession. The Texas Tech University

Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment.

Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms.

Student’s Signature: ______________________________

Where indicated, use the financial statements for Alamo Distributing (a small electrical components distributor that sells in both the wholesale and retail markets).

Clearly Circle the BEST response for each Multiple Choice questions and work the short answer problems: 3 Points Each in this section – No Partial Credit

Use the attached financial statements for Alamo to answer questions 1-8

1. Compute Alamo’s current ratio for the year ended 20X1

2. Compute Alamo’s Day’s Supply of Inventory for 20X2.

3. Compute Alamo’s EBITDA per share for the year ended 20X1

4. Compute Alamo’s IGR for 20X2

- 1 -

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

5. Compute Alamo’s Operating Profit Margin for 20X2

6. Compute Alamo’s ROE for 20X2

7. Compute Alamo’s Times Interest Earned for 20X1

8. Compute Alamo’s Debt Service Margin for 20X2

9. The major benefit of using method of comparables as a stock price screening tool is:

a. It provides consistent results

b. It is grounded in financial theory

c. It requires extensive forecasts and analysis

d. It requires little judgment

e. It is quick and easy to implement

10. Which of the following will result in increasing operating efficiency? a.

Increasing Days Supply of inventory. b.

Increasing Working Capital Turnover. c.

Extending more generous credit terms from 30 days to 60 days d.

Decreasing Accounts Receivable Turnover e.

Increasing the Cash to Cash Cycle

11. Identify the best statement regarding seasonal adjustments. a.

Seasonal adjustments should be applied to annual data b.

Seasonal adjustments with an underlying growth should be computed using the same quarter in previous years and applying an annual growth rate for the year. c.

Seasonal adjustments with an underlying growth should be computed using the same quarter in previous years and applying a growth rate based on the quarters. d.

Seasonal adjustments should never incorporate underlying growth. e.

Seasonal data can be directly identified in the 10-K financial statements.

- 2 -

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

12. Which of the following decreases free cash flows to the firm (both equity and debt)? a.

An increase in net profit margins b.

An decrease in inventories c.

A decrease in accounts receivable d.

An increase in accounts payable e.

An increase in Plant, Property and Equipment

13. Consider a company with the following: Value of debt is 400 with k d

of 12%. Before Tax value of firm is 600 and the before tax WACC is 14%. How much is the k e a.

12% b.

42%

for the firm. c.

08% d.

14% e.

18%

14. Consider a following company: V

D

is 200 with k d

of 8%. V

E

is 300 and WACC

12.5%. Compute the after tax WACC for the firm assuming a tax rate of 30%.

BT

is a.

3.2% b.

8.75% c.

9.3% d.

11.54% e.

12.5%

15. Discounted dividends valuation models require which of the following discount factors?

a. WACC and the dividend growth rate

b. Cost of Debt and Cost of Equity

c. Cost of Debt and the dividend growth rate

d. Cost of Equity and the dividend growth rate

e. Cost of Equity and WACC

16. Which of the following types of market return measure would be most appropriate for estimating Beta for a mid-size firm (market cap between $200 million and $1 Billion)? a.

S&P 500 monthly return b.

New York Stock Exchange Monthly Return c.

Dow Jones Industrial Average’s monthly return d.

A broad-based market composite return with small, medium and large cap firms e.

The 3-month treasury yield

17. You have estimated K e

is 15% using the CAPM. The estimated relevant risk-free rate is

5%. The expected market return next period is 8% and the appropriate market risk premium is 7% and the tax rate is 40%. What Beta did you use? a.

.024 b.

0.56 c.

1.00 d.

1.43 e.

3.33

- 3 -

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

Consider the following information for Questions 18 through 20:

You have just estimated β for XYZ Corp. using the Capital Asset Pricing Model. Your regression results follow. In addition, you also have performed research on the 10-K to get the balance sheet information below. Your goal is to estimate the relevant costs of capital for XYZ Corp. Assume that last year’s market return was 12% and the 5-year Treasury had a yield of 5.0%. Also, you found the market risk premium over the last 3-years to be 6.5% and that interest rates are not expected to change in the next 4 years. The tax rate is 30%.

Estimation Rate

Period

β R 2

Total Assets

300

5-Year

3-Year

2-Year

Published β

2.00

1.50

1.80

1.90

15.25%

42.45%

28.55%

Current Liabilities

Long Term Liabilities

Long-term Debt

Pension Liabilities

60

80

40

4.00%

8.00%

12.00%

Book Value of Equity 120

Market Value of Equity 180

18. Based on your analysis, what is the appropriate estimate of the cost of equity?

a. 14.8%

b. 16.7%

c. 17.4%

d. 18.0%

e. 19.0%

19. Compute the appropriate weighted-average cost of debt of XYZ Corp. a. 4.00%

b. 7.56%

c. 8.00%

d. 10.40%

e. 12.00%

20. Assume the weighted average cost of debt is 8% and the appropriate K e

is 14%, compute

WACC

BT.

a. 8.0%

b. 9.0%

c. 9.8%

d. 10.4%

e. 11.0%

- 4 -

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

21. Which of the following will cause estimated before-tax WACC to be most severely biased downwards? a. P/B > 1 and using the book value of liabilities instead of market value of liabilities. b. P/B < 1 and using the book value of liabilities instead of market value of liabilities. c. P/B > 1 and using the book value of equity instead of market value of equity. d. P/B < 1 and using the book value of equity instead of market value of equity. e. P/B > 1 and using the market value of equity instead of book value of equity.

22. What is the main disadvantage of using daily returns to compute the firm’s Beta? a.

The data is not available to the public b.

Daily returns are inconsistent with the theoretical model c.

Daily returns are computed only on a Monday through Friday basis, and weekends

(when markets are closed) renders the model useless d.

Daily returns are “noisy” and provide less explanatory power than longer-term measures. e.

The true value of a firm’s Beta changes on a daily basis.

- 5 -

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

Short Problem # 1 (Show all work to receive full credit) – 16Points

Valuation with P/E and P/B and P/EBITDA multiples

Sealed Air Corp. is a manufacturer of packaging materials that you are trying to value.

Using the method of comparables, assess the value of Sealed Air Corp. Information is provided concerning the current share price (PPS), current earnings per share (EPS), the current book value of equity per share (BPS), and EBITDA per share for Sealed Air and three of its listed competitors.

Required: Sealed Air using the P/E the P/B and the P/EBITDA multiples. Do not eliminate potential outliers. Briefly comment on which method comes closest to the observed market price of $34.02 per share. Finally, based upon the ratios, which (if any) of the firms appears to be an outlier and briefly justify your response.

PPS EPS BPS EBITDA (per share)

Sealed Air Corp 34.02 2.93 20.51 9.03

Ball Corp 45.95 3.14 11.19 7.46

PactIV Corp 32.01 1.96 6.43 4.29

Crown Holdings 23.88 1.82 <3.35> 4.98

a) Valuation based on P/E multiple

b) Valuation based on P/B multiple

c) Valuation based on P/EBITDA

d) Method that provides closest valuation and any apparent outlier company

- 6 -

FSA 3321 – Spring (2007) Exam 2 – Version 1

Problem 2 (Common Size Financial Statements) – 12Points

Prepare a common size Balance Sheet for Alamo Distributing for 20X1

- 7 -

Moore

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

Problem 3(Interpreting Regression Results) – 8 Points

Below are two sets of regressions for estimating Beta in the CAPM model. Both are based upon the result using the 6 month treasury bill as the relevant risk free rate and the S&P500 as the proxy for the market return. Based on the best regression, below, identify the estimated Beta and the appropriate degree of explanatory power.

Beta Estimate: _________

Explanatory Power: _________

SUMMARY OUTPUT - 72 Month Data Beta Estimate

Regression Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

ANOVA

0.570

0.325

0.316

0.081

72

Regression

Residual

Total df

1

70

71

SS

0.2221

0.4610

0.6831

MS

0.22

0.01

F

33.728

Significance F

1.70647E-07

Intercept

X Variable 1

Coefficients Standard Error

0.03

1.40

0.0096

0.2419

t Stat P-value

2.97

0.004092482

5.81

1.70647E-07

Lower 95%

0.0093

0.9224

SUMMARY OUTPUT - 36 Month Regression for Beta Estimate

Regression Statistics

Multiple R

R Square

Adjusted R Square

Standard Error

Observations

0.459

0.211

0.187

0.057

36

ANOVA

Regression

Residual

Total df

1

34

35

SS

0.030

0.111

0.140

Coefficients Standard Error

0.03

1.48

0.01

0.49

Intercept

X Variable 1

- 8 -

MS

0.030

0.003

F

9.071

Significance F

0.005

t Stat

3.51

3.01

P-value

0.001

0.005

Lower 95%

0.01

0.48

FSA 3321 – Spring (2007) Exam 2 – Version 1 Moore

ALAMO DISTRIBUTING COMPANY

ASSETS

Current Assets:

Cash

Accounts Receivable (net)

Inventories (at FIFO Cost)

Prepaid Expenses

BALANCE SHEETS

December 31, 20X1 and 20X2

20X1

$ 70,000

65,000

31,000

6,000

20X2

$ 38,000

105,000

52,000

4,500

Total Current Assets

Non-current Assets (at cost):

Land

Buildings

Equipment

Less: Accumulated Depreciation

Total Assets

Total Non-current Assets

$172,000

$208,000

150,000

460,000

(240,000)

$578,000

$750,000

========

$199,500

$237,000

150,000

681,000

(338,000)

$730,000

$929,500

========

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities:

Accounts Payable

Notes Payable

Accrued Liabilities

$ 22,000

60,000

18,000

$ 47,000

32,000

24,000

$100,000 $103,000 Total Current Liabilities

Notes Payable - Long Term 312,000 400,500

$412,000 $503,500 Total Liabilities

Stockholders' Equity:

Common Stock (no par value)

Retained Earnings

Total Stockholders' Equity

Total Liabilities & Stockholder Equity

$200,000

138,000

$338,000

$750,000

========

$220,000

206,000

$426,000

$929,500

========

- 9 -

FSA 3321 – Spring (2007) Exam 2 – Version 1

ALAMO DISTRIBUTING COMPANY

INCOME STATEMENTS

For Years Ending December 31, 20X1 and 20X2

20X1 20X2

Sales

Cost of Goods Sold

Gross Profit on Sales

$900,000

(350,000)

$550,000

$1,200,000

(580,000)

$ 620,000

Moore

Selling Expenses (110,000) (133,500)

Administrative Expenses

Income from Operations

Interest Expense

Income before Taxes

(238,000)

$202,000

(250,000)

(52,000)

$150,000

$ 236,500

(65,000)

$ 171,500

Income Tax Expense

Net Income

(60,000)

$ 90,000

========

(63,500)

$ 108,000

==========

Earnings per Common Share * $1.80 $1.96

Total Depreciation Expense included above .....

* Based on 50,000 and 55,000 average common shares outstanding in 20X1 and 20X2, respectively.

Summary of Cash Flow Statements

Cash Flow from Operating Activities

Cash Flow from Investing Activities

Cash Flow from Financing Activities

Dividends Paid

$ 82,000

20X1

$150,000

-$ 90,000

$ 20,000

$30,000

$ 98,000

20X2

$180,000

-$130,000

$10,000

$40,000

- 10 -