Third Examination – Finance 3321 Summer II (Moore)

advertisement

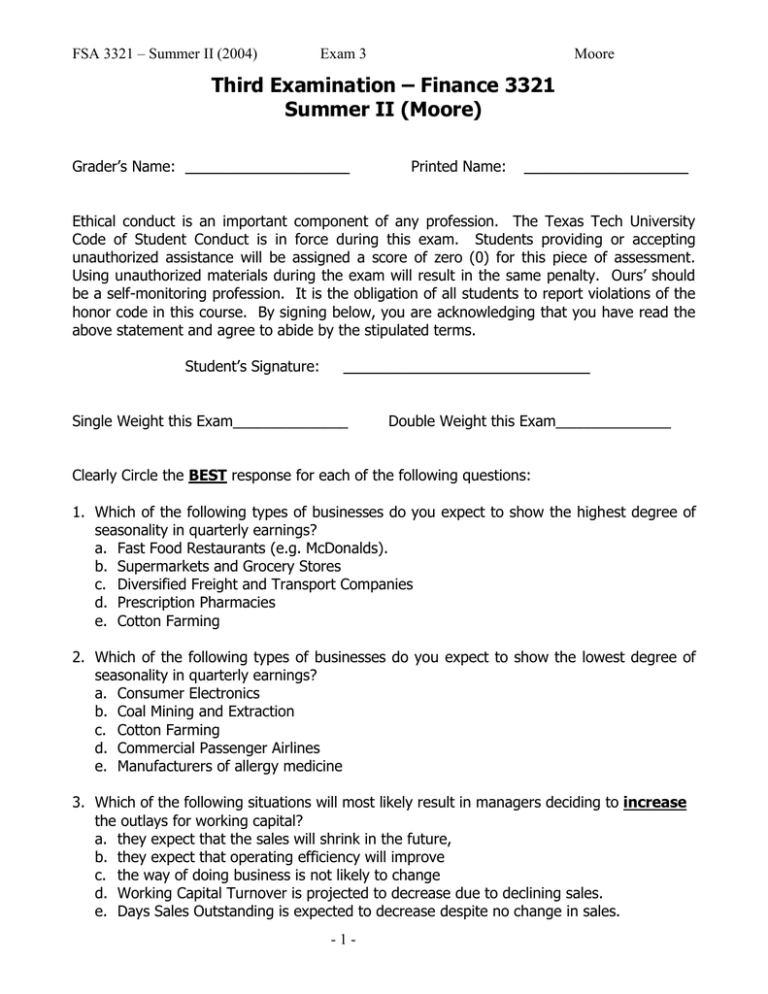

FSA 3321 – Summer II (2004) Exam 3 Moore Third Examination – Finance 3321 Summer II (Moore) Grader’s Name: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ Single Weight this Exam______________ Double Weight this Exam______________ Clearly Circle the BEST response for each of the following questions: 1. Which of the following types of businesses do you expect to show the highest degree of seasonality in quarterly earnings? a. Fast Food Restaurants (e.g. McDonalds). b. Supermarkets and Grocery Stores c. Diversified Freight and Transport Companies d. Prescription Pharmacies e. Cotton Farming 2. Which of the following types of businesses do you expect to show the lowest degree of seasonality in quarterly earnings? a. Consumer Electronics b. Coal Mining and Extraction c. Cotton Farming d. Commercial Passenger Airlines e. Manufacturers of allergy medicine 3. Which of the following situations will most likely result in managers deciding to increase the outlays for working capital? a. they expect that the sales will shrink in the future, b. they expect that operating efficiency will improve c. the way of doing business is not likely to change d. Working Capital Turnover is projected to decrease due to declining sales. e. Days Sales Outstanding is expected to decrease despite no change in sales. -1- FSA 3321 – Summer II (2004) Exam 3 Moore Use the following information for Questions 4 – 7. The following Models are quarterly EPS forecasting models. ~ Model 1: Et 0 ( EPS t 1 ) EPSt ~ Model 2: Et 0 ( EPS t 1 ) 0 EPSt 5 t 4 ~ Model 3: Et 0 ( EPS t 1 ) (105 . ) EPSt ~ Model 4: Et 0 ( EPS t 1 ) (.55) EPSt (.25) EPSt 1 (.20) EPSt 2 ~ Model 5: Et 0 ( EPS t 1 ) 0 EPSt (0.05) EPSt 3 4 t 3 Model 6: Et 0 ( EPS t 1 ) (.25) EPSt 3 EPSt 7 EPSt 11 EPSt 15 (.10) EPSt 3 ~ 4. Which of the above models would be described as a simple pure growth model? a. Model 1 b. Model 2 c. Model 3 d. Model 4 e. Model 5 5. Which of the above models would be described as a mean reverting moving average forecast that places unequal weights on previous earnings? a. Model 1 b. Model 2 c. Model 3 d. Model 4 e. Model 5 6. Which of the above forecasting models would be best described as a seasonally adjusted model with underlying growth? a. Model 2 b. Model 3 c. Model 4 d. Model 5 e. Model 6 7. Use Model 5 to forecast EPS for Q3(2004) given previous EPS: Q1(2003) = $1.75; Q2(2003) = $1.80; Q3(2003) = $2.20; Q4(2003) = $1.50; Q1(2004) = $1.80; Q2(2004) = $2.10 a. $1.95 b. $2.01 c. $2.16 d. $2.25 e. $2.36 -2- FSA 3321 – Summer II (2004) Exam 3 Moore 8. Manufactured Earnings is a "darling" of Wall Street analysts. Its current market price is $15 per share, and its book value is $5 per share. Analysts forecast that the firm’s book value will grow by 10 percent per year indefinitely. The cost of equity is estimated to be 15%. You have just estimated the long-term average ROE for the firm to be 30% per year. What is the appropriate intrinsic valuation of the firm you would have computed? a. $15 per share b. $20 per share c. $25 per share d. $30 per share e. $35 per share Use the following information for Question 9 Accounting-based valuation suggests that the stock price (a numerator of the PE ratio) can be viewed as the sum of the current book value per share plus the discounted expected future abnormal earnings per share. E ROE t 1 rE Et ROE t 2 rE 1 g t 1 Et ROE t 3 rE 1 g t 1 1 g t 2 PPSt BVE t 1 t 1 rE 1 rE 2 1 rE 3 9. How can a company with a low ROE have a high PE ratio? a. Cost of equity capital is low; expected growth of book value is high; future ROE is high (relative to current period ROE). b. Cost of equity capital is high; expected growth of book value is low; future ROE is low (relative to current period ROE). c. Cost of equity capital is low; expected growth of book value is low; future ROE is low (relative to current period ROE). d. Cost of equity capital is high; expected growth of book value is low; future ROE is low (relative to current period ROE). e. Cost of equity capital is high; expected growth of book value is high; future ROE is low (relative to current period ROE). and expected and expected and expected and expected and expected 10. Which of the following decreases free cash flows to the firm (both equity and debt)? a. An increase in gross margins b. An increase in inventories c. A decrease in accounts receivable d. A decrease in accounts payable e. A decrease in Plant, Property and Equipment 11. Consider a company with the following attributes. Value of debt is 200 with kd of 12%. Value of the firm is 300 and the WACC is 14%. How much is the ke for the firm. a. 12% b. 42% c. 08% d. 14% e. 18% -3- FSA 3321 – Summer II (2004) Exam 3 Moore 12. Discounted dividends valuation models require which of the following discount factors? a. WACC and the dividend growth rate b. Cost of Debt and Cost of Equity c. Cost of Debt and the dividend growth rate d. Cost of Equity and the dividend growth rate e. Cost of Equity and WACC 13. Assume next period’s dividend is forecast to be $1.20 per share; that WACC = .18; the cost of equity is 20%; the cost of debt is 14%; the risk-free rate is 5% and the long-run dividend growth rate is expected to be 8% . The best estimate the today’s share value using the discounted dividends method is: a. $6.67 b. $12.00 c. $6.00 d. $10.00 e. $24.00 14. From an empirical (estimation) perspective, the main problem of the discounted dividends valuation model (as compared to free cash flows and residual income) is that: a. Dividend payments are too variable compared with price variability b. The implied investment horizon to recover value is unrealistically short. c. The amount of price variability explained by dividend variability is relatively small. d. Next period’s dividends are relatively difficult to predict. e. Special dividends are difficult to incorporate when firms pay regular dividends 15. The major benefit of using the method of comparables as a stock price screening tool is: a. It provides consistent results b. It is grounded in financial theory c. It requires extensive forecasts and analysis d. It requires little judgment e. It is quick and easy to implement 16. Which of the following is true regarding the sensitivity of the Free Cash Flow valuation model to errors? a. The future terminal (continuation) cash flow is extremely sensitive to forecasting and growth rate errors. b. All else being equal, a terminal (continuation) value computed 10 years from today with a 3% overstatement in the growth rate will bias the intrinsic valuation more than if the terminal (continuation) value computation were made in 6 years with a 3% overstatement in growth. c. Financial statements after the year 2002 provide less accurate information regarding the market value of debt than financial statements prepared in the late 1980’s. d. Cash flow based statements provide more forward looking information than do accrual based statements and valuation methods. e. Free Cash Flow valuations are riddled with errors and do a poorer job of explaining and forecasting stock prices that the Discounted Dividends model. -4- FSA 3321 – Summer II (2004) Exam 3 Moore 17. The present value of the terminal (continuation) value cash flow that begins in 9 years is $10,000,000 assuming a cost of equity equal to 14%. The year 9 free cash flow (beginning of the growing perpetuity) is $3,137,860. What is the growth rate required for the continuation value term? a. 1% b. 2% c. 3% d. 4% e. 5% 18. Based upon the time-series behavior of ROE (US firms from 1984-2001), the following can be concluded: a. Operating Asset turnover tends to be highly volatile b. Net financial leverage has been highly volatile c. NOPAT margin has been very stable d. Spread has been volatile e. The change in spread is independent of the change in NOPAT margin 19. Which of the following is false regarding the Residual Income Valuation Model. a. It is grounded in financial theory b. It has the least explanatory and predictive power of the models we have considered c. It links accounting valuations of equity to market valuations of equity d. Normalized earnings are based upon the equity investment and cost of equity e. It is a flexible model that allows the analyst to focus on specific business elements 20. Assume you had just performed a valuation using the residual income model. You found that 15% of the value was supported by the current book value; that 15% of the value was supported by residual income forecast annual for the next 7 years and the remainder was associated with terminal value computations. What type of firm are you valuing? a. A manufacturer within a stable, mature industry b. A public utilities company c. A high tech company in a growing industry d. A major retailer such as Wal-Mart e. A healthcare provider such as a hospital -5- FSA 3321 – Summer II (2004) Exam 3 Moore Short Problem # 1 (Show all work to receive full credit) – 10 Points Market Value Price/book Revenue R&D Net Inc. Amgen 8,096.71 5.6 1571.0 307.0 406.0 Biogen 1,379.00 3.6 152.0 101.0 15.0 Chiron 2,233.60 4.6 413.0 158.0 28.0 Genetics Institute 925.00 2.5 138.0 109.0 -7.0 Immunex 588.53 4.5 151.0 81.0 -34.0 Genentech ? ? 795.4 314.3 124.4 Genentech book value is 1,348.78 Use the multiples approach to value Genentech. Use Market to Book; Price to Earnings; (Market-Book)/(R&D); and Price to Sales ratios. Make sure you show both the industry average and Genentech’s Market value of equity for all of the methods. What would the average over all of the determined values be? -6- FSA 3321 – Summer II (2004) Exam 3 Moore Short Problem # 2 (Show all work to receive full credit) – 10 Points Value General Electric at the beginning of 1999. Assume that kd = 5% and that ke = 10% Assume after 2002 that residual income is expected to grow at 4% per year. Make sure to show all components of the valuation. Decompose into value derived from assets-in-place; forecast residual income and terminal value. Also, comment on your results. General Electric Co. Actual 1998 Forecast 1999 Forecast 2000 Forecast 2001 Forecast 2002 EPS 3.75 4.36 4.85 3.03 5.51 DPS 1.46 1.70 1.92 2.08 2.32 BPS 20.73 Forecast year, t -7-