Exam 3 – Fin 3321 – Statement Analysis Summer 2014...

advertisement

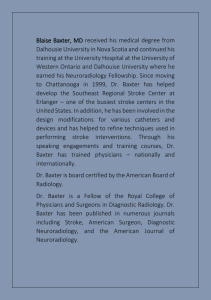

Fin 3321 – Summer 2014 Exam 3 Moore Exam 3 – Fin 3321 – Statement Analysis Summer 2014 (Moore) Section Time: ____________________ Printed Name: ____________________ Ethical conduct is an important component of any profession. The Texas Tech University Code of Student Conduct is in force during this exam. Students providing or accepting unauthorized assistance will be assigned a score of zero (0) for this piece of assessment. Using unauthorized materials during the exam will result in the same penalty. Ours’ should be a self-monitoring profession. It is the obligation of all students to report violations of the honor code in this course. By signing below, you are acknowledging that you have read the above statement and agree to abide by the stipulated terms. Student’s Signature: ______________________________ The First 3 Problems must be completed in Class. No extra time will be allowed on these items. The excel file work and accompanying write-ups (Problems 4-6) are take-home and completed files are to be emailed to me. You will have until 10pm on Thursday, 26 June to submit the excel file work for consideration. Use the Financial Statements for Baxter Medical Equipment Corp, a medical equipment manufacturer, at the end of the exam booklet to answer the following 10 questions (no partial credit) – clearly show all inputs to be eligible for credit. Numerical answers must be taken to 2 decimal places (e.g. 25.42) and percentage based answers must be taken to the tenth of a percent (e.g. 36.4%). Time measures must be denoted by days, turnover ratios by turns, and pure numbers should have no suffix. All information (on financials) stated in thousands except per share data. -1- Fin 3321 – Summer 2014 Exam 3 Moore Problem 1 (10 Points) (multiple choice at 2.5 points each) 1. Within the context of forecasting, which of the following ratios best links the income statement to the balance sheet? a. Net profit margin b. Current Ratio c. Return on Equity d. Asset Turnover e. Day’s Sales outstanding 2. You have just computed the Beta of a stock to be 1.5 and the estimate the expected market return next period is 7.3333%. The estimated cost of equity is 16%. With an estimated long run market risk premium of 8.0%, what risk free rate supports this cost of equity? a. 2.00% b. 3.00% c. 4.00% d. 5.00% e. 6.00% 3. You are trying to value Baxter, Inc. (financials on the spreadsheet). Today is June 23, 2014. In one week valuation forecasts will be made. Assume Baxter publishes its 10-K’s no earlier than 6 weeks after the fiscal year end and 10-Q’s no earlier than 2 weeks after the period end, how many quarters of activity must you forecast (in one week) when estimating the annual net income that will be reported on the next published 10-K? a. 0 b. 1 c. 2 d. 3 e. 4 f. 5 4. Which statistic is assess the whether the estimate of Beta significantly differs from zero in a statistical sense? a. Beta b. T-Statistic of the intercept c. T-Statistic of the independent variable d. Adjusted R-squared e. Correlation coefficient -2- Fin 3321 – Summer 2014 Exam 3 Moore Problem 2 (10 Points) (short answers and show work) Compute the IGR and SGR for Baxter for the Past 5 years (10 Points) Show your work and inputs. -3- Fin 3321 – Summer 2014 Exam 3 Moore Problem 3 (10 Points) (short answers) Provide a brief discussion that links the underlying philosophy of IGR and SGR approaches to managing growth of the firm and the impact each approach has on the underlying cost of capital over time. (5 Points) A company has the opportunity to generate annual long term growth of 15% per year. Unfortunately, it currently has an SGR of 11%. How can senior management use the components of SGR to determine the best path to achieve the targeted long run growth rate of 15%? (5 Points) -4- Fin 3321 – Summer 2014 Exam 3 Moore Problems 4 through 6 are to be submitted on the student excel file Problem 4 (20 Points) Prepare Common-Sized Financial Statements for Baxter Corporation for the most recent 5 years. Use the file provided with the exam and update the spreadsheet with this information. Provide a brief discussion (below) regarding assumptions you have made regarding the preparation of the common-sized income statement, balance sheet and statement of cash flows. Make sure you find (assess) drivers for CFFO and CFFI. Problem 5 (30 Points) Use the information (assumptions) provided on the first tab of the Baxter Excel file (exam file) to provide 10 years of financial forecasts for Baxter Medical Equipment. You will work with the provided assumptions and the additional assumption of no further stock issuances or repurchases for forecast relevant income statement and balance sheet information (direct accounts and totals of major sections). You will use your own judgment to forecast CFFO and Capex based on historical information. Problem 6 (20 Points) Use the monthly share price, dividend and stock split data for Baxter, the price data for the S&P 500 and the Yields to Maturity on the 2-Year Treasury to estimate the 6, 5, 4, 3, and 2 year Betas for the firm from the CAPM model. (Run the regressions). Base this on monthly data that ends with May 2014. Next, assume an equilibrium market risk premium of 6.5% and the most recent risk-free rate on the 10-Year Treasury Bond (May 1, 2014 yield) to estimate the cost of equity for Baxter for each of the annual windows. Comment (written stuff) on the stability of Beta over the rolling time windows being analyzed. -5-