April 28, 2004 Ms. Debbie Cook, City Recorder City of Lenoir City

advertisement

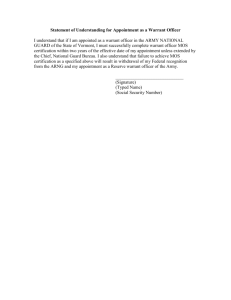

April 28, 2004 Ms. Debbie Cook, City Recorder City of Lenoir City 600 East Broadway P.O. Box 445 Lenoir City, Tennessee Re: Delinquent Business Tax Dear Ms. Cook TCA 67-4-719(4)(c) indicates that in the case of taxes owed a municipality, the proper tax collector is empowered and it is their duty when any tax becomes delinquent under this part, to issue a distress warrant for the collection of tax, interest and penalty for each delinquent taxpayer. The Act requires that you send them a notice prior to the issuance of a distress warrant. Enclosed is a notice which has been reviewed by an MTAS Legal Consultant that should be sent under your signature on city stationery and a distress warrant to use if the taxes and fees remain unpaid. The tax collector is authorized to sign the distress warrant. In summary, Tennessee law requires that you sent the notice and issue a distress warrant if the tax is not paid. The law provides (TCA 6-55-301) that the clerk shall issue to the sheriff, city marshal, or any constable a distress warrant, commanding such official to levy, in case of a privilege tax, double the highest tax imposed upon any such privilege, and in other cases double the highest tax imposed on any similar business, together with costs and charges, by distraining and selling so much of the delinquent’s goods and chattels as shall be sufficient for the purpose. This includes taking cash from the cash drawer if necessary. We believe that a police officer may serve the distress warrant. Since council members may not understand the procedure required by state law, you may want to send copies of this correspondence to council members. Please call me if you have questions about the distress warrant and notice. Sincerely Ron Darden Municipal Management Consultant cc. Mayor Mathew Brookshire City Administrator Dale Hurst MTAS Legal Consultant Melissa Ashburn NOTICE Notice is hereby served that the City of __________, Tennessee shall, ten (10) days from the mailing of this notice, cause a distress warrant to be issued for delinquent taxes. Tennessee Code Annotated §§ 6-55-301 et seq and 67-4-719 authorize the City to issue such a warrant to the police who are then empowered to seize goods and chattels bearing a value of twice the highest amount of the taxes owed. If after the seizure of such property the delinquent taxes are not paid, the City may, upon ten (10) days notice, conduct a sale of the distrained goods. The delinquent taxes are due for any and all years, up to six (6) years duration, that you have failed to pay business taxes to the City. We regret that we have to take this measure, however, an increasing amount of revenue is being denied to the City of _________ because of your delinquent taxes. It is inequitable for those businesses which pay taxes to subsidize those that do not. Payment of delinquent taxes within ten (10) days will prevent the seizure of your property. State of Tennessee, Loudon County, City of Lenoir City TO THE CHIEF OF POLICE OF THE CITY OF OR ANY LAWFUL OFFICER THEREOF, GREETINGS: Whereas,________________________________________________________________ ______________________________________, is the owner of certain tangible or intangible property in the said City of ____________, and is indebted to the City of __________ for the following past due Business Taxes to wit: For Taxing Periods: ______________________ Business Tax Due: ______________________ Subtotal Due: _______________________ Distress Warrant Fee: _____________________ Total Amount Due: _____________________ Now, therefore, you are hereby commanded to distrain and sell so much goods, chattels and personal property, either tangible or intangible, of the said_____________________________ ______________________________________, as shall be sufficient to pay ______________ __________________________Dollars ($) all of which is past due and owing to the City of _____________, being the tax, interest and penalty imposed by law in such cases, and provided, and to execute and make return to me by the ______day of____________, 2003, under the penalty prescribed by law. Herein fail not. Witness my hand at office this________day of ____________-, 2003. _________________________________ City Recorder Account Number_____________ OFFICER’S RETURN Executed as commanded by attaching the following property: _________________________________________________________ _________________________________________________________ _________________________________________________________ and taking into my custody This ________day of ________________, 2003. ________________________ Police Officer, City of _________ And finally after advertisement according to law, I sold the above described property on the ____day of ______, 2003 and tender herewith the sum of _____________________Dollars realized from said sale. This______day of _______________, 2003. ________________________________ Police Officer, City of ___________ Collected from the Taxpayer in lieu of executing the within writ $____________________ in cash, this__________day of _________, 2003. __________________________________ Police Officer, City of ____________ Distress Warrant City of _________ VS. ________________________________________________________________________ ____ ________________________________________________________________________ ____ Issued the _______day of _____________, 2003. _________________________________ City Recorder Came to hand the ______day of ___________,2003. _____________________________ Police Officer, City of ___________ Received by: ________________________________