House Prices & Household Debt Laura Berlinghieri UW – Eau Claire

advertisement

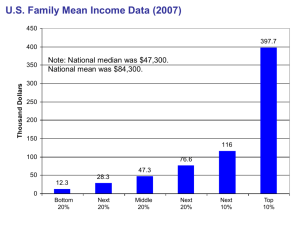

House Prices & Household Debt Laura Berlinghieri UW – Eau Claire Summary • There is a positive and significant relationship between the median debt payment-to-income ratio and house prices. – This relationship differs across income groups. • The debt payment-to-income ratio of households in the lower tail of the income distribution is more sensitive to house price fluctuations. Aggregate Debt-to-Income Ratio 1.2 1 0.8 0.6 0.4 0.2 0 1965 1970 1975 1980 1985 1990 1995 2000 Total Household Debt/Personal Income Household MortgageDebt/Personal Income Other Household Debt/Personal Income Sources: Federal Reserve; Bureau of Economic Analysis 2005 Household Debt and House Prices • What are the possible relationships between these variables? 1. As additional households gain access to credit, the median debt-to-income ratio will likely increase. Homeownership Rate 70 69 68 Percentage 67 66 65 64 63 62 61 60 1965 1970 1975 1980 1985 1990 1995 Source: U.S. Census Bureau 2000 2005 Household Debt and House Prices • What are the possible relationships between these variables? 2. As house prices rise, credit-constrained homeowners gain more access to credit. • These homeowners are more likely to be in the lower income groups. Ratio of Debt Secured by Primary Residence to Household Income 3.0 2.5 2.0 1.5 1.0 0.5 0.0 1989 1992 1995 1998 2001 2004 2007 Income pct < 20 Income pct: 20-39.9 Income pct: 40-59.9 Income pct: 60-79.9 Income pct: 80-89.9 Income pct: 90-100 Source: Survey of Consumer Finances Survey of Consumer Finances • Triennial survey – 1989 through 2007 waves • Multiple imputation • Dual-frame sample – Oversamples the wealthy • Subject to large outliers – Use median regression Ratio of Monthly Debt Payments to Monthly Income Descriptive Statistics Survey Year 1989 1992 1995 1998 2001 2004 2007 Max 6.97 399.11 71.67 1093.82 46.80 43.65 159.13 Min 0.00 0.00 0.00 0.00 0.00 0.00 0.00 Median 0.12 0.12 0.13 0.13 0.11 0.12 0.13 Mean 0.18 0.45 0.30 0.60 0.21 0.22 0.37 Std. Dev. 0.31 8.38 1.94 19.66 1.12 1.02 4.24 Median Monthly Payments Relative to Monthly Income, All Households 0.25 0.20 0.15 0.10 0.05 0.00 1989 1992 1995 1998 2001 2004 2007 Income pct < 20 Income pct: 20-39.9 Income pct: 40-59.9 Income pct: 60-79.9 Income pct: 80-89.9 Income pct: 90-100 Source: Survey of Consumer Finances Empirical Results, Part I • Median regression first applied to: PIRi = β1 + β2HousePricei + δ1Y92i + … + δ6Y07i + γ1Q40i + … + γ5Q100i + β3Agei + β4Agei2 + β5Agei3 + β6HSi + β7Collegei + β8Homeowneri + β9Log(Incomei) + εi • Coefficient estimate for β2: 0.001 – Significant at 5% level Empirical Results, Part II • Next, the median regression is applied to: PIRi = β1 + β2HousePricei + δ1Y92i + … + δ6Y07i + γ1Q40i + … + γ5Q100i + ζ1HousePriceiQ40i + … + ζ5HousePriceiQ100i + β3Agei + β4Agei2 + β5Agei3 + β6HSi + β7Collegei + β8Homeowneri + β9Log(Incomei) + εi Relationship Between Payment-to-Income Ratio & House Prices… by Income Group Income Quantile < 20% Relevant Coefficient(s) Coefficient Estimate β2HousePricei 0.815 20-39.9% β2HousePricei + ζ1HousePriceiQ40i 0.246 40-59.9% β2HousePricei + ζ2HousePriceiQ60i 0.121 60-79.9% β2HousePricei + ζ3HousePriceiQ80i 0.059 80-89.9% β2HousePricei + ζ4HousePriceiQ90i 0.035 90-100% β2HousePricei + ζ5HousePriceiQ100i 0.001 Summary of Empirical Results • There is a positive and significant relationship between the median debt payment-to-income ratio and house prices. – This relationship differs across income groups. • The debt payment-to-income ratio of households in the lower tail of the income distribution is more sensitive to house price fluctuations. • Results are robust to the choice of dependent variable. Results Default Rates • The literature on default rates suggests a positive relationship between a borrower’s debt payment-to-income ratio and the probability of default. – As house prices increase, credit-constrained households will likely respond by borrowing more. • Monthly debt payments relative to monthly income will rise. – Probability of default increases as a result.