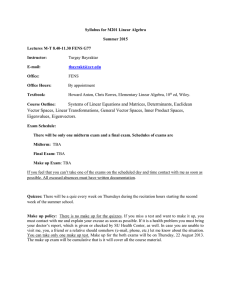

SYLLABUS

advertisement

SYLLABUS Management 3412B – Finance University of Lethbridge Spring 2007 Instructor: Dr. Eahab Elsaid Telephone: 332-5276 Email: eahab.elsaid@uleth.ca Office Hours (E463): Tuesdays 12:30 to 2:30, Thursdays 12:30 to 2:30, and by appointment. CLASS TIME & ROOM: Tuesdays and Thursdays, 10:50 TO 12:05, AH117 PREREQUISITE: Finance 3040 TEXTBOOK: W. Sean Cleary and Charles P. Jones, INVESTMENTS – Analysis and Management, Canadian Edition, John Wiley & Sons Canada, Ltd. GOALS: To provide students with a good understanding of the operation of security markets, the types of securities traded in them and the theory, concepts, and models underlying investment analysis and management in preparation for more advanced study. COURSE OBJECTIVE: This course is designed to provide students with an overview of the investment management in Canadian Capital Markets. Throughout the course, theory and practice will be emphasized within the framework of the portfolio management process. The material describes the financial markets and the instruments traded in them. Contents include valuation of stocks; how shares are traded in the equity market; risk and return; diversification; portfolio formation; fixed income securities; options and futures; valuation and management of fixed income securities; and risk hedging techniques. COURSE REQUIREMENTS: Grades will be determined by: • Quizzes (15%) • First Midterm (25%) • Second Midterm (25%) • Comprehensive Final (35%) GRADING CRITERION: Grade Percentage Grade Percentage A+ 95 - 100% C 66 - 69 A 90 - 94 C62 - 65 A86 - 89 D+ 58 - 61 B+ 82 - 85 D 51 - 57 B 78 - 81 F Less than 50 B74 - 77 C+ 70 - 73 Quizzes and Exams - each quiz and exam will cover assigned chapters, discussion in class, handouts, and any other material assigned or class content. First Midterm (TBA) Second Midterm (TBA) Final (TBA) Course Contents (subject to progress) Chapter Chapter 1 Chapter 2 Chapter 3 Chapter 4 Chapter 5 Chapter 6 Chapter 7 Chapter 8 Chapter 9 Chapter 10 Chapter 11 Chapter 13 Chapter 17 Chapter 19 Chapter 20 Topic Understanding Investments Investment Alternatives Investment Funds Securities Markets How Securities are Traded The Returns and Risks From Investing Expected Return and Risk Portfolio Selection Capital Market Theory Market Efficiency Bond Yields and Prices Common Stock Valuation Company Analysis Options Futures Notes: Exams, Assignments, etc. Missed quizzes, exams, assignments etc. will result in a mark of zero being recorded and will continue to be weighted in accordance with this syllabus. Make-up quizzes and assignments will not be given to anyone for any reason. Weighting and time of writing of any exam cannot be shifted, except where a documented, legitimate reason is provided which will be verified (eg. medical reasons supported by a Doctor’s note. Students will not be allowed to return to the exam room after leaving the room; all materials must be submitted (including the exam itself) which will be graded to the extent completed. All original exams must be submitted to the Instructor/Invigilator before leaving the room otherwise a grade of zero will be recorded. All University of Lethbridge calendar policies, including Academic Offences and Discipline Procedures, will be enforced. Plagiarism on assignments and cheating during exams will not be tolerated. Quizzes and Exams – format, formula sheet, calculator All quizzes and exams are closed book. Use of a calculator* (non-programmable) and a formula sheet (maximum 1 page – both sides) will be allowed during any testing. You must hand in the formula sheet used during exams, but it is recommended that you keep a copy of your formula sheet for each quiz or exam to add on to it for the next exam. Understanding formulas is essential to grasping concepts, however, fluency in the use of a financial calculator to maximize accuracy and efficiency is highly encouraged as well. *HP (Hewlett Packard) 10B II is recommended. Do not bring a programmable calculator to quizzes or exams.