Chapter 14 Problems

Chapter 14

Problems

1Suppose today is January 1, 2007; MAM Industries issued a 20-year bond with a

9% coupon and a $1,000 face value, payable on January 1, 2027. The bond now sells for $915. Use this bond to determine the firm’s after-tax cost of debt.

Assume a 34% tax rate. (6.6%)

2MAM Industries just declared a dividend of $3.50 per share of common stock.

The current stock price is $25 per share, and the dividend is expected to increase at a rate of 4% per year for the foreseeable future. Use the dividends growth model approach to compute the cost of equity capital. (18.56%)

3MAM Industries has a preferred stock issue outstanding which pays an annual dividend of $3.25 per share and currently has a market price of $25 per share.

Compute the cost of preferred stock. (13%)

4-

Suppose MAM’s capital structure is 30% debt, 10% preferred stock, and 60% equity. Using your answers from Questions 1 thru 3, compute the WACC.

(14.416%)

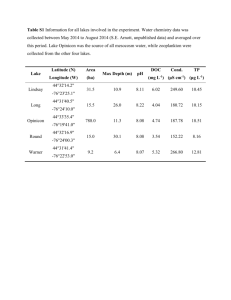

Use the following information to answer Questions 5 and 6

Margo Corporation is a major producer of lawn care equipment. Its stock currently sells for $80 per share. There are 10.5 million shares outstanding. Margo also has debt outstanding with a book value of $400 million. Margo bonds currently yield 10% and trade at 90% of face value. The risk free rate is 8%, the market risk premium is 9%, and

Margo has a β equal to 2. The corporate tax rate is 34%.

5Margo is considering expansion of its facilities. Use the SML to determine the cost of equity. (26%)

6Compute the weighted average cost of capital for Margo. (26%)