Use the Black-Scholes formula to find the value of a... Time to expiration HOMEWORK #3 – Intro to Derivatives

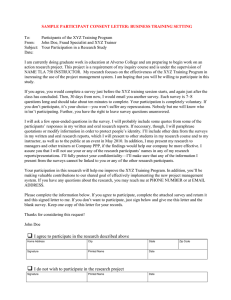

advertisement

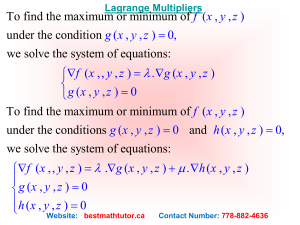

HOMEWORK #3 – Intro to Derivatives Question #1: Use the Black-Scholes formula to find the value of a call option on the following stock: Time to expiration Standard Deviation Exercise Price Stock Price Interest Rate 6 months 50% per year $50 $50 10% Question #2: Find the value of put option on the stock in the previous problem with the same information above (Hint: there are two ways of calculating such value). Question #3: You would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $100 at year-end. XYZ currently sells for $100. Over the next year, the stock price will either increase by 10% or decrease by 10%. The T-Bill rate is 5.0%. Unfortunately, no put options are traded on XYZ Co. Suppose the desired put option were traded. How much would it cost to purchase?

![[Date] [Policyholder Name] [Policyholder address] Re: [XYZ](http://s3.studylib.net/store/data/008312458_1-644e3a63f85b8da415bf082babcf4126-300x300.png)