INDR 473 Koç University Fall 2005

advertisement

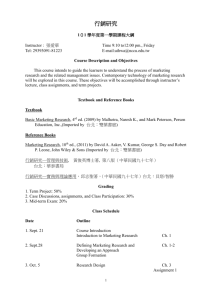

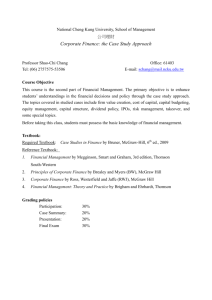

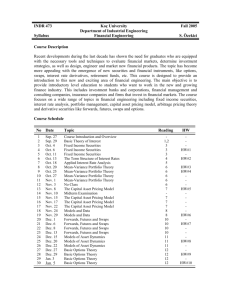

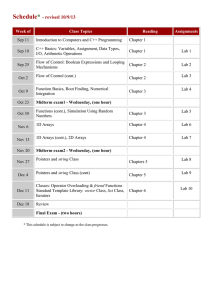

INDR 473 Koç University Department of Industrial Engineering Financial Engineering Syllabus Fall 2005 S. Özekici Course Description Recent developments during the last decade has shown the need for graduates who are equipped with the necessary tools and techniques to evaluate financial markets, determine investment strategies, as well as design, engineer and market new financial products. The topic has become more appealing with the emergence of new securities and financial instruments, like options, swaps, interest rate derivatives, retirement funds, etc. This course is designed to provide an introduction to this new and exciting area of financial engineering. The main objective is to provide introductory level education to students who want to work in the new and growing finance industry. This includes investment banks and corporations, financial management and consulting companies, insurance companies and firms that invest in financial markets. The course focuses on a wide range of topics in financial engineering including fixed income securities, interest rate analysis, portfolio management, capital asset pricing model, arbitrage pricing theory and derivative securities like forwards, futures, swaps and options. Course Schedule No Date Topic 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Sep. 27 Sep. 29 Oct. 4 Oct. 6 Oct. 11 Oct. 13 Oct. 18 Oct. 20 Oct. 25 Oct. 27 Nov. 1 Nov. 3 Nov. 8 Nov. 10 Nov. 15 Nov. 17 Nov. 22 Nov. 24 Nov. 29 Dec. 1 Dec. 6 Dec. 8 Dec. 13 Dec. 15 Dec. 20 Dec. 22 Dec. 27 Dec. 29 Jan. 3 Course Introduction and Overview Basic Theory of Interest Fixed Income Securities Fixed Income Securities Fixed Income Securities The Term Structure of Interest Rates (PS#1) Applied Interest Rate Analysis Mean-Variance Portfolio Theory Mean-Variance Portfolio Theory Mean-Variance Portfolio Theory Mean-Variance Portfolio Theory No Class The Capital Asset Pricing Model (PS#2) Midterm Examination The Capital Asset Pricing Model The Capital Asset Pricing Model The Capital Asset Pricing Model Models and Data Models and Data Forwards, Futures and Swaps Forwards, Futures and Swaps (PS#3) Forwards, Futures and Swaps Forwards, Futures and Swaps Models of Asset Dynamics Models of Asset Dynamics (PS#4) Models of Asset Dynamics Basic Options Theory Basic Options Theory Basic Options Theory Basic Options Theory (PS#5) Jan. 5 Reading HW 1,2 3 3 3 4 5 6 6 6 6 6 7 7 7 7 8 8 10 10 10 10 11 11 11 12 12 12 12 HW#1 HW#2 HW#3 HW#4 HW#5 HW#6 HW#7 HW#8 HW#9 HW#10 Required Textbook 1. D.G. Luenberger, Investment Science, Oxford University Press, 1998 Textbooks on Reserve 1. J.C. Hull, Options, Futures and Other Derivatives, Prentice Hall, 2000 2. P. Wilmott: Derivatives: The Theory and Practice of Financial Engineering, John Wiley, 2000. These textbooks are not required and they are on reserve in the library. They are recommended for additional reading. Homework The students are encouraged to work on all of the problems that are given at the end of each chapter. They are required to hand in homework assigned and graded on a regular basis. Some homework questions will be discussed in class or in problem sessions. Late submissions will not be accepted. The following list gives the questions and the duedates for each set. HW # 1 2 3 4 5 6 7 8 9 10 Questions Duedate Chapter 2: 4, 6, 8, 10, 12 Chapter 3: 2, 6, 10, 12, 14 Chapter 4: 2, 6, 11, 12, 14 Chapter 5: 2, 7, 8,10, 12 Chapter 6: 2, 4, 6, 8, 10 Chapter 7: 2, 4, 5, 6, 8 Chapter 8: 2, 4, 5, 6, 8, Chapter 10: 4, 8, 10, 12, 14 Chapter 11: 2, 4, 6, 7, 8 Chapter 12: 4, 6, 10, 13, 15 Oct. 13 Oct. 13 Nov. 8 Nov. 8 Nov. 8 Dec. 6 Dec. 6 Dec. 20 Jan. 5 Jan. 5 Problem Sessions Extra problem sessions are scheduled to discuss some of the homework and review exercises. They will take place in ENG B15 during 17:00-18:30. The dates are: 1. PS#1: Oct. 13 2. PS#2: Nov. 8 3. PS#3: Dec. 6 4. PS#4: Dec. 20 5. PS#5: Jan. 5 Grading 1. Homework: 10% 2. Midterm Examination: 40% (Nov. 10) 3. Final Examination: 50% The examinations will be closed-book and closed-noted, but the students will be allowed to bring an A4 size formula sheet with them. Programmable calculators are not permitted or they will be reset at the beginning of the exam. Attendance All students are required to attend classes and discussion sessions such as tutorials, labs and problem sessions. Academic Honesty Honesty and trust are important to all of us as individuals. Students and faculty adhere to the following principles of academic honesty at Koç University: 1. Individual accountability for all individual work, written or oral. Copying from others or providing answers or information, written or oral, to others is cheating. 2. Providing proper acknowledgement of original author. Copying from another student’s paper or from another text without written acknowledgement is plagiarism. 3. Authorized teamwork. Unauthorized help from another person or having someone else write one’s paper or assignment is collusion. Cheating, plagiarism, and collusion are serious offences resulting in an F grade and disciplinary action. Instructor Assistant Süleyman Özekici Email: sozekici@ku.edu.tr Room: ENG 119 Phone: 1723 Office Hours: TU TH B5 B5 Kenan Arifoğlu Email: karifoglu@ku.edu.tr Room: TBA Phone: TBA Office Hours: MN WE B4 B4