FE Practice Problems w/ Solutions 5-63

advertisement

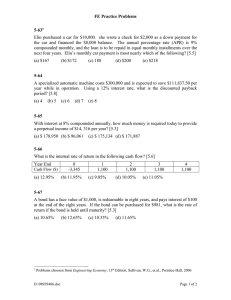

FE Practice Problems w/ Solutions 5-631 Elin purchased a car for $10,000. she wrote a check for $2,000 as a down payment for the car and financed the $8,000 balance. The annual percentage rate (APR) is 9% compounded monthly, and the loan is to be repaid in equal monthly installments over the next four years. Elin’s monthly car payment is most nearly which of the following? [5.5] (a) $167 (b) $172 (c) 188 (d) $200 (e) $218 Solution: i mo = 9% 12 = 3 4 % per month N=4´ 12=48 months ( ) A = 8, 000 A , 3 4 %, 48 = 8, 000 (0.0249) = $199.20 P Select (d) 5-64 A specialized automatic machine costs $300,000 and is expected to save $111,837.50 per year while in operation. Using a 12% interest rate, what is the discounted payback period? [5.8] (a) 4 (b) 5 (c) 6 (d) 7 (e) 8 Solution: EOY 0 - 300, 000 1 2 3 4 ( F ,12%,1) = - 200,140 + 111,837.50 (P ,12%, 2)= F - 110,983 + 111,837.50 (P ,12%,3) = F - 31,377 + 111,837.50 (P ,12%, 4) = F - 300, 000 + 111,837.50 P Cumulative PW (i = 12%) - $300, 000.00 - $ 200,140.30 - $110,983.45 - $ 31,377.52 + $ 39, 695.21> 0 \ Æ' = 4 Select (a) 1 Problems choosen from Engineering Economy, 13th Edition, Sullivan, W.G., et.al., Prentice-Hall, 2006 D:\98926340.doc Page 1 of 4 FE Practice Problems w/ Solutions 5-65 With interest at 8% compounded annually, how much money is required today to provide a perpetual income of $14, 316 per year? [5.3] (a) $ 178,950 (b) $ 96,061 (c) $ 175,134 (d) $ 171,887 Solution: ( 14,316 = X A ,8%, ¥ P 14,316 = X (0.08) X= ) 14,316 = $178,950 0.08 Select (a) 5-66 What is the internal rate of return in the following cash flow? [5.6] Year End Cash Flow ($) (a) 12.95% 0 -3,345 (b) 11.95% 1 1,100 (c) 9.05% 2 1,100 (d) 10.05% 3 1,100 4 1,100 (e) 11.05% Solution: Find i% such that PW(i%) = 0 ( ) 0 = - 3,345 + 1,100 P , i '%, 4 A PW (10%) = 141.89 tells us that i '% > 10% PW (12%) = - 3.97 tells us that i '% < 12% (but is close to 12%) \ IRR = 11.95% Select (b) D:\98926340.doc Page 2 of 4 FE Practice Problems w/ Solutions 5-67 A bond has a face value of $1,000, is redeamable in eight years, and pays interest of $100 at the end of the eight years. If the bond can be purchased for $981, what is the rate of return if the bond is held until maturity? [5.3] (a) 10.65% (b) 12.65% (c) 10.35% (d) 11.65% Solution: ( ) VN = C P ( ) , i %, N + rZ P , i %, N = 981 F A where N = 8; r = 10% per period (1,001000 = 10%); and C = Z = 1, 000 ( ) 981 = 1, 000 P ( , i%,8 + 0.10´ 1, 000 P , i%,8 F A try i = 10%; 466.50 + 533.49 = 999.99 try i = 12%; 403.90 + 496.76 = 900.66 by observation: i % > 10 but very close to 10% \ rate-of-return = 10.35% ) Select (c) 5-70 A new machine was bought for $9,000 with a life of six years and no salvage value. Its annual operating costs were as follows: $7,000, $7,350, $7,717.499, … , $8,933.968 If the MARR = 12%, what was the annual equivalent cost of the machine? [5.5] (a) $7,809 (b) $41,106 (c) $9,998 (d) $2,190 (e) $9,895 Solution: i = 12% f = 5% 7, 000 éê1- P ,12%, 6 F ,12%, 6 ù ú F P ë û PW(12%) = 9, 000 + 0.12 - 0.05 7000[1- (0.5066)(1.3401)] = 9, 000 + 0.07 = 41,110.53 ( ( )( ) ) AW(12%) = 41,110.53 A ,12%, 6 =41,110.53(0.2432) P = $9,998.08 Select (c) D:\98926340.doc Page 3 of 4 FE Practice Problems w/ Solutions 5-71 A bank offers a loan at a nominal interest rate of 6% per year to be paid back in five equal annual installments. The bank also charges an application fee equal to 13.67% of the loan amount. What is the effective interest that the bank is charging? [5.6] (a) 11.65% (b) 11.35% (c) 12.65% (d) 12.35% Solution: For simplicity, assume a loan amount of $1,000. The yearly payment due on this loan is 1,000 A ,6%,5 = 1,000 (0.2374)= $ 237.40 P The application fee due is $1,000 (0.1367) = $136.70. Thus the borrower walks away with $1,000 - $136.70 = $863.30. The effective interest rate being charged can be found by solving the following equivalence equation for i': 863.30 = 237.40 P , i %,5 A P , i %,5 = 863.30 = 3.6365 A 237.40 P ,12%,5 = 3.6048 and P ,10%,5 = 3.7908 A A using linear interlopation: i % = 11.65% ( ) ( ( ( ) ) ) ( ) Select (a) 5-72 You want to deposit enough money in a bank account for your son’s education. You estimate that he will need $8,000 per year for four years, starting on his 18th birthday. Today is his first birthday. If you earn 12% interest, how much lump sum should you deposit in the bank today to provide for his education? [5.3] (a) $24,298 (b) $3,538 (c) $32,000 d) $3,963 Solution: ( )( P = 8, 000 P ,12%, 4 P ,12,16 A F 3.0373 0.1631 = $3,963.07 ) Select (d) D:\98926340.doc Page 4 of 4