Competition Policy and Transnational Investment: Issues and Developments Marc Proksch, UNESCAP

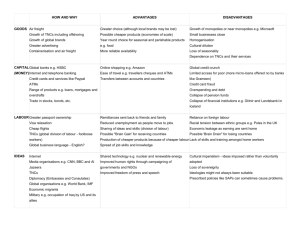

advertisement

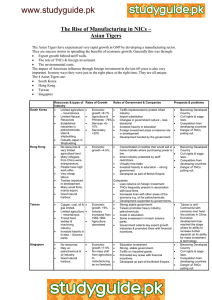

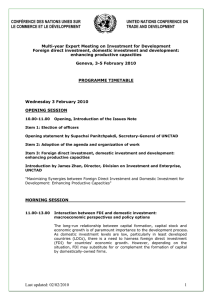

Competition Policy and Transnational Investment: Issues and Developments in Asia and the Pacific Marc Proksch, UNESCAP Determinants of national competitiveness (Porter) Competition vs. Competitiveness A high level of competition (rivalry) is a strong determinant of national competitiveness as it optimizes the efficient allocation of capital; triggers innovation and quality improvements, guarantees market prices, and maximizes consumer welfare Individual businesses traditionally seek to avoid competition but industries and consumers (and the economy as a whole) thrive in a competitive environment It can therefore be argued that a competition policy is required to ensure that adequate levels of competition are maintained Five competitive forces which determine intensity of competition in a given industry (Porter) FDI affects all five forces and can positively affect competition Bargaining power of suppliers or customers can be enhanced (when it is low) or reduced (when it is high) with TNC entry as supplier (e.g. automobile components) or customer (e.g. large retailer) Role of TNC as supplier or customer is enhanced through backward and forward linkages TNCs are new entrants and have power to lower barriers to entry: TNCs can provide substitutes through their high marketing and R&D capabilities TNCs can directly add to competition/rivalry in the industry by increasing the number of players Contribution is particularly positive when TNCs are SMEs Possible negative impacts of TNCs on competition When TNCs are large and powerful, they may monopolize the local industry and raise entry barriers. I.e. through their superior knowledge, management and marketing expertise and technological edge they can crowd out domestic enterprises They have the power to engage in anti-competitive behaviour (e.g. predatory pricing, dumping, cartels) They can monopolize intellectual property rights They can take over monopoly public enterprises through privatization They can take over weak domestic enterprises (e.g. Asian 1997 crisis) and as a result they can rapidly become dominant player which may lead to abuse TNCs affect competition in developing countries through their dominant role in international trade They are involved in 2/3 of all international trade; 1/3 is intra-firm trade (UNCTAD, 2002) They often get special privileges when they are export oriented They are more likely to engage in dumping They are major holders of IPR which may restrict trade Domestic market-oriented TNCs will often call for trade protection TNCs view of competition TNCs, like all businesses, tend to avoid competition However, they are attracted to high growth economies which operate on market economic principles, including competition Therefore, economies which demonstrate national competitiveness in a given industry (including competition) are better able to attract FDI in that industry However, once attracted, TNCs may strive to reduce competition through their superior assets The contribution of TNCs to national development is therefore enhanced through the implementation and enforcement of an adequate competition policy/law in addition to an adequate investment policy/law Investment policy vs. competition policy Goal of investment policy is to attract FDI. Improving competition may be part of that policy. In turn, FDI may enhance competition (like increased imports) Goal of competition policy is to maximize efficient utilization and allocation of resources and/or consumer welfare through the establishment of a level playing field; FDI attraction can be part of that policy; competition policy ensures that TNCs cannot exploit their often superior assets Investment laws tend to have competition provisions while competition laws have implications for FDI Investment laws tend to discriminate among foreign and domestic companies; competition law is non-discriminatory and therefore attracts FDI Sometimes both policies are incompatible, e.g. incentives to attract FDI give TNCs an unfair competitive edge; attracting more FDI may negatively affect the level of competition Therefore investment and competition policies should be mutually consistent and coherent Experiences in Asia Pacific Investment policy and laws have become norm; however their implementation and enforcement have a mixed track record; institutional framework also tends to be weak In many countries, investment policies tend to focus on attracting FDI through incentives rather than on the basis of competitiveness factors In many countries competition is restrained as a result of market concentration and government intervention, including public enterprise monopolies. However, privatization policies have been and/or are currently being implemented in virtually all Asian countries Competition policy and laws are relatively new concept and still lacking in many countries though awareness is growing, especially after the Asian 1997 crisis Often trade and investment laws and liberalization policies are quoted in the context of competition policy. However, while such laws/policies may promote competition they do by themselves not regulate competition and prevent monopolies. Examples in the region Republic of Korea: until crisis no effective pro-FDI and competition regime despite 1980 competition law; Even now, chaebols continue to dominate India, Pakistan, Sri Lanka: competition regime/laws in place but their effective implementation/enforcement is often lacking; India is slowly liberalizing FDI and enacted new competition law in 2002; Sri Lanka has liberal investment regime Hong Kong, China; Singapore: very liberal investment regimes; competition promoted but no consolidated competition policy or law (currently in process); sectoral approach; market knows best Economies in transition in Central Asia: competition law enacted in early 1990s; enforcement/implementation issue; main modality: privatization China, Viet Nam: main FDI destinations but investment regime does not meet international standards; competition policies and legislation are fragmented and not effective. In China, adoption of an anti-monopoly law is currently in process; Viet Nam adopted competition law in 2004. ASEAN: Competition law in Thailand strengthened, in Indonesia formulated only in response to crisis (implementation?); Malaysia and Philippines have competition policy but no specific competition law LDCs like Bangladesh, Cambodia, Lao PDR and Nepal: investment policies and laws in place and are very liberal by international standards, but poor enforcement due to lack of resources; no competition policy, law Some conclusions For some countries it was possible to develop rapidly despite restrictive FDI and competition regimes However, the region faced a reality check in 1997 In the current era of globalization and liberalization it is doubtful that successful development can be achieved without a strong supporting investment and competition regime The issue is not whether you have excellent investment and competition laws: relevance, implementation and enforcement are crucial Need for consistency and coherence between industrial, trade, investment, competition and IPR regimes Proper policy responses Trade liberalization should be combined with conducive industrial, investment and competition policies; Industrial policy should strive towards forging strong backward and forward linkages between TNCs and domestic enterprises where feasible Establishment of proper investment and competition (and related) laws and institutions; Such laws need to be realistic and duly implemented and enforced and applicable to public enterprises Enforcement institutions need proper expertise, mandate and resources; Coordination among institutions and consistency among laws and regulations are essential: sometimes consolidations may be useful Proper policy response, cont. Privatization of government enterprises, especially monopolies. Successful privatization process requires healthy environment of competition. With regard to public goods and services, government monopolies may be more desirable IPR regime needs to balance investment promotion objectives with competition objectives For small countries, regional cooperation is essential, but even for bigger ones it is highly recommended For FTAs to be effective, investment and competition provisions could be included (e.g. ASEAN/AFTA has common frameworks for investment and IPR but not for competition) Some questions arising from Asian experience Is competition a necessary condition for competitiveness? How can competition be maximized: through the market or through the government? I.e. is a competition policy/law necessary to ensure competition? How does the need for competition be reconciled with the need to create economies of scale for global competitiveness? Are “national champions” compatible with competition objectives?