Key Learning and Recommendations from the Project University of Ghana

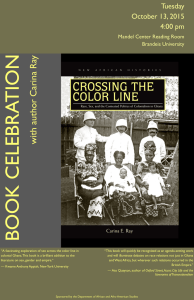

advertisement

Key Learning and Recommendations from the Project Charles Ackah and Dela Tsikata University of Ghana Institute of Statistical Social and Economic Research (ISSER) Outline of presentation Introduction Key lessons Conclusions and policy recommendations Introduction Despite differences, developing countries are generally characterised by lower degrees of market competition than their industrialised country counterparts. Interest in promoting competition in developing countries has increased over the past decade. The interest has particularly resulted from the failures of economic reforms in the 1980s, that overly relied on trade liberalisation to promote One general conclusion was that trade liberalisation did not do the whole job – it did not guarantee by itself a desirable level of competition in an economy. The idea that trade liberalisation would improve domestic competition has led to a reassessment that indicates that success in trade and liberalisation is itself dependent on establishing a competitive domestic market environment. Introduction Until relatively recently, Competition Policy and the formulation of competition laws had received very little attention from developing country governments because of lack of resources and the apathy of civil society and other key stakeholders. However, in this present era of increased globalisation, consumers and CSOs have gradually started to understand the implications of a competitive market both for economic gains and consumer welfare. In spite of this increased awareness, there are widespread cases of anti-competitive behaviour in the market right from government procurement processes through to utility services provision. Introduction ISSER was selected to partner CUTS to undertake this project on competition in Ghana, primarily to conduct an in-depth study of the bottlenecks in the system which prevents firms from competing efficiently. The first step in this process was the compilation of a preliminary country paper on the current state of competition in Ghana, and later a Country Research Report on the state of competition in Ghana. A National Reference Group (NRG) was formed to offer us the opportunity to create an awareness of competition issues and to find ways in which we can promote a competition culture at a much higher level. Key Lessons What is needed is a sound competition regime in Ghana that drives firms to become more efficient and also ensures the best possible utilisation of available resources. The rewards are that the consumer has a greater choice of products at lower prices. Consumer Protection Policy Ghana lacks a comprehensive consumer protection law. There is no centralized consumer protection law and/or policy in Ghana. What exists currently is a group of public institutions mandated to oversee specific aspects of consumer protection. These institutions included: Ghana Standards Board (GSB) Food and Drugs Board (FDB) Public Utilities Regulatory Commission (PURC) National Communications Authority (NCA) Environmental Protection Agency (EPA). 8 Progress towards a Competition Act The Government is in the process of developing a Bill on competition law. Two draft Bills have been prepared before; the Trade Practices Draft Bill, drafted in 1993 and the Draft Competition and Fair Trade Practices Bill in 2004, all which could not be developed into an Act of Parliament. We understand background work is underway to bring the third bill before cabinet? The key question: Why has it been so difficult to put a Competition Act into law? Sectoral Policies 10 Energy Water Telecom Financial Services Energy Ghana's energy sector is dominated by state-owned enterprises. Transmission and distribution of electricity are under state monopoly. Although Ghana is a net exporter of electrical energy in most years, low water levels at the Volta dam frequently lead to supply shortages and electricity cuts. The Energy Commission is in charge of technical standards and licensing of electricity utilities. The Public Utilities Regulatory Commission (PURC) is responsible for competition regulation and quality of service monitoring. There has been no significant privatisation programme to date. A previous government subsidy of electricity has been drastically slashed in the past year with consequent increases in electricity tariffs by more than 100 percent. Competition and Sector Regulation Interviews were conducted with key stakeholders in select sectors. Some key findings were: Only a few of the regulatory agencies were financially independent (most notably the NCA) and most were funded through government subvention. The agencies noted that there was ample room for political interference in major decisions, such as the awarding of licenses. With regard to the level of competition in the sectors, there was variation. In some sectors, like utilities, there was little competition with some monopolies being present; in sectors like communications, however, there was significant competition. The regulatory agencies generally have a policy of no tolerance of anticompetitive practices but not all are equipped with provisions for punishing such behaviour. Anti-competitive practices – some evidence Price –fixing & Excessive pricing e.g. Ghacem, the major player in the industry, has long been suspected of price-fixing. Collusion e.g. suspicion that firms involved in the food sector whether as sellers or manufacturers and financial institutions are in collusion in setting prices and rates. False advertisement e.g. unfair practices are prevalent in the pharmaceuticals industry, particularly with regards to herbal medicines. Trademark violation e.g. music and video industry but also the Chinese accused by players in the textile & clothing sector. 13 PERCEPTIONS REGARDING COMPETITION CONCERNS Assessment of Level of Competition Assessment of Enforcement Issues Competition Culture and Public Awareness Assessment of Level of Competition Assessment of level of competition among companies % High 30.8 Moderate 51.8 Low Nil Total Impact of competition on consumers 16.4 1.0 100 Highly Moderately Not at all Total 51.0 39.7 9.3 100 Assessment of competition in key sectors, 2009 Sectors characterized by monopolies Perception of most frequent anti-competitive practices Anti-competitive practices Price fixing Price discrimination Entry barrier Exclusive dealing Bid rigging Market sharing Tied selling Predatory pricing Resale price maintenance Concerted refusal to deal Anti-competitive M&A % 25 14 13 10 10 9 6 6 5 2 2 Majority of respondents (58%) have quite frequently encountered anti-competitive practices ASSESSMENT OF ENFORCEMENT ISSUES Majority (58%) had no knowledge of rules or laws to check anti-competitive behaviour. Majority (63%) had no knowledge of agencies put in place to administer such rules or laws. On enforcement issues, again the majority (64%) do not know if any action is taken in instances where the rules are violated. 41% of respondents are of the view that no actions are taken because the laws are not enforced whilst others attribute this to agencies not having enough clout to punish offenders. Others believe that corruption and the influence of strong lobbies make taking action less appealing for agencies. On issues regarding state owned monopolies, majority (89%) acknowledged their existence and were of the opinion that these institutions indulged in anticompetitive practices such as exclusive dealing and price discrimination come tops in the list. COMPETITION CULTURE AND PUBLIC AWARENESS Awareness on competition issues among key groups Generally, majority of respondents (82%) perceive that competition issues are not well understood in Ghana. The main reason being the lack of publicity on competition issues and lack of political will. Nonetheless, awareness of competition issues is perceived to be high among businesses and low among consumers Role of Media How competition issues are perceived to be reported Assuming they encounter any anticompetitive practice, 36 percent of respondents agreed to report such cases to the media houses, and 24 percent would inform local authorities or traditional leaders. Competition issues are not reported because there is no institutional framework to handle such issues. Others believe that the media are more interested in sensational news items and therefore are less likely to report them. Journalist may lack the training needed to appreciate competition issues, however business correspondents are sometimes able to highlight some anti-competitive practices Some Key Conclusions There is a perceived severe lack of awareness of competition issues and regulations in Ghana. There is a general perception that there is a lack of publicity on competition issues and lack of political will to have competition laws established. Competition issues not regularly reported in the media, and the level of awareness of competition issues by journalists not perceived to be high. In conclusion, respondents are of the opinion that the government should play a key role in ensuring the setting up a Competition Authority to protect consumers and producers. Also regulators need to be fully equipped to enforce laws and legislation which they are charged with. There is also the need for more advocacies on the negative effects of anticompetitive practices on the economy and especially on consumer welfare. Conclusion (Perception survey) In conclusion, respondents are of the opinion that the government should play a key role in ensuring the setting up a Competition Authority to protect consumers and producers. Also regulators need to be fully equipped to enforce laws and legislation which they are charged with. There is also the need for more advocacies on the negative effects of anticompetitive practices on the economy and especially on consumer welfare. Conclusion (Overall) Market concentration enhances the power of multinational corporations to dictate their terms, compounding the difficulties of commodity-reliant developing countries. There is at least circumstantial evidence to indicate that anti-competitive trade practices are on the increase related to market concentration and increased buyer power among the TNCs. Given the situation, policy must play a role in ensuring that levels of market concentration in local and international markets need to be tackled to ensure that the MNCs cannot abuse their market power and extract unfair profits. Competition law in Ghana could play an important role in tackling some abuses of market power, especially by domestic intermediaries or domestic subsidiaries of MNCs and ultimately protecting consumers. CONCLUSION and RECOMMENDATIONS A number of possible instances of anti-competitive practices were found in a range of sectors including, inter alia, beverages, cement, cargo handling and the utilities. In all these cases the ill-effects on consumers consisted of having to pay higher prices and accept lower quality than would have been the case with more (and fairer) competition. The prevalence of anti-competitive practices can be ascribed to lack of adequate governmental regulation and civil society action. Government has, for the most part, been lax in preventing the establishment of monopolies and taking stringent action when any unfair practices are revealed. Civil society organisations, for their part, do not seem to have placed high priority on tackling competition concerns and pushing for consumer protection. The first step in addressing competition concerns in Ghana will be the passing the pending Competition Bill into law. Following this should be the establishment of a well-resourced and legally empowered Competition Authority. The fact that the new Minister of Trade and Industry seems quite keen on pushing for the Bill’s passage is very encouraging. Efforts must be sustained to make sure that other pressing concerns of Government do not push this issue to the backburner. A key part of this process will be impressing on the public the benefits that will come from competition reform and the losses they will continue to make if the status quo is maintained. Results from our perception survey suggest that this will involve not only educating the public but also educating the media to identify abuses and produce well-thought-out stories that accurately detail the ills of the situation. Overall, this project has been eye-opening and the comprehensive results should be crucial in pushing forward the agenda of competition reform. It is now left to advocacy to convince the policymakers and the public that reform is desirable and will bring benefits to all. THANK YOU FOR YOUR ATTENTION