MANAGERIAL FINANCE • Name: Mcebo Seyama • ID #: MA0N0243 • Presentation

advertisement

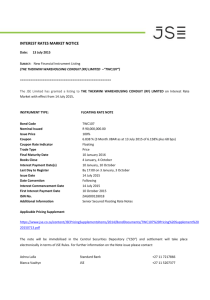

MANAGERIAL FINANCE • Name: Mcebo Seyama • ID #: MA0N0243 • Presentation • Johannesburg Stock Market (JSE) Backgroung information • The stock exchange was first established in 1887 after the discovery of gold in the Witwatersrand. • This led to a boom in mining and financial companies and a need for a stock market arose • In the year 2000, Johannesburg Stock Market changed its name to JSE Limited. • Johannesburg Stock Market Limited is a stock exchange located in Sandton, Gauteng, South Africa. • It is the largest stock exchange in Africa and #16 in the world. Purpose of JSE • The main purpose is the raising of primary capital by rechannelling cash resources into productive economic activity, thus building the economy while enhancing job opportunities and wealth creation. • The JSE provides a market where securities can be traded freely under a regulated procedure. • also provides investors with returns on investments in the form of dividends. Board of directors • The exchange is directed by an honorary committee of 16 people, all with full voting rights. • The elected stockbroking members, who cannot number less than eight or more than eleven, may appoint an executive president and five outside members to the committee. • Policy decisions are made by the committee and carried out by a full-time executive committee headed by the executive president. • The JSE is governed by its members but through their use of JSE services and facilities, these members are also customers of the Exchange. Although there is only one stock exchange in South Africa, the Stock Exchanges Control Act (repealed by the Securities Services Act of 2004) does allow for the existence and operation of more than one exchange. • Each year the JSE must apply to the Minister of Financefor an operating license which vests external control of the exchange in the FSB. Securities • Stocks- part ownership of a company. When an individual buys a stock, he or she buys a stake in the assets and earnings of the company. • bonds- is a debt security, in which the authorized issuer owes the holders a debt and, depending on the terms of the bond, is obliged to pay interest to use and/or to repay the principal at a later date, termed maturity. A bond is a formal contract to repay borrowed money with interest at fixed intervals. • derivatives-instrument is a contract between two parties that specifies conditions (especially the dates, resulting values of the underlying variables, and notional amounts) under which payments, or payoffs, are to be made between the parties • The exchange trades shares for a wide variety of industries, with the largest portion of market capitalization coming from the mining industry. • The Johannesburg Stock Exchange lists more than 400 companies and has market capitalization of over $182 billion Trading System • The exchange is fully electronic • using the JSE TradElect. indexes • JSE