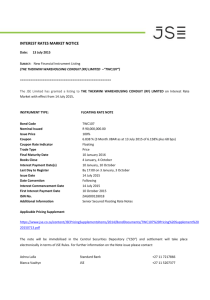

equities rules - Johannesburg Stock Exchange

advertisement