WHITHER GOES INVESTMENT BANKING IN THE CARIBBEAN BB HOLDINGS LIMITED 1

advertisement

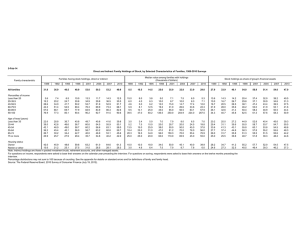

BB HOLDINGS LIMITED WHITHER GOES INVESTMENT BANKING IN THE CARIBBEAN 1 BB HOLDINGS LIMITED 1. The Financial Crisis to date has claimed several venerable names and may yet claim more Investment Banks. 2. The Investment Banking Industry Caribbean is extremely important: in the - Contribution of Investment Banking Sector 2 BB HOLDINGS LIMITED - Emp – (1000 – 2000) - Profits – USD 200MM - Raising Capital - USD 1.5 Billion - Funding Projects - USD 250MM 3 BB HOLDINGS LIMITED 3. It is therefore natural to enquire and to examine whether or not the Investment Banking Industry in the Caribbean is exposed in the same way or will be susceptible to contagion via transmission mechanisms. 4 BB HOLDINGS LIMITED HYPOTHESIS The current Financial crisis stemmed from a deterioration in credit quality (sub-prime Loans) which was exacerbated by Liquidity crisis in US Investment Banks (which typically fund their assets with wholesale short-term Liabilities) but which was further compounded by Mark-to-Market (MTM) Accounting convention. 5 BB HOLDINGS BB HOLDINGSLIMITED LIMITED CAUSES AND AMPLIFIERS A. B. C. D. E. F. G. H. I. Sub-prime Lending and the Lowering of Credit Standards Liquidity Mark to Market Accounting Excessive Leverage Exposure to Derivatives Off Balance Sheet Financing Inability to access Federal Reserve Funding Lack of on-site supervision Credit Rating Agencies 6 BB HOLDINGS LIMITED SUB-PRIME LENDING AND THE LOWERING OF CREDIT STANDARDS In a nutshell, global liquidity from China and other current-account surplus countries was directed towards the US and UK which then inflated asset markets (especially housing) which was plagued by poor regulation and dangerous incentives. 7 BB HOLDINGS LIMITED By contrast, Caribbean Investment Banks have little or no exposure to US Sub-Prime Loans, very little exposure to mortgages generally and are currently exhibiting non-performing ratios of less than 2.5%. 8 BB HOLDINGS LIMITED LIQUIDITY US Investment Banks are particularly vulnerable to credit-market turmoil, because they rely on funding from wholesale markets, much of it shortterm including over-night funding in repurchase markets. This 4.5 Trillion Market became unstuck during the crisis. 9 BB HOLDINGS LIMITED Caribbean Investment Banks, unlike their US and UK counterparts raise their liquidity via deposits. Furthermore, if they ever run into difficulty, they can go to their parents which are usually commercial banks. Due to their lower reserve requirements they are often more competitive than their retail and commercial counterparts. 10 BB HOLDINGS LIMITED LIQUIDITY RISK This situation is further compounded by the fact that there is what I have described as a liquidity trap whereby, due to poor transmission mechanisms. (from local to foreign currency) local liquidity is actually trapped in the local financial system and keeps “slushing around” moving to where it attracts the highest internal rates. 11 BB HOLDINGS LIMITED REGULATORY ARBITRAGE Regulatory Arbitrage means that because the range of investment opportunity is limited for regional institutional investors even more liquidity is trapped in the system. 12 BB HOLDINGS LIMITED MARK TO MARKET ACCOUNTING AND THE PREPONDERANCE OF TRADING ASSETS OF THE BALANCE SHEETS OF INVESTMENT BANKS Fair value accounting can cause a downward spiral in prices by encouraging institutions to sell assets quickly and forcing them to take writedowns that do not reflect the “true” value of the underlying assets. 13 BB HOLDINGS LIMITED In respect of Caribbean Investment Banks, although MTM accounting is in effect, the component of their balance sheet which is affected by this convention is still relatively small when compared to North America Investments Banks. 14 BB HOLDINGS LIMITED EXCESSIVE LEVERAGE US Investment Bank were allowed to leverage their Balance Sheet to levels unheard of in the Caribbean. The Leverage ratio of Bear Stearns rose from 26 Times (assets were 26 times equity) in 2005 to almost 30 times at the time of its collapse in 2008. Under the FIA Trinidadian Merchant Banks are limited to 12 times their capital 15 BB HOLDINGS LIMITED EXPOSURE TO DERIVATIVES According to the Economist Magazine (May 7, 2008) approximately half of the write-down of banks was due to the exposure to derivatives which contained synthetic exposures to sub-prime assets (CDO’s) and credit default swaps. In the case of Caribbean Investment Bank, this exposure is almost non-existent. 16 BB HOLDINGS LIMITED OFF BALANCE SHEET FINANCING AND EXPOSURE TO SIV’S US Investment Banks accounting under US GAPP, typically allowed for SIV’s which are akin to a “shadow banking system” in which short-term funding was raised (at lower interest rates) and later invested in long-term higher yielding assets. Quite often these structures were not consolidated 17 BB HOLDINGS LIMITED and therefore provided a false sense of security in terms of the bank’s capital adequacy ratio. Citi had more than 83 Billion in SIV’s in September 2008. Caribbean Investment Banks typically use IFRS. In this regard, IAS 39 and SIC 12 would require these enterprises to consolidate any “SIV” or SPV once they retained an economic interest in the enterprise. 18 BB HOLDINGS LIMITED INABILITY TO ACCESS (IMMEDIATELY AVAILABLE) EMERGENCY FINANCING FROM THE FEDERAL RESERVE Because US Investment Banks did not come under the jurisdiction of the Federal Reserve they did not have access to Federal Financing. Investment/Merchant Banks in the Caribbean are regulated by the Central Bank and by virtue of this, have access to Central Bank Financing via the repurchase market 19 BB HOLDINGS LIMITED REGULAR BANK SUPERVISION Because regional banks fall under the supervision of the Central Bank, they are subject to regular on-site inspections by the regulators. US Investment Banks were not subject to such routine regulation which would have alerted the authorities to the impeding danger. 20 BB HOLDINGS LIMITED THE ROLE OF CREDIT RATING AGENCIES The legitimacy and stamp of approval of Credit Rating Agencies undoubtedly contributed to the crisis. As these assets began defaulting the Credit Rating Agencies downgraded these assets further exacerbating the situation on account of the MTM accounting convention thereby forcing further sales. 21 BB HOLDINGS LIMITED In the case of Caribbean Investment Banks and Institutional Investors Credit Rating Agencies played and plays no such role. Indeed, Pension Funds are mandated as to what investments they can invest in statutorily so that you do not have this vicious cycle and therefore no compulsion to sell. 22 BB HOLDINGS LIMITED CARIBBEAN INVESTMENT BANKING MODEL Regional Projects Requiring Financing Up to USD 250 MM Non-Investment Grade Projects Projects with a pay-back period of 10-20 years 23 BB HOLDINGS LIMITED Basic Infrastructure financing (Toll Roads, Airports, Seaports, Hydro-plads) Local Private Placement Issues 144 A Issues REG: S. Issues 24 BB HOLDINGS LIMITED PROFILE OF INVESTORS LOCAL INSTITUTIONAL INVESTORS LOCAL BANKS US INSTITUTIONAL INVESTORS CENTRAL AMERICAN INSTITUTIONAL INVESTORS 25 BB HOLDINGS LIMITED CARIBBEAN INSTITUTIONAL INVESTORS HNW INDIVIDUALS 26 BB HOLDINGS LIMITED WHITER GOES CARIBBEAN INVESTMENT BANKING Notwithstanding The remotest of nexus. To Its US and European Counterparts The Investment Banking Industry In The Caribbean Is At A Critical Juncture CLICO / CIB Bailout (US 1-2 BN) - Not Related to US Financial Crisis - Related Party Lending - High Cost Resource Mobilisation Strategy 27 BB HOLDINGS LIMITED Collapse Of Stanford Banking Group 28 BB HOLDINGS LIMITED THE MULTINATIONALISATION OF THE REGIONAL BANKING SECTOR In the recent past several highly profitable indigenous financial organisations have been targeted by Foreign Banks. At least one has been taken over. 29 BB HOLDINGS LIMITED Invariably, the purchasers of these bank tend to be much more “risk averse” than their predecessors with a propensity for “white good” financing. This is done to the detriment of Development Financing. Quite simply they gravitate towards Retail Banking and tend not to be developmental or transformative in their approach to financing. 30 BB HOLDINGS LIMITED INABILITY/RESTRICTION ON SELLING SECURITIES TO US INSTITUTIONAL INVESTORS Due to the meltdown in the US, due to the imposition of new and “higher “ standards US Institutional Investors are likely to purchase regional now less securities. (Approximately USD 150-200MM in regional securities were being sold into the US before the crisis. 31 BB HOLDINGS LIMITED REGULATORY OVER REACH Having seen finance wreck havoc, the temptation would be to bind it in a regulation. 32 THANK YOU. 33