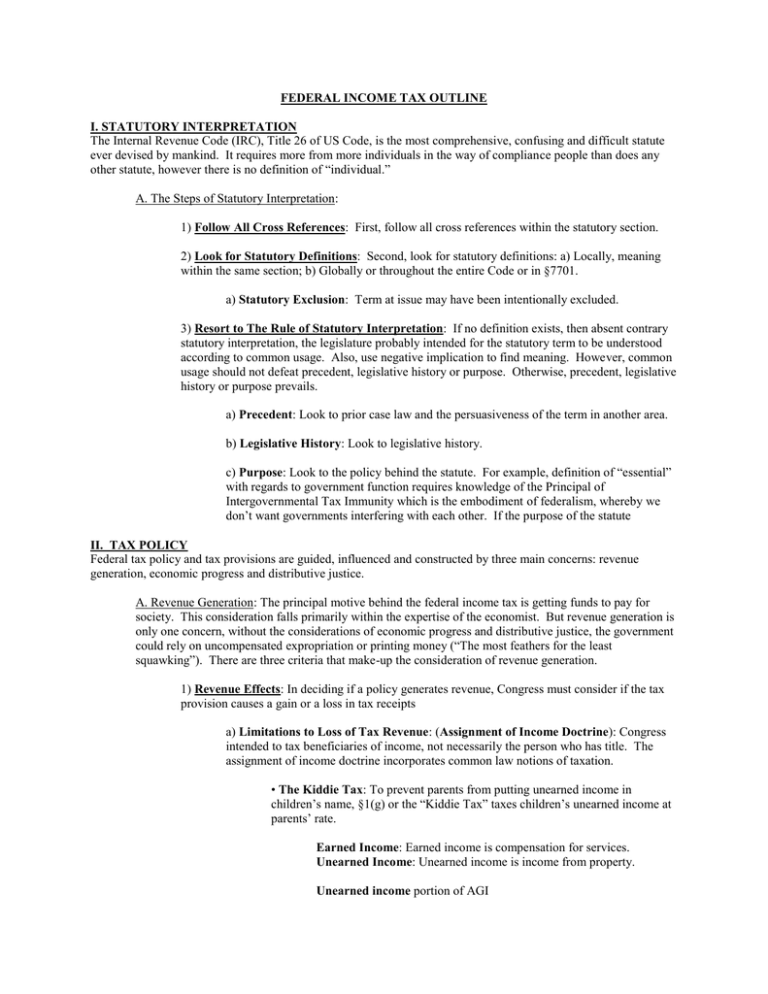

FEDERAL INCOME TAX OUTLINE I. STATUTORY INTERPRETATION

advertisement