•

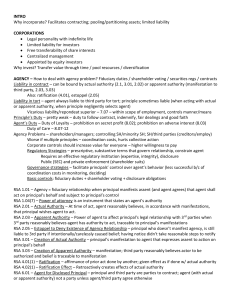

Piercing the Corporate Veil

•

•

Disregard the corporate fiction

Creditors ask the court to disregard the separateness between shareholder and corporation

(so that shareholders may be held liable)

When veil might be pierced:

Started w/ too few assets to pay debts (under capitalization not bad per se, but could be

fraud if objective is to operate risky business while avoiding claims of creditors)

Alter ego (when shareholders mix personal & corporate transactions)

Failure to adhere t corporate formalities (holding directors & shareholders meetings, keeping books, etc)

(piercing) can also apply . . .

To corporations who operate business through a subsidiary

Subsidiary: majority of stock owned by a parent company

Business Judgment Rule

Courts will not second guess business judgment of officers & directors when they act in good faith…

Must:

•

•

•

Make informed decision

Have no conflict of interest

Have a rational basis

Self-Dealing

Deprives officers and directors of the protection of the business judgment rule

Fiduciary Duty

One of the highest duties imposed by law

Arises in a fiduciary relationship

Fiduciary relationship is a relationship of trust and confidence

Can be formal: atty/client, partners in partnership, officers & directors/corporation

OR can arise informally in SPECIAL relationships of trust and confidence

Fiduciary Duties officers and directors owe the corporation:

•

•

Of loyalty (no self-dealing)

Of care

No fiduciary duty

In arms-length business transactions i.e borrower/lender, insured/insurer etc

MUST BE SPECIAL REALATIONSHIP