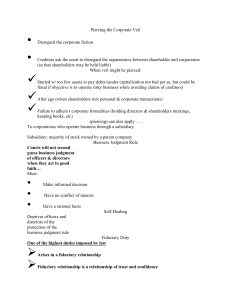

I. Economic and Legal Aspects of the Firm A. Economic Backdrop

advertisement