Corporations Outline 2016-Spring Spamann Aeris 6369

advertisement

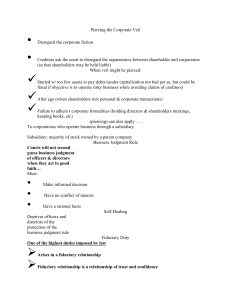

INTRO Why incorporate? Facilitates contracting; pooling/partitioning assets; limited liability CORPORATIONS Legal personality with indefinite life Limited liability for investors Free transferability of share interests Centralized management Appointed by equity investors Why invest? Transfer value through time / pool resources / diversification AGENCY – How to deal with agency problem? Fiduciary duties / shareholder voting / securities regs / contracts Liability in contract – can be bound by actual authority (2.1, 3.01, 2.02) or apparent authority (manifestation to third party, 2.03, 3.03) Also: ratification (4.01), estoppel (2.05) Liability in tort – agent always liable to third party for tort; principle sometimes liable (when acting with actual or apparent authority, when principle negligently selects agent) Vicarious liability/repondeat superior – 7.07 – within scope of employment, controls manner/means Principle’s Duty – pretty weak – duty to follow contract, indemnify, fair dealings and good faith Agent’s Duty – Duty of Loyalty – prohibition on secret profit (8.02); prohibition on adverse interest (8.03) Duty of Care – 8.07-12 Agency Problems – shareholders/managers; controlling SH/minority SH; SH/third parties (creditors/employ) Worse if multiple principles – coordination costs, hurts collective action Corporate controls should increase value for everyone – higher willingness to pay Regulatory Strategies – prescriptive, substantive terms that govern relationship, constrain agent Requires an effective regulatory institution (expertise, integrity), disclosure Public (SEC) and private enforcement (shareholder suits) Governance strategies – facilitate principals’ control over agent’s behavior (less successful b/c of coordination costs in monitoring, deciding) Basic controls: fiduciary duties + shareholder voting + disclosure obligations RSA 1.01 – Agency = fiduciary relationship when principal manifests assent (and agent agrees) that agent shall act on principal’s behalf and subject to principal’s control RSA 1.04(7) – Power of attorney is an instrument that states an agent’s authority RSA 2.01 – Actual Authority – At time of act, agent reasonably believes, in accordance with manifestations, that principal wishes agent to act. RSA 2.03 – Apparent Authority – Power of agent to affect principal’s legal relationship with 3rd parties when 3rd party reasonably believes agent has authority to act, traceable to principal’s manifestations RSA 2.05 – Estoppel to Deny Existence of Agency Relationship – principal who doesn’t manifest agency, is still liable to 3rd party if intentionally/carelessly caused belief; having notice didn’t take reasonable steps to notify RSA 3.01 – Creation of Actual Authority – principal’s manifestation to agent that expresses assent to action on principal’s behalf RSA 3.03 – Creation of Apparent Authority – manifestation; third party reasonably believes actor to be authorized and belief is traceable to manifestation RSA 4.01(1) – Ratification – affirmance of prior act done by another; given effect as if done w/ actual authority RSA 4.02(1) – Ratification Effect – Retroactively creates effects of actual authority RSA 6.01 – Agent for Disclosed Principal – principal and third party are parties to contract; agent (with actual or apparent authority) not a party unless agent/third party agree otherwise RSA 7.03 – Principal’s liability – principal subject to direct liability to 3rd party harmed by agent when acting with actual authority or ratified; when principal negligent in selecting/supervising; delegates duty of care to agent who fails to perform. Vicarious liability if agent commits tort while within scope of employment or acting with apparent authority in dealing with third party RSA 8.01 – General Fiduciary Principle – Agent has fiduciary duty to act loyally for principal’s benefit in all matters connected with agency relationship RSA 8.02 – Material benefit arising out of position – Agent has duty not to acquire material benefit from 3rd party in connection with transactions taken on behalf of principle RSA 8.03 – Acting as or on behalf of an adverse party – duty not to act on behalf of adverse party CHARTERS – very little is mandatory; only board can initiate charter amendment (DGCL 242) DGCL 102(a) – mandatory elements of corporate charter – voting stock, board (size, terms, removal), shareholder voting, name incorporators, fix initial capital structure DGCL 102(B)(1) – Contents of Charter – may contain any provision not contrary to laws of this state DGCL 102(f) – May not impose liability on stockholder for attorneys’ fees / expenses for internal claim DGCL 151(a) – Types / Rights of Stock – may issue stock as described in charter DGCL 212(a) – Votes per share – one vote per share unless charter provides otherwise DGCL 242 – Amendments – requires board resolution; vote of majority of outstanding stock (and majority of each class entitled to a class vote); filing of amendment certificate BYLAWS – must conform to statute/charter; shareholders or board can initiate amendment (DGCL 109) DGCL 109 – Bylaws – Stockholders have power to adopt/amend/repeal bylaws; Corp can let board also; can include any provision not inconsistent with the law (but no liability for attorneys’s fees / expenses) DGCL 112 – Access to proxy solicitation materials – May require minimum stock ownership; submission of specific info; indemnify for false statements; no nomination if acquiring x% before election DGCL 113 – Proxy expense reimbursement – may provide but limit DGCL 115 – Forum selection provisions – may require / can’t prohibit internal corp claims brought in DE DGCL 141 – board has primary management authority (usually delegated to managers DGCL 141(d) – default is entire board elected for one year term; but allowed staggered board with up to three classes Decisionmaking Power (DGCL Defaults) SH only – board election, annual, DGCL 212(b) SH and board jointly – fundamental changes (mergers – 251c except 251fh, 253; charter – 242b2) SH or board alone – bylaws 109a Board only – business decisions – 141a Voting – shareholders have little agenda control on what to vote for Only board can initiate merger, charter amendment, call special meeting, what to put on proxy cards (no access for SH board nominees, may get in precatory resolutions i.e. bylaw proposals) Disclosure Requirements - Securities Exchange Act of 1934 Disclose ownership above 5% (form 13D) If more than 10%, you’re a corporate insider – disclose within two days (Section 16a) PARTNERSHIPS UPA 202 – association of two or more persons to carry on as co-owners a business for profit forms a partnership, whether or not the persons intend to form a partnership o Dangerous default rule Joint owners of assets Jointly and severally liable for obligations (UPA 15(b)) – unlimited liability All both agents and principals of partnership; all have control (equal right to manage) One partner can force liquidation / dissolution (UPA 31(b), 38(1)) Partnership interests are not transferable Why have partnership? Tax benefits, align incentives – but almost entirely replaced by corporations UNCONFLICTED BEHAVIOR – Duty of Care If directors are disinterested/reasonably informed/not wasteful, decision will be protected by business judgment rule (Aronson) – primarily, a process requirement Possible exception: gross negligence (Van Gorkom), but damages waivable under 102(b)(7) Also can’t violate the law To survive motion to dismiss, have to plead fraud, self-dealing, self-interest; specific duty of loyalty violation (knowingly illegal acts – motion to dismiss denied) Violation for inaction (Stone v. Ritter) – bad faith - must have utterly failed to implement reporting system or consciously failed to monitor or oversee operations (more than gross negligence - Disney) Demand futility – under particularlized facts, reasonable doubt that (1) majority of directors are disinterested or independent OR challenged transaction was (2) product of valid exercise of business judgment (AND no sufficiently independent special litigation committee – Zapata/Aronson – tough independence standards, independent business judgments) (essentially a heightened pleading standard) Director is partial if – personal interest in challenged transaction; subject to liability by participating In practice – heightened pleading standard for fiduciary duty violations – particularized facts I.e. – if bringing suit against former directors, no demand excuse Duty of Care – act with appropriate care / ordinary prudent person; essentially eliminated by BJR Aronson v. Lewis – Fink (47%) got huge comp. package; derivative suit claiming no valid business purpose; waste; claimed demand futility b/c Fink controls board; Holding: not enough facts alleged Derivative Suit – shareholder against board on behalf of the company; need to own one share Demand Requirement – DGCL 23.1 – must allege efforts made to get board to bring suit Demand futility test: under particularized facts alleged, reasonable doubt that directors were disinterested / independent (essentially a heightened pleading standard) Must rebut: informed basis, in good faith, honest belief in best interests of company Can get around by appointing independent committee (Zapata) – court look to independence / good faith of the committee; independent business judgment (not rubberstamping) Can’t just say that all directors are defendants, controlled by Fink Ensure first use corporate democracy, prevent strike suits (settlements) Business judgment rule: 1. Disinterested and independent (otherwise appoint independent committee) 2. Reasonably informed (look to gross negligence, Van Gorkom) 3. Rationally believes is in best interest of corp (no waste) Zapata (discussed in Aronson) – even in demand excused case, independent committee can ask for dismissal 1. court will look at independence and good faith of committee 2. review reasonableness and good faith of committee’s investigation Van Gorkom - shareholders seek merger damages, direct suit; board not adequately informed – no independent evaluation, short time frame / no emergency; no justification for price (Van Gorkom set it); AND didn’t disclose all material information to stockholders Ran numbers to see what cash flow would be necessary for debt (not appropriate value of co.) Court uses a gross negligence standard; found market test didn’t cure Board may also face suit for rejection of merger / tender offer (unlikely DE court would impose liability on these facts today) Stockholder Action – when majority of fully informed stockholders ratify action of even interested directors, an attack on transaction must fail (but here stockholders not fully informed) Takeaway: get better procedure – valuation; don’t agree to deal (no liability) Delaware responds with DGCL 102(b)(7) – Can have charter provision that eliminates or limits personal liability of director / stockholders for monetary damages for breach of fiduciary duty EXCEPT for breaches of duty of loyalty; not in good faith (intentional dereliction of duty; conscious disregard for one’s responsibilities – Disney) intentional misconduct; knowing legal violation); under § 174 (unlawful dividends); for any transaction where director derived improper personal benefit Walt Disney – giant exec comp package; derivative action – breach of fiduciary duty / contract, waste Claims against Ovitz fail – no duty until deal already made; not breach to get what contract says Claims against Disney fall – comp. committee didn’t meet best practices, but acceptable Good Faith Standard – gross negligence without more cannot constitute bad faith; need subjective bad faith or intentional dereliction of duty; conscious disregard for responsibilities 102(b)(7) waiver – waived liability as long as good faith violation – broader than b. jud. Takeaway: no duty of care violations unless bad faith if you have a 102(b)(7) waiver Board Inaction Graham – Absent cause for suspicion, no duty to “install and operate a corporate system of espionage to ferret out wrongdoing which they have no reason to suspect exists.” Caremark – narrows Graham – should have good info / reporting system to ensure you know what’s going on; Only liability if “sustained or systematic failure of board to exercise oversight – such as an utter failure to attempt to ensure a reasonable information and reporting system exists.” Stone v. Ritter – for oversight, need to establish lack of good faith (Disney – not just gross negligence); at motion to dismiss / demand requirement stage – argue directors face substantial likelihood of liability; can’t show information was reaching the board to raise red flags; not enough info to excuse demand Demand futility test – to get around 102b7 waiver, have to show not in good faith / loyalty violation Failure to Monitor Test – liability if directors (must show directors knew not following obligations) 1. Utterly failed to implement any reporting or information system or controls 2. Having implemented, consciously fail to monitor or oversee DGCL 141 – board manages business and affairs of corporation; e – fully protected in relying in good faith on reports made by officers DGCL 145 – Corp can indemnify dir/off for reasonable expenses, judgments, fines if person acted in good faith and not adjudged liable to corporation (and maybe if anyway); if successful defense, must reimburse expenses; corp can purchase insurance whether or not power to indemnify Strong incentive to settle before you’re found in bad faith – insurance will stay pay Why do directors care even with waiver/indemnification? Reputational; huge payout possible; most settle anyway; in criminal – no reason to think action unlawful CONFLICTED BEHAVIOR – Duty of Loyalty (Fair Dealing + Fair Price) Self-dealing transactions – must fully disclose (otherwise entire fairness); should get approval by disinterested party, approval by minority shareholders Controlling stockholder – always use entire fairness Business opportunity (Guth) – can ask for ex ante permission from board – DGCL 122(17) Duty of loyalty applies to directors, officers, and controlling shareholders (Weinburger) DGCL 144 – Interested Directors – transaction not void solely because made with interested director if approved in good faith after full disclosure by majority of disinterested directors or shareholders; or is fair Weinberger – cash out merger – controlling stockholder w/ board members – problem: feasibility study performed by company for majority board members; not arms length / didn’t abstain; even though shareholders approved, burden remains on defendants because they weren’t fully informed Majority owned 50.5, decided it wanted the other 49.5; directors did study on what they could pay, didn’t disclose to shareholder/disinterested directors Fair Dealing – procedural requirement – total disclosure; duty of candor Fair Price – substantive requirement – economic and financial considerations (courts often punt) But price is he preponderant consideration Burden Shifting Framework – If plaintiff shows self-dealing, defendant has to show entirely fair by preponderance; but if informed vote by disinterested parties (majority of minority shareholders), burden shifts to plaintiff If plaintiff shows self-dealing; burden bears burden of showing entire fairness; burden shifts if independent directors and/or majority of minority approve Takeaway: fn. 7 – appoint independent committee of outside directors to negotiate, and you’re ok Demanding standard of review for conflicted transactions w/ controlling stockholder Sinclair – owns 97% of subsidiary; claim paying too high a dividend, not investing in R&D; found no self-dealing – parent received nothing to exclusion of minority shareholders – should apply business judgment; but did find self-dealing in not enforcing contract breach – have to show intrinsic fairness Test for self-dealing – actions that bestow exclusive benefit on parent at expense of minority If self-dealing – entire fairness; if not – business judgment Guth – Pepsi case – unbelievable amount of self-dealing; comingling of assets; require Pepsi assets be given to Loft; corp. officer/dire not permitted to use position to further private interests; undivided / unselfish loyalty If business opportunity that belongs to corporation, you have to turn over to the corporation Business Opportunity Test – In which capacity did fiduciary receive knowledge; did corp have financial means to pursue; is this kind of thing corp does; does corp have interest / expectancy in this opp; by taking opp for own, will fiduciary be placed in position inimicable to duties? May take a business opp if: 1. opportunity is presented to director in individual, not corp capacity 2. opportunity is not essential to corp 3. corp holds no interest or expectancy in opp 4. director/officer has not wrongfully employed resources of corp in pursuing/exploiting Meinhard v. Salmon – “Joint adventurers, like copartners, owe to one another, while the enterprise continues, the duty of the finest loyalty. . . . A trustee is held to something stricter than the morals of the market place.” Broz v. Cellular Information Systems – corporate opportunity – presenting opportunity to board creates a kind of “safe harbor”, but presentation isn’t necessary prerequisite DGCL 122(17) – corp./board can renounce any expectancy of corp in specified business opportunities or specified classes or categories of business opportunities presented by officer/director/stockholder Self-Dealing? Approval by Nobody (or we don’t know) Full informed disinterested directors Full informed disinterested SHs Self-dealing by Controlling SH Director / Officer Entire Fairness [D] Entire Fairness [D] Sinclair DGCL 144 Entire Fairness [?] BJR / Waste [P] Kahn v. Lynch Aronson Entire fairness [P] Weinburger, but Kahn may need both Yes. Controlling SH? Yes. Entire fairness BJR / Waste [P] Wheelabrator No. 102(b)(7) waiver or Caremark claim? No. Approval by disinterested directors or SH? No. Entire fairness No. BJR Yes. Good faith Yes. BJR/Waste SHAREHOLDER LITIGATION Aronson – demand requirement – at motion to dismiss time America’s Mining – awarded $35,000/hr attorney’s fees – 15% of common fund – incentivize litigation Common Fund Doctrine – litigant who recovers common fund for benefit of group is entitled to reasonable attorney’s fee from fund as a whole – 10-33% depending on Sugarland factors Sugarland factors – benefit achieved, difficulty & complexity, contingent representation, standing and ability of counsel, time & effort of counsel In re Riverbed – class action litigation for stockholders with rights extinguished in merger; objector argues disclosures were worthless; extinguishing potentially valuable claims; result is too modest a benefit to justify the fee sought ($712.95/hr); uses Sugarland factors to award $330k instead of $500k Standing – need to be member of class affected by settlement (not need to own share at merger) Reviewing settlement – policy preference for settlement vs. need to insure class fairly represented Agency problems in class actions – plaintiffs’ attorneys may favor quick settlement; interest of particular principal is extremely small Plaintiffs got a peppercorn (positive result of small therapeutic value), released a mustard seed In other situations, breadth of release could be troubling DGCL 102(f) – charter cannot contain fee shifting provision – impose liability on stockholder for attorney’s fees DGCL 115 – forum selection provisions – may require, cannot prohibit that internal corporate claims be brought only in Delaware Ct. Chancery Rule 23.1 – Derivative Actions by Shareholders – must allege that plaintiff was a shareholder at time of transaction of which shareholder complains; allege with particularity efforts made by plaintiff to achieve goal from dir/off; class representatives must file affidavit saying not receiving compensation for acting as rep; action not dismissed without approval of court SHAREHOLDER VOTING – see this section on H2O Schnell v. Chris-Craft – mgmt. moved up annual meeting; using Delaware law and corporate machinery to perpetuate itself in office – complying strictly with the law doesn’t make it ok – reinstate later date “Inequitable action does not become permissible just because legally possible.” Blasius – board added new members to defeat proposal to make board much bigger Business judgment rule doesn’t apply if board acts with primary purpose of interfering with stockholder’s vote, even if taken advisedly and in good faith But adopts intermediate standard – not per se invalid Actions – shareholder/board jointly modify charter, merge; shareholders or board change bylaws Board alone: everyday business, initiate merger / charter amendment; call special meeting; decide what goes on proxy cards (board only picks board candidates; shareholder can propose bylaw) DGCL 141(d)/(k)(1) – Charter (by initial bylaw) or bylaw (adopted by stockholder) may vote on staggered board (up to 3 classes; 1/3 of board up each year); any director removed with majority of votes unless staggered board (then maybe removed only for cause), cumulative voting? DGCL 214 – Cumulative Voting – charter may give shareholders number of votes x number of directors to be elected, allow votes to be cast for single director or among several DGCL 112 – Access to proxy solicitation materials – Bylaws may require corp to include shareholder nominate candidates in materials with requirements – minimum stock ownership, particular info, indemnification DGCL 113 – Proxy expense reimbursement – may provide reimbursement with limitations DGCL 213 – voting rights determined on record date – 10-60 days before actual vote DGCL 242b – shareholders must approve charter amendment DGCL 252c - shareholders must approve merger SEA 14a-1 – (federal rule) Definitions – Solicitation = furnishing of a form of proxy to security holders under circumstances reasonably calculated to result in procurement, withholding or revocation of proxy; not inclue communication stating how intending to vote in speech / press release / advertisement SEA 14a-2 – rules apply to every proxy solicitation except when not seeking power (except for officer / nominee / any person soliciting in opposition to a merger / soliciting no more than 10 people) SEA 14a-8 – Shareholder Proposals – must hold at least $2000 in market value or 1% for at least one year; no more than one proposal per meeting; can’t suggest a candidate for board M&A – buying, selling, joining of entire corporation; only a board can propose a merger Asset sale – very cumbersome; transfer individual assets, no contract transfer w/out consent; dissenting shareholders don’t get appraisal rights; don’t automatically assume all liabilities Merger – very easy; simple majority approval by board/shareholders Options: Merger only – appraisal rights, no entire fairness review Tender + merger – appraisal rights; entire fairness review only on longform merger, not shortform Asset sale – no appraisal, no entire fairness review Williams Act Requirements for Tender Offer – disclosure rules – file w/in 10 days of acquiring 5%; amend on acquiring material change (+/- 1%) (SEC 13D) 14D – requires tenderer offeror to disclose identity and future plans 14E – prohibits any fraudulent, deceptive, or manipulative practices in connection with tender 14E-1 – tender must be open for at least 20 business days 14D4-7 – substantive terms of tenders offer – duration, equal treatment etc Generally – open at least 20 business days; shareholders can withdraw at any time before offer closes, all offered best price; open to all shareholders of same class 14D6 – if oversubscribed, offeror must take up tendered shares pro rata DGCL 251 – normal mergers require approval from board and majority of shareholders in both target and buyer DGCL 251(h) – back-end squeeze out – don’t need a vote if you own majority of stock – now allows a shortform merger following a tender offer if the acquirer obtained at least majority for long-form – top up no longer required! Still need 90% to do without a vote; 3G Burger King is different – if you negotiate merger up front, launch tender, has at least 50%, then they can do merger without shareholder vote – negotiate up front, tender off for all shares, board would have to approve up front anyway Creates appraisal right for dissenters; if controller from outset – entire fairness; arms length – BJR Glassman – only applies directly to 253 Could challenge initial agreement But controlling stockholder will always face entire fairness Before 251h, everyone used tender and top up DGCL 259 – Status of corp after merger – at merger, surviving corp shall have all rights / obligations DGCL 260 – Powers of surviving corp – may issue obligations to pay for merger; may mortgage or issue stock DGCL 261 – Effect of merger upon pending actions – may continue as normal or substitute surviving corp DGCL 251 – Merger of domestic corps – both boards agree, approved by shareholder vote (1/2 of all shares) DGCL 253 – Merger of parent / subsidiary – If parent owns at least 90%, short-form merger; 262 doesn’t apply DGCL 262 – Appraisal rights – stockholder must deliver written demand for appraisal before vote; may order expenses to be charged against value (no appraisal rights in asset sale, short-form) DGCL 271 – Sale, Lease, Exchange of Assets – may sell on majority vote Hariton v. Arco Electronics – sold assets, effectively creating merger using asset sale statute; court says ok, but means that dissatisfied shareholders don’t get appraisal rights (DGCL 271) Weinburger – also involved squeezeout merger Glassman v. Unocal – parent company executing short form merger with subsidiary; established special negotiating committee; tried to meet entire fairness (unnecessary) – DGCL 253 Short-form merger – already own 90%, don’t need vote of shareholders/board, just file a form Supposed to be easier – won’t require the full fair dealing component of entire fairness Appraisal – exclusive remedy available for non-fraudulent mergers; company won’t have to establish entire fairness, but duty of full disclosure remains; court will consider proof of value by any methods generally acceptable in community; all relevant factors; if you want appraisal, have to send in dissent before vote then file for appraisal (only those who ask get the additional money) Absent fraud or illegality Kahn v. MFW – controlling (43%, lots of board) stockholder squeezing out minority; conditioned merger on both independent committee and majority of minority approve; does entire fairness apply? Business judgment standard applies when merger is conditioned upon both approval of independent special committee that fulfills duty of care (independent, can pick its own advisors, able to say no) and the uncoerced, informed vote of majority of minority stockholders If plaintiff can plead reasonably conceivable set of facts showing any conditions not met, entitle to proceed to discovery, trial with entire fairness review If only one of protections in place ex ante, proceed with Weinburger burden shifting If both, can resolve on summary judgment (entire fairness determined at trial) In re Delphi – charter says both share classes get same consideration; but Rosencrantz won’t sell w/out higher price for his shares; deal conditioned on majority of first class amending charter to allow differential; other side deals also sweetening pot for Rosencrantz; won’t award injunction but will allow to proceed for damages Allowing amendment would make charter rights illusory; let controlling shareholder benefit twice Implied covenant of good faith and fair dealing Equal Opportunity Rule – benefits shareholders if there is a deal, but controller may prevent deal Delaware default is that control premium is ok, can change in charter/bylaw SEA r. 14d/e SEA r.13d – if you acquire in/directly 5% of shares, must file Schedule 13D w/ SEC w/in 10 days TAKEOVER DEFENSES Unocal v. Mesa – Board has power to defend against hostile takeovers, even with discriminatory measures Strategy: if Mesa successful in bid, buy remaining shares at much higher price; exclude Mesa from offer Board has obligation to determine whether tender offer is in interests of the corporation But directors may not act solely/primarily out of desire to perpetuate themselves in office Defense must be reasonable in relation to threat posed – intermediate review (stricter than BJ) Claim – grossly inadequate price, coercive bid (two-tier bid) Target board bears burden of showing proportional to threat Intermediate scrutiny stsandard of review for defensive actions – must reasonable reasonably related to threat posed Board Authority – DGCL 160 – to deal in corp’s stock; DGCL 141 mgmt of corp’s business & affairs Corporate law is not static. It must grow and develop in response to evolving concepts and needs. (although discriminatory self-tender is now illegal under SEC regulations) Moran v. Household – approved the poison pill – only goal: deter hostile acquisition; never intended to trigger Effectively stops all hostile takeovers; fundamental power shift from shareholders to boards Court finds statute silent to this particular technique; corporate law should grow and change (Unocal) Finds board authority under DGCL 157, 141 SEC amicus: court seriously underestimates impact; will deter all hostile offers Defense: burden with board to show reasonable grounds for believing danger to corporate policy existed; look for evidence of bad faith / entrenchment Why are we ok with the pill? Better than the other defenses people had used before Sale of discounted stock, sale of stock to other party, acquisition to create antitrust problem DGCL 203 – can’t merge if you’ve recently acquired a lot of stock unless you own 85%; 2/3 majority vote of other stockholders + board consent; waivable by charter or bylaw Revlon – if board decides to sell/break up company, can no longer defend selectively against some bidders Lock-ups / no-shops permitted only where untainted by director interest / breach of fiduciary duty OK that board initially chose poison pill, but then not ok to agree to sell elsewhere, prevent other sale Once board permitted management to negotiate, duty only to maximize company’s value for shareholders (not note holders) Revlon used scorched earth tactic – issued notes with major restrictions Today – generally ok with giving first bidder 4% break up fee – valuation process is very expensive Some defenses still available - Airgas – board must act in good faith, after reasonable investigation and in reliance on outside advisors who say legitimate threat before instituting poison pill; inadequate price is sufficient to show coercion Board can maintain a poison pill for as long as it likes and for the mere reason that it believes offer price to be inadequate But board must show it’s aacting in good faith, after reasonable investigation and reliance on advice of outside advisors – showing tender poses legitimate threat to corporate enterprise Just forces the bidder into a proxy fight to elect majority of board Under existing Delaware law, inadequate price alone is a threat – shareholders will mistakenly tender into an inadequately price offer – substantive coercion Quickturn Design Systems v. Mentor Graphics – dead-hand pill violates DGCL 141(a) – deprives new board of power to manage the business and affairs of the corporation Paramount v. Time – inadequacy of price is sufficient threat (when combined with shareholders may elect to tender in ignorance) = substantive coercion Stock deal only triggers Revlon duties in stock deal if change of control; not triggered if corp widely held both before and after merger Burger King – go shop provision UK Approach – both takeovers and defenses very restricted in the UK; not allowed to defend Probably shouldn’t worry about short termist investors, but do worry about shorttermist managers i.e. put stuff on sale, cut R&D budget – one strategy: unstaggered boards SECURITIES LAW SEC Rule 10b-5 – unlawful to make any untrue statement of a material fact or to omit to state a material fact necessary; engage in act/practice/course of business which creates fraud/deceit in connection with purcuase or sale of any security Insider trading made to fit in here: insiders commit fraud by omission when not disclosing SCOTUS stipulated duty to abstain from trading or disclose 10b-5-1 – safe harbor for execs to precommit to buy/sell at certain times in the future Securities fraud – usually litigated by class action; insider trading – usually litigated criminally (no plaintiffs incentives – damages capped at gains derived by defendant) Basic v. Levinson – Fraud on the market (who would knowingly roll the dice in a crooked crap game?): false or misleading statement of a material fact made with scienter that plaintiff reasonably relied on that causes injury (can always rebut fraud on the market theory – show others knew, other reason for sale) Materiality: omitted fact is material if substantial likelihood that reasonable shareholder would consider it important in deciding how to vote Scienter: intent or knowledge of wrongdoing; someone must know statement was wrong Reliance: assume you relied on any material information there Problems: most people don’t rely on market price – assume undervalued; why do we want the rest of shareholders (who didn’t trade) to suffer to pay out the ones who did? Purpose of securities acts: “to substitute a philosophy of full disclosure for the philosophy of caveat emptor” “achieve high standard of business ethics” not to “attribute to investors a child-like simplicity, and inability to grasp the significance of negotiations” Rule vs. standards – any test with dispositive factor is necessarily over/underinclusive No agreement-in-principle bright line rule Dissent – people purchase stock because they don’t think the market price reflects value SEA Section 16 – Corp directors, officers, principal stockholders must disclose every transaction in securities (including derivaties) within 2 days; corp right of action to recover so-called short swing trading profits from o/d/ps made within 6 months; liability also fits with 10b-5; state law (unjust enrichment) SEC 14e3 – relates to information regarding tender offers – Allegan – if any person has taken a substantial step to commence a tender offer, no other person can trade unless that information is first disclosed Safe harbor trading plans – executives precommit to buy/sell at certain times – 10b5-1 State law claim – Kahn v. Kolberg – claim no limited to damages sustained by corporation or even loss of corporate opportunity, but on unjust enrichment based on misuse of corporate confidential information Is it a bad thing? Reveals info to market, pushes price in the true direction; but insiders may want price more volatile, riskier businesses, divert attention Chiarella – printer – no violation – fraud to not disclose only if under a duty to disclose If not an insider or a fiduciary, no obligation to reveal; not everything unfair is fraud Not recognizing a market-wide duty to disclose; possible another violation you could bring Dissent – would find a violation of information obtained by unlawful means – person who has misappropriated nonpublic information has an absolute duty to disclose or refrain from trading Would be decided differently today – 14e3; O’Hagan 10b5 misappropriation Dirks – received material nonpublic info from insiders to corp with which he had no connection; disclosed information to investor client who relied Test – was the first passing of information a breach; if not, likely ok No actionable violation here – tipper received no monetary/personal benefit for revealing; purpose was not to make a gift but to expose fraud (contacted WSJ) Dissent – shouldn’t have motivational requirement on fiduciary duty doctrine O’Hagan – misappropriation theory – fraud when misappropriates confidential info for securities trading Misapp can target trading by corporate outsiders in breach of duty owed to source of information Classical theory – trading on insider, material, nonpublic info is deceptive device b/c of duty to SHs Applies to officers/directors/insiders/attorneys/accountants/consultants/etc Duty to the source of the information US v. Newman – building on Dirks- only liability if tipper got personal benefit from tipping Gov must prove beyond reasonable doubt that tippee knew insider disclosed confidential information AND did so in exchange for a personal benefit 1. Corp insider was entrusted with fiduciary duty 2. Corp insider breached his fiduciary duty by a. Disclosing confidential information to tippee b. In exchange for personal benefit 3. Tippee knew of tipper’s breacher (confidential & divulged for personal benefit) 4. TIppee traded anyway Gov argues presumed to know that info was illicit (“must have known” standard); sophisticated parties Absent some personal gain, there has been no breach of duty Liability requires scienter (mens rea) – acted willfully; knew insider breached for personal benefit State liability – self-dealing – faces entire fairness review; could sue derivatively But until SEC regs, no liability for traders, just corporation NON-SHAREHOLDER CONSTITUENCIES Delaware corps owe fiduciary duties only to common stockholders (Revlon, Trados, Gheewalla, Ebay) Problems with expanding realm of fiduciary duties – conflicts of interest; but what about NEPAish? Constituent interests so diverse as to be pretext for managers to favor themselves? PBC – Public Benefit Corporation – DGCL 365, 362 – shall manage to balance pecuniary interests of stockholders, best interests of those materially affected by corp’s conduct, and the specific public benefit or public benefits identified in certificate of incorporation One example where this matter – Dodge v. Ford Motor Co Why protect only shareholders? No legal means other than fiduciary duties to get their money back; no contract rights; bankruptcy protections; can’t withdraw equity Junior/Senior Conflict (Equity/Credit) Junior/Equity prefer riskier projects, underweight downside; will gamble for resurrection Senior/Credit underweight upside – favor excessive caution Neither consistently maximizes value of company as a whole How to deal with this? Management incentive plan Trados – directors must maximize common shareholder interest; found directors conflicted by obligations to VCs, preferred shareholders Management Incentive Plan – receive portion of sale price Entire fairness review – found satisfied because common stock was worth zero Failed process – no independent committee to represent common stockholders, no independent evaluation for fairness, no majority of disinterested stock to approve But ok on price Gheewalla – creditors of Delaware corp that is either insolvent or in zone of insolvency have no right as a matter of law to assert direct claims for breach of fiduciary duty against corp’s directors When company goes insolvent, creditors take over SH role, can bring derivative claims Direct claim – would have implied duty owed to creditors; assumption to maximize their value Corporations only owe fiduciary duties to common stockholders (also Revlon, Trados) MetLife v. RJR – no express covenant restricting incurrence of new debt; won’t read implied covenant of good faith to read in terms Contracts specifically permitted mergers and assumption of additional debt; Court won’t create contractual terms post hoc Statutory Rules to protect creditors EU has minimum capital requirements (25,000 euros) – basically worthless Some industries have more finely calibrated requirements – bank debt to equity ratios Distribution Constraints – restrictions on dividends and share repurchases Directors held jointly and severally liable for negligent violations – big stick DGCL 173 – Dividends can be paid out of surplus; DGCL 154 – surplus = net assets – capital DGCL 1601a – share repurchases may not impair capital Fraudulent Transfer – creditors should be able to claim back an asset from transferee who obtained without paying equivalent consideration (transfer asset to wife, e.g.) Equitable Subordination – in bankruptcy, may subordinate some creditors on equity grounds; may treat shareholder loans like equity Piercing the corporate veil – hold shareholders directly liable for corporate debt – look for unity of interest and ownership b/w shareholder and corp; disregard of corporate formalities; commingling of funds; undercapitalization (usually only applies to small single owner corps) eBay v. Newmark (Craigslist) Rights plan – faces Unocal intermediate scrutiny – objective reasonableness – reasonably perceive threat to craigslist’s corporate policy and effectiveness, and if so, proportional response? Paramount Communiations v. Time – corporate culture can be ok, but must relate to stockholder value; craigslist’s corporate culture not protected here Corporate vehicle is not an appropriate vehicle for purely philanthropic ends Fails first Unocal Plan Staggered board is ok; stock exchange / dilution not ok (self-dealing) DGCL 226 –Appointment of custodian or receiver of corporation on deadlock or for other cause – court may appoint when stockholders or directors are so divided DGCL 341 - Law applicable to close corporations DGCL 342 – close corp defined – no more than 30 stockholders, transfer restrictions, no public offering DGCL 350-353 CORPORATE CRIME Why have corporate crime? Deterrence, Incapacitation, procedural enhancements (wiretaps), government enforcement when private parties don’t have incentive Federal Sentencing Guidelines – when possible, make victims whole; if org primarily for criminal purpose, divest org of all assets Fine based on seriousness (pecuniary gain / loss) & culpability (involvement / tolerance of crime, prior history, violation of order, obstruction of justice, effective compliance program, self-reporting, cooperation, acceptance of responsibility Probation appropriate when needed to ensure other sanction will be fully implemented Yates Memo – Most effective way to combat corporate misconduct is seeking accountability from individual who perpetrated the wrongdoing 1. to qualify for cooperation credit, corp must provide all relevant facts relating to individuals reason for misconduct 2. criminal and civil corp investigations should focus on individuals from the beginning 3. Crime and civil lawyers should be in communication 4. Absent extradordinary circumstances or approved departmental policy, not release culpable individuals from civil or corporate liability 5. Don’t resolve matters with corp w/out clear plan to resolve related individual cases 6. Civil attorneys should consistently focus on individuals How much do we want to incentivize? May be socially wasteful to have big compliance department GM Lawsuit – wire fraud + statutory – didn’t report to regulatory agency INTERNAL AFFAIRS DOCTRINE – applicable corporate law governed by state of incorporation Radical choice of law rule; CTS v. Dynamics – new Indiana corporate law was not preempted by Williams Act Doesn’t really say constitutionally mandated; some things could be burden on interstate commerce Vantagepoint Venture Partners v. Examen – only the law of state of incorporation governs a corporation’s internal affairs; issue of notice – prevent corps from being subject to inconsistent legal standards Delaware court wants to say constitutionally mandated Lidow v. Superior Court – CA court found could apply CA law on wrongful termination Found this wasn’t really internal affairs – if really strong CA interest, then can apply state law SUM UP If everyone is acting voluntarily and can look out for own interests, private law is the best solution, not regulation Notes from book on M&A Tender offer bypasses target’s board – achieves control through purchase directly from stockholders Merger – approved by board/shareholders of each constiuetn corporation (typically majority) Usually, shareholders of target receive premium for shares over market price Board proposes, majority of outstanding shares must approve (not just present shares) Shareholder vote not required if qualifies as short-form merger – parent/sub; owns 90% of outstanding stock; only parent’s board must approve (assumption – votes would be foregone conclusions) Open market purchases SEC 13d requires disclosure once you get over 5% within 10 days; once you get over 10%, may have to disgorge profits on subsequent sales within next 6 months to target corp (16b – short-swing profit provision) Proxy contest – prospective acquirer nominates slate of directors Asset sales – board has almost unconstrained authority to dispose of assets, unless disposing of all or substantially all corporate assets – DGCL 271a – majority of outstanding voting shares Even with voting, has benefits to merger (no appraisal rights, only target SH, less liability) Ensuring exclusivity – cancellation fees, no shop / best efforts clauses Appraisal remedy – DGCL 262(a) – hold shares continuously through effective date of merger; perfect appraisal rights (send notice before vote), and don’t vote in favor or consent to merger Once you acquire 50.1% of stock, you can do whatever you want, but can take a long time, get really expensive as arbitragers moe in Tender offer – offer to buy certain number of share for specified price for fixed period of time Takeover defenses Within the charter – staggered boards, supermajority requirements Would want to put staggered board in charter, so only board can initiate change of it Require supermajority for mergers – ok under 102b4, make it changeable only with supermajority vote Poison pill – shareholder rights plan – option to pourchase new shares Issuance of rights does not require shareholder approval – only board Usually cannot be traded separately from common stock, priced so that exercise would be economically irrational Only become exercisable on distribution event – announcement of intent to acquire 20% e.g. Once triggered, rights holders get option to buy new stock at extreme discount Transactional options Dual Class Stock – allowed under DGCL 151, will likely have to issue a bigger % of stock, because it’ll be worth less, but you can keep way less for yourself (but you’ll get a smaller percent later) Make differential rights dissolvable on transfer – transition into other class of stock Fix board size in the charter (if only in bylaws, majority stock ownership could change, DGCL 228, shareholders always have right to amend bylaws under 109) Staggered board – ok under DGCL 141(d) – wait longer Probably don’t want cumulative – allows proportional representation, get minority on the board; when staggered board can only remove for cause (DGCL 141ki Give board right to amend bylaws – 109 (can they just undo whatever bylaw amendments shareholders make?) Indemnify yourself as much as possible in the charter Reasonable expenses taken in good faith, insurance – DGCL 145 Waiver of liability under 102b7 Can’t indemnify from duty of care violations – if only board members, can’t have vote of disinterested directors As controlling shareholders, would face entire fairness Although, may not be controlling if less than 50% (Aronson) How to get financing Sell Assets – if substnaitlaly all – DGCL 271 (shareholder approval) Get a loan Sell equity – gives someone a stake in your company doing well; maybe put them on the board Arbitration clauses Exacerbate collective action problem of shareholders; removes deterrent incentives, but removes expensive litigation inefficiencies (especially those driven by plaintiff’s lawyers) Empirical question – do we have evidence for it? Eliminating Fiduciary Duties – problem in the middle, but maybe not problem ex ante Can’t contract away good faith and fair dealing Do we need fiduciary duties in partnership – personally liable Questions If board is given power to amend bylaws, can it just undo anything shareholders propose? DGCL 251(h) – top up no longer required – so if you tender and get 50.1%, you can proceed without a shareholder vote – but does that actually save you much? Entire fairness? Summary judgment – does that actually ever happen? Seems like you deal with business judgment on motion to dismiss; entire fairness on trial Possible to sue one board member but not others? Reasons why you wouldn’t want to squeeze out someone when you have 90% ish Law not clear on what sort of independent burden shifting you would need Control premium – not making an offer to everyone Intentional dereliction of duty – don’t have to actually being inted to harm if just the board If not listed, can’t pay employees in stock; can’t easily newly issue stock, regulatory requirements (local ownership requirements e.g.) DGCL says board cannot amend shareholder passed bylaw Board is always thinking about what the public would think If competing board proposal, shareholders can’t bring one – 14a SEC (but board can’t announce something ex post) Long form – board proposes, shareholders approve Written consent – most charters exclude it – antitakeover measure – also subject to proxy rules What can you not put on proxy Business decision, nothing for this year’s director election Can’t nominate directors using 14a8 Could propose bylaw amendment 112 which would give you right to put your candidates on corp’s proxy But can only do that prospectively But Blasius – used written consent