● e om inc

advertisement

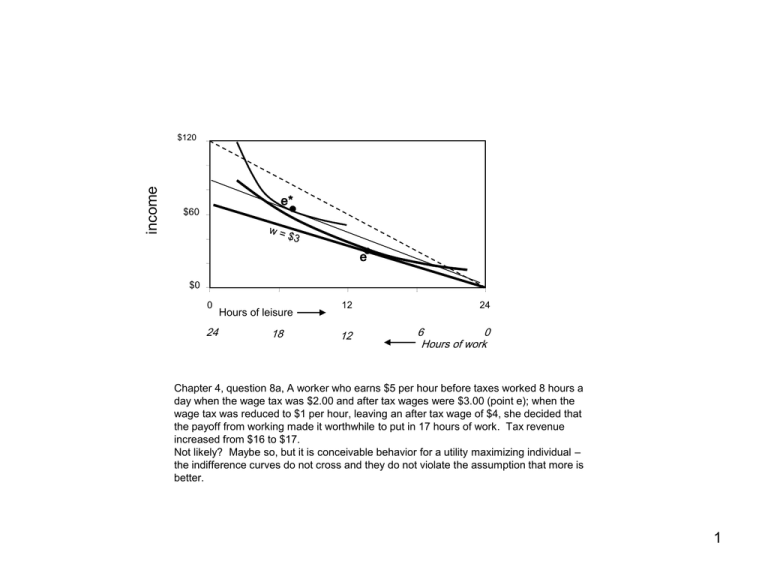

income $120 e* ● $60 e● $0 0 24 Hours of leisure 18 12 24 12 6 0 Hours of work Chapter 4, question 8a, A worker who earns $5 per hour before taxes worked 8 hours a day when the wage tax was $2.00 and after tax wages were $3.00 (point e); when the wage tax was reduced to $1 per hour, leaving an after tax wage of $4, she decided that the payoff from working made it worthwhile to put in 17 hours of work. Tax revenue increased from $16 to $17. Not likely? Maybe so, but it is conceivable behavior for a utility maximizing individual – the indifference curves do not cross and they do not violate the assumption that more is better. 1 income $120 $60 e’ ● e ● $0 0 24 Hours of leisure 18 12 24 12 6 0 Hours of work Chapter 4, Question b: Backward bending supply of labor Same tax cut as in 4.8a, but now this individual cuts back on his hours of work and enjoys more leisure after the tax cut. So a tax cut can but need not result in an increase in work effort 2 income $120 $60 e’ ● e ● $0 0 24 Hours of leisure 18 12 24 12 6 0 Hours of work Our worker put in an 8 hour day when the wage was $5.00 pr hour. After the imposition of a 40% wage tax reduced the after tax wage to $3.00, our worker decided to work 12 hours, sacrificing leisure in an attempt to preserve real income. Thus we have a backward bending supply curve for labor. 3 $250 Next year $200 $150 c ● ● b $100 ●a $50 $0 $0 $50 $100 $150 $200 This year Chapter 4, Question 4.11 #3: The above graph, the opposite of Figure 4.22, page 161, shows how an increase in interest rates might lead to a reduction in saving. Our worker makes $100 this year and will earn $50 next year. He could save nothing and consume at point a. Or he can put some money in the bank and earn interest. When the interest rate was zero, he could consume at any point on the dashed budget line going through points <0,175> and <175,0>. He chose to consume $87.50 each period at point b. So his is savings $100 - $12.50 = $87.50. When the interest rate increased to 50% out consumer can pick any point on the budget line that goes through points <0,$225> and <$150,0>; its slope is – (1 + interest rate). The consumer with the indicated indifference curves chooses point c, consuming $85 this year and saving $15 instead of $25 for next year, when he gets to consume $97.50: $75 of income, the $15 saved, plus $7.50 of interest income. 4 XJane 0 6 4 2 8 10 5 15 UD =5 UJ =21 b 5 YJane a ● 15 ● 10 10 UJ =11 YDick 0 20 b● 20 0 0 2 4 6 8 10 XDick Point a represents fair shares for everyone, for the available supply of each good is equally divided between the two citizens. Point b is a Parato Improvement over point a because Jane is better off and no one is made worse off. All the points inside the cigar dominate point a because both individuals are made better off. 5