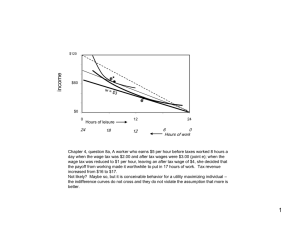

Individuals want to maximize well-being by consuming goods/leisure 2-1 Measuring the labour force CPS (Current Population Survey) classifies everyone above 16 to 3 things: • employed, unemployed, and out of labour force • Employed (E): worked 1hr pay at least or 15hrs on nonpaid job • Unemployed (U): temporary layoff from job or no job but seeking work Labour force (LF) = E + U Labor force participation rate = LF/P Employment rate = E/P Unemployment rate = U/LF Hidden unemployed If you don't seek work, considered as "out of labour force" • but they might claim to be seeking to get UE benefits Hiddden UE: when they seek, but then give up 2-2 Basic Facts about Labour Supply Over time, in 2-1 labour force decreases, especially since people are retiring earlier. In 2-2, a lot more women entered the workforce Work hours also decreased over time, from 55hrs in 1900 to 34hrs in 2010 In table 2-3 (at textbook), many factors affect labor participation, like education, race, etc. More women are in part time jobs then men 2-3 Worker's Preferences Framework used to analyze labor supply behavior is called the neoclassical model of labourlesiure choice • model isolates factors about whether someone works/how many hrs they would work • Helps predict changes in economic condictions/gov policies • Person in model recieves satisfaction from consumption of goods (C) and consumption of leisure (L) ◦ C is $ of all goods purchased (eg. food, rent, movies, etc.) ◦ L is # of hrs of leisure consumed Utility/Indifference Curves Utility function for consuming goods/leisure U = f(C,L) • U = individual's level of satisfaction/happiness Lets say consuimg $500 worth of goods & 100hrs of leisure created 25,000 utils in a function • in that case, if they consume $400 and 125hrs, would be same utility • Would be X/Y in indifference curve, as both provide same Utils If someone has $450 worth of goods & 150hrs of leisure, it's 40,000 utils, and is Z (a new indifference curve) Indifference curve (IC) has 4 important properties: • IC are downward sloping • Higher indifference curves = higher utility ◦ Eg. Z has more hrs/consumption then X • Indifference curves don't intersect ◦ Because if Y/Z are on same curve, that means X can have same utility as Z since X/Y are on same curver ‣ But that doesn't make sense cuz Z > X • Indifference curves are convex to origin (has that curve shape) The slope of an Indifference Curve Marginal Utility: change in utility after additional hour devoted to leisure activites, holding goods consumed constant? (for MUL) Marginal utility of goods: when someone consumes 1 dolllarmore of goods, but keeping leisure constant Based on indifference curve graph, slope of any point = rate person is willing ot give up leisure time in return for additional consumption • Or how much it costs to bribe them to give leisure time RIght shows indifference curve slope Marginal rate of substitution = ratio of marginal utlities Difference in preference across workers Different people have differend demands Eg. for Cindy, takes lots of money to bribe her to give up an hr of leisure • Cindy's MRS is very high • For Mindy, easy to bribe her to work more 2-4 Budget Constraint People's consumption of goods/leisure is limited since only 24hrs in a day • People also earn income from other means, like property, stocks, lottery, etc. ◦ This can be denoted as V Budget constraint formula is C = wh = V • w = wage • h = hr • V = nonlabor income It means expenditure of goods (C) = labor earnings (wh) + non labor income (V) Since total time = hours worked + leisure, that means T = h + L Therefore budget constraint can be C = w(T L) + V or C = (wT + V) - wL The last equation creates a budget line E = endowment point, where if they devote all time to L, they can still make a certain amount of money Budget line gives opportunity set, set of all consumption baskets a worker can afford to buy • worker can also choose C/L combos below the line 2-5 Hours of Work Decision People will always choose goods/leisure that maximizes utility In figure 2-6, FE budget line shows when someone has $100 nonlabor income weekly, faces a $10 per age wage & 110hrs for both work/leisure weekly Point P gives best utlity, 70hrs of leisure + $500 of goods • Ideally U1 would be better, but it can't be obtained, as she can't afford the goods consumed in Y • She can also choose A, but A gives less utility • Optimal point for goods/leisure is when budget line intersects indifference curve Interpreting the Tangency Condition If at P, where indifference curve = budget line • intersection of when someone is willing to give hrs for consumption & wage rate where they compensate workers for giving an hour of time What happens to hours of work when nonlabor income changes? In this graph, V = $100, and to get most optimal utility, worker works 40 hours Then V (nonlabor income) = $200, increases slope and lets worker be better off • in 2-7a, because V increased, thye can purchase more goods/leisure hrs, and workweek reduces • in 2-7b, addition V increases workweek Impact of change in nonlabor income on # of hours worked is called the income effect • In the income effect, generally more wealth Leisure is a normal good • Something is considered a normal good when increases in income (while good prices are constant) increase consumption • Inferior good: when increase in income (w/ prices constant) decrease consumption ◦ Eg. budget cars What happens to hours of work when the wage changes? When wage changes, Endowment point stays the same but slope of line changes • Based on getting $10/20 an hour • Even though wage go up, it's possible that hours of leisure can go up or down • Regardless of change, worker has larger opportunity set, can make more choices w/ higher wage • Increased wage = increased sacrifice when choosing 1 less hr of work In 2-9, when wage rate changes, it creates income/substitution effect Income effect = P -> Q, substitution effect = Q -> R • In 2-9a, income effect dominantes and in 2-9b, substitution effect dominates Subsitution effect is when it moves in the indifference curve In summary: • increase in wage rate increases hrs of work if SE > IE • Increase in wage decreases hrs of work if IE > SE 2-6 To Work or Not to Work? E0 indicates utility without working • What justifies a person to work beyond E0? At GE budget line, no wage is better than E0 utility • but at HE wage line, any point is better than E0 When you go from wlow to whigh, the wage that makes her indifferent to working/not working is reservation wage • minimum increase in income that makes them indifferent to E and working • Person will work when reservation wage > market wage 2-7 The Labor Supply Curve Labor Supply Curve: predicted relationship between hrs of work & wage rate As seen in graph, labor supply curve records down their wage & hours they worked • Reservation wage is $10, because after that point they won't work • Curve intially curves positively, but after income effect dominates • Labor supply curve in aggregate market: adding up hrs of all people willing to work in economy Shows market labor supply curve? Labour supply elasticity: measures responsiveness to hrs of work to change in wage rate • Considered inelastic if labour supply is less than 1 • if labor supply elasticity > 1, considered elastic 2-8 Estimates of the Labor Supply Elasticity Study of relationship between working hrs/wages model used is: hi = # of hours person i works, wi = wage rate, vi = non labor outcome B coefficient measures impact of 1 dollar wage increase, V coefficient measures 1 dollar increase in nonlabor income (V) B depends on if IE/SE dominates • B = negaitve if IE dominate • B = positive of SE dominates Problems w/ the Estimated Elasticities Doesn't specify if hours of work means hours in a week/day/year? • More elastic if measured by hrs per year The wage rate Salaried worker gets paid by annual salary? Wage rate can be inaccurate, since people can report higher hours • people who don't work don't necessarily have 0 wage rate, but perhaps a wage below reservation wage Nonlabor income can be stuff like savings/investments Unsure about reading household commodities, look back if it becomes relevant again Also skipping 2-10 as well 2-11 Policy Application: Welfare Programs & Work Incentives Eg. Welfare program where Unmarried women w/ children can earn 1k per month if they're outside the labor force As seen in 2-16, the option of the welfare program creates 1, and only 1 extra dot option G • G actually gives higher utlity then current budget line, so it's worth choosing • This type of program encourages people to drop out of workforce, reduces work incentives The impact of Welfare on Labor Supply Pretty unrealistic to just give 1 option and thats it • Typically when there's a welfare program, it will do something like "we will take x% amount of money from your wages if you do enter the labor force" • It would be like 2-17, and would create a flatter slope after taking the G welfare program • Endowment point changes from E to G, since not working at all at G offers a good benefit, as you still get that even after work • HG is a much better option than FE • From P to Q, you can see that Q is clearly a better option ◦ P to Q movement is income effect, increases leisure demand ◦ Q to R is substitution effect Welfare program reduces probability of person working & # of hrs they work • When they also improse a "tax" on people who takes the program, reduces leisure price, reduces working hrs 2-12 Policy Application: Earned Income Tax Credit Lets say there's the following right example (same example on 2b slide!) The result would be 2-18 From E to J is when she can get the tax advantage • She can then maintain the benefit from J to H (14k to 18k), which is why HJ is parallel to budget line ◦ J Y axis is at 19k, because it's the point where the benefit is at it's max (14040) and the sum of the earnings + benefit (19656) ◦ Same applies for H • After 18k, the benefit slowly diminshes by 21.06% for every dollar she earns, which is why it gradually intersects back to the budget line at C in 2-19c, worker can work less hours with new policy Overall, it increases # of workers, and changes # of hrs worked • Draws people into the labor force Table 2-4 shows benefits of new policy • Labor force participation rate went form 72.9% to 75.3% However to verify this growth, a control group is needed (group without new policy benefits) • no change in this group, shows new policy works 2-13 Labor Supply Over the Life Cycle People can work more today to save/consume more in the future • Most people's wage in their life cycle has a pattern, they start small young, get high to 50s, then decrease again Change along worker wage's profile = evolutionary wage change • doesn't affect lifetime income People's wage can be different from each other tho • Joe makes more, and probably consumes more as well • Difference in 2 wage profiles generate an income effect? • If income effect deomniate, Joes hrs of work is below Jack • If substitution effect dominiates, Joe will work more hrs than jack Evidence Labour participation is high when wages are high Labor Supply over the Business Cycle Eg. what if a recession happens? Added worker effect: because times are tough, more people need to work Discouraged worker effect: impossible to find jobs in a recession, gives up Can find which effect dominates based on correlating labour force participation w/ aggregate unemployment rate (summary measuring economic activity) Should discouraged workers be considered in umemployment? • Cuz technically if they want to be most efficient, they shouldn't find a job in such a tough time