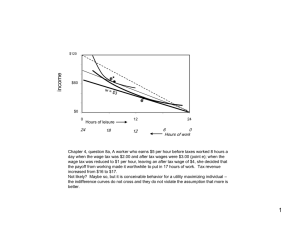

Problem Set #1ll Due 3 March 2021 **This problem appeared on the final exam in June 2018. 1. Suppose the MRS=C/3L. One function that guarantees this is U=LC^3. Please remember that we could also have solutions where individuals work the entire time and none of the time. a. Solve for the optimal labor supply rule. A person might use all his time om leisure or all his time in work: b. Suppose that w=1, V=10, T=10. What is the level of consumption, leisure, and what is the level of utility? c. Now suppose that the government institutes a tax on overtime workers. Every hour over 8 is taxed at 50 percent. How many hours will the individual work? Show this graphically. This one I couldn’t figure out how to calculate. But I believe this would be an incentive for the worker to work less hours. It would give a negative substitution effect. The budget line would get flatter and leisure would become cheaper. The worker would work less hours compared to without 50 percent tax on overtime pay. d. Would your answer change if the tax were ¼ and T=20? **This problem appeared on the final exam in June 2019. 2. Consider the following shocks, discuss the likely impact on hours worked in the current periods and in others to come. Respond for each shock as if it were the only shock in the system. a. A decrease in taxes on hourly wages. A decrease in taxes would increase the wage rate and the slope of the budget constraint would get steeper. The higher wage would generate both an income and a substitution effect. The income effect would reduce the hours of work, hen can work less and still get more consumption and leisure. This would make hen feel richer, and want more consumption and leisure. The substitution effect on the other hand tells us that an increase in the wage rate increases hours of work as leisure becomes more expensive. The income effect and substitution effect works against eachother and one effect might be more dominant for one group of individuals than another. For example Leisure time is expensive for a high wage worker and for a low wage worker leisure time is cheaper. For a non-worker an increase in the wage would not have an effect on hens real income. The amount consumption for a non-worker is independent of whether hens potential wage rate is $15 or $25 an hour. Therefore, an increase in the wage does not generate an income effect. The wage increase makes leisure time more expensive and hence is likely to draw the nonworker into the labor force. To conclude: • • An increase in the wage rate increases hours of work if the substitution effect dominates the income effect. An increase in the wage rate decreases hours of work if the income effect dominates the substitution effect. (A to B) High wage worker will work less hours if the income effect dominates. (C to D) Low wage workers will work more if the substitution effect dominates. b. A $1000 decrease in government benefits. A decrease in a non-labor income would shift the budget constraint down. Making the consumption and leisure level go down. The slope of the budget constraint line is still the same. If leisure is a normal good then the decrease in income will decrease leisure and increase hours of work. The income effect implies that an decrease in non-labor income, holding wage constant, increases hours of work. For people outside the labor force it would be an incentive to get in to the labor force. c. A decrease in overtime premiums (wages decrease to half after 8 hours in a day). A decrease in overtime premium would cause a negative subsitution effect. This will discourage the workers to work overtime and will lead to a fall in hours worked.