Cost-Volume-Profit Analysis: CVP Explained

advertisement

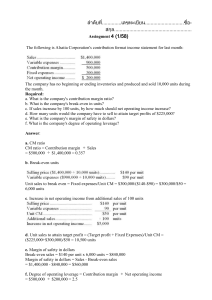

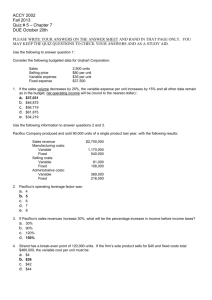

CHAPTER 4 Cost-Volume-Profit Analysis Common Cost Behavior Patterns Variable Costs Fixed Costs Mixed Costs Step Costs Variable Costs Costs that change in proportion to changes in volume or activity At restaurants, food costs vary with the number of customers served For airlines, fuel costs vary with the number of miles flown Example Activity increases by 10% Cost increases by 10% Variable Costs Fixed Costs Do not change in response to changes in activity level Typical fixed costs are depreciation, supervisory salaries, and building maintentance Example Activity increases by 10% Costs remain unchanged Fixed Costs Fixed Costs Discretionary Fixed Costs Management can easily change Advertising, Research and Development Committed Fixed Costs Cannot be easily changed Rent, Insurance Fixed Costs Mixed Costs Contain variable and fixed cost elements Example Salesperson with base salary (fixed) Receives commission on sales (variable) Mixed Costs Step Costs Fixed cost for a specific range Increases to higher level when upper bound of range is exceeded Example Company adds third production shift Costs increase to include supervisory costs Step Costs Direct Labor Cost Estimation Methods Account Analysis Scattergraphs High-Low Method Regression Analysis Account Analysis Most common approach Requires professional judgment of management Management classifies costs as fixed and variable Account Analysis Costs are then estimated Variable cost per unit Total fixed costs Account Analysis Estimates used to find total production costs at various production levels Scattergraphs Utilization of cost information from previous periods Weekly, monthly, or quarterly cost reports Plot the costs at specific activity levels Scattergraphs High-Low Method Utilization of cost information from previous periods Connect straight line from lowest activity level to highest activity level High-Low Method High-Low Method Cost Estimations Variable cost equals the slope of the line Fixed cost equals the intercept of cost axis Estimates used to find total production costs at various production levels Regression Analysis Statistical technique Estimates the slope and intercept of a cost equation Typically spreadsheet programs are utilized Regression Analysis The Relevant Range Limitation of estimates Accuracy expected only for production levels within range Difficult to assess costs outside the relevant range The Relevant Range Cost-Volume-Profit Analysis Equation Abbreviations x = Quantity of units produced and sold SP = Selling price per unit VC = Variable cost per unit TFC = Total fixed cost Cost-Volume-Profit Analysis The Profit Equation Profit = SP(x) – VC(x) – TFC Fundamental to CVP analysis Cost-Volume-Profit Analysis Break-Even Point Number of units sold that allow the company to neither a profit nor a loss $0 = SP(x) – VC(x) – TFC Margin of Safety Difference between expected sales and break-even sales Break-Even Point Cost-Volume-Profit Analysis Contribution Margin (CM) Difference between selling price and variable cost per unit Profit = (SP – VC)(x) – TFC OR Profit = CM per unit(x) - TFC Cost-Volume-Profit Analysis Contribution Margin Ratio Contribution of every sales dollar to covering fixed cost CM Ratio = SP – VC SP Profit Equation (utilizing CM Ratio) Sales($) = Profit + TFC CM Ratio Cost-Volume-Profit Analysis “What If” Analysis Utilize profit equation to determine impact of managerial decisions Change in Fixed and Variable Costs Change in Selling Price Cost-Volume-Profit Analysis Taxes in CVP Analysis Profit Formula without Tax Considerations Before Tax Profit = SP(x) – VC(x) – TFC Profit Formula with Tax Considerations After Tax Profit = [SP(x) – VC(x) – TFC](1-t) Gabby’s Wedding Cakes creates elaborate wedding cakes. Each cake sells for $500. The variable cost of baking the cakes is $200 and the fixed cost per month is $6,000 1. Calculate the break-even point for a month. 2. How many cakes must be sold to earn a monthly profit of $9,000? Break-Even Point x = (Profit + TFC) / CM per Unit x = ($0 + $6,000) / $300 x = 20 cakes What if monthly profit is $9,000? x = ($9,000 + $6,000) / $300 x = 50 cakes Multiproduct Analysis Contribution Margin Approach Used if products are similar Identify number of units needed to be sold to break even Calculate weighted average contribution margin based on expected units sold Multiproduct Analysis Contribution Margin Ratio Approach Products are substantially different Identify dollar amount of sales needed to break even Calculate total CM Ratio and use to determine break-even point Assumptions in CVP Analysis Costs can be accurately separated into fixed and variable components Fixed costs remain fixed Variable costs per unit do not change Operating Leverage Level of fixed versus variable costs in a company High level of fixed costs has a high operating leverage Typically have large fluctuations in profit when sales fluctuate Outsourcing Constraints Constraints on how many items can be produced Shortage of space, equipment, or labor Utilize contribution margin per unit to analyze situations Rhetorix, Inc. produces stereo speakers. The selling price per pair of speakers is $800. The variable cost of production is $300 and the fixed cost per month is $50,000. 1. Calculate the contribution margin associated with a pair of speakers. 2. Calculate the contribution margin ratio for Rhetorix associated with a pair of speakers. Contribution Margin CM = SP – VC CM = $800 - $300 CM = $500 If the company sells five more speakers than planned, what is the expected effect on profit of selling the additional speakers? Expected Effect = $500 * 5 units = $2,500 Contribution Margin Ratio CM Ratio = (SP – VC)/SP = ($800 - $300)/$800 = 62.5% If the company has sales that are $5,000 higher than expected, what is the expected effect on profit? Expected Effect = 62.5% * $5,000 = $3,125 1. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Contribution Margin per unit is? a. $65 b. $75 c. $175 d. $30 1. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Contribution margin per unit is? a. $65 b. $75 c. $175 d. $30 2. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Break-Even Point is? a. 1,000 units b. 1,083 units c. 2,000 units d. None of these 2. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Break-Even Point is? a. 1,000 units b. 1,083 units c. 2,000 units d. None of these 3. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Expected sales are 4,200 units. The Margin of Safety is? a. $264,000 b. $384,000 c. $143,000 d. $121,000 3. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Expected sales are 4,200 units. The Margin of Safety is? a. $264,000 b. $384,000 c. $143,000 d. $121,000 4. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Expected sales are 4,200 units. What is profit expected to be? Answer here: _________________ 4. At Winford Corp., the selling price per unit for lawn mowers is $120, variable cost per unit is $55. Fixed costs are $130,000. Expected sales are 4,200 units. What is profit expected to be? Answer here: $143,000