CHINA & USA _ GROUP 7

advertisement

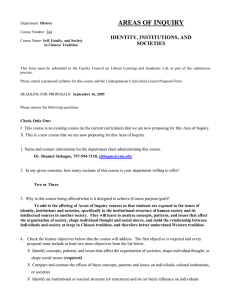

CHINA & USA _GROUP 7_ Hoang Thi Ngoc Huyen M987Z239 Hyacintha FAUSTINO M997Z Krissapon Apinyaupatum M997Z241 Antun Paradzik M997Z223 Nguyen Thi Thu Trang M997Z210 Le Van M997Z246 I. INTRODUCTION II. OVERVIEW : CHINA VS USA III. CHINESE CULTURAL VALUES AND TRADITION IV. THE COMPETITIVE ADVANTAGE OF BOTH NATIONS: CHINA & USA V. THE BIG MAC INDEX VI. THE FLYING GEES PARADIGM VII. CONCLUSION INTRODUCTION In CHINA: As a leaders stick to a topdown strategy that favors state-owned enterprises, fears grow that the nation’s economic miracle is in jeopardy In the steel markets of Taiyuan, above, and elsewhere in Shanxi Province, state firms dominate. In AMERICA: The experts have run through many of their prescriptions for an ailing economy. They worry that some one cures may cause new problems Like inflation or deflation Uncertainty reigns on Wall Street CHINA VS. USA CHINA: Most potent economy in the world All strategic sectors controlled by government Huge amount of money invested in infrastructure Government- run industry, in which very important role have diplomatically lobbying in other countries Key of the China success is find good source of energy ( gas, coal, renewable, or in the future fusion) CHINA VS. USA USA: Big debt: military, tax cuts Inflation Overrated stock market Downward spiral: LESS WORK + LOWER WAGES = LESS SPENDING POWER = LESS INVESTMENT & HIRING Real estate market in problems CHINA VS. USA USA big dependence on Chinese production China leading foreign owner of U.S. treasury securities Possible end of the U.S. neoliberal capitalism CHINESE CULTURAL VALUES & TRADITION • • • • Trust/Mistrust : Family / Cousin’s Business Face: Physiognomy Hierarchy : Respect by order Reciprocity : Give & Get for long relationship • Harmony : Unity is the best. http://www.china-window.com/china_business/china_business_tips/chinese-cultural-values-a.shtml CHINESE CULTURAL VALUES & TRADITION http://www.legacee.com/Culture/CultureOverview.html CHINESE CULTURAL VALUES & TRADITION http://www.legacee.com/Culture/CultureOverview.html CHINA'S COMPETITIVE ADVANTAGE China had opened itself to foreign investment, trade, and the market-oriented ideas that would stimulate domestic productivity and build its global competitiveness Dense interfirm relations, and foreign direct investment (FDI) in full growth China’s always had a major industrial policy. At the local level, governments set up 8,000 state-owned investment companies in 2009 alone to channel government dollars into business and industrial ventures. CHINA'S COMPETITIVE ADVANTAGE Cheap labor force State control of energy supplies Efficient production system Unfair trade practices: • Such as export subsidies • Undervaluation of the currency • Counterfeiting and piracy Lax environmental and health and safety at work AMERICA'S COMPETITIVE ADVANTAGE America has high-skilled workforce in company, industry, and national economy. The USD is seen as a reliable currency American brand have been recognized throughout the world as symbols of quality and value American cultures is exported worldwide Military advantage Weakened by the crisis, the Capitalism is questioned THE BIG MAC INDEX An informal way of measuring the PPP ( Purchasing Power Parity )between currencies Invented by the news paper « The Economist » A semi humorous , but still reliable illustration Big Mac is produced in 120 countries The Big Mac index is built around the notion that each $ should buy the same amount in all countries THE FLYING GEESES PATTERN1/2 A model of industrialization division of labor in east asia The flying geese model intends to explain the process of industrialization of late comer economies from the following three aspects: I Agricultural economy, raw material, few importations domestic demand for manufactured products can not be met by imports from developed countries. Developing countries develops little trade with its neighbouring countries which have similar economic structures. THE FLYING GEESES PATTERN1/2 II Manufacturing phase of consumer goods, domestic production tends gradually to replace imports, whichisgrowing (capital goods), because they are needed for local industry consumption. III Local producers address the markets of neighboring countries Imports of raw materials from less developed countries are increasing. There is therefore an expansion of trade among developing countries. The country concerned undertakes the production of capital goods that will, in turn, exported in a fourth time. CONCLUSION China’s Government empowers and pumped up money to private company to reienceforce their economy, upgrade to be industrial base and increase employment rate. FED (US Central Bank) inject the money to attack the deflation problem, and relieved the US’s Bank of troubled investment to have more room to make the new loan.