Chapter 13 – Risk from the Company Perspective prospective

advertisement

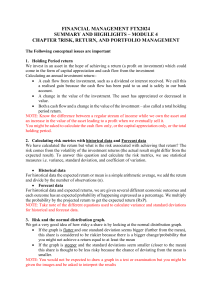

Chapter 13 – Risk from the Company Perspective Reasons for looking at risk from the company prospective The company perspective is often the focus of senior management Customers who depend on company survival to support the product will consider company perspective Other stakeholders such as employees, suppliers, lenders, and communities, will consider total company risk Security analysts typically follow one or a few industries and are responsible for making successful picks Correlation and Company Risk Correlation between project and firm Capital budgeting does not start with a clean slate The firm is a portfolio of projects The risk question for capital budgeting is the impact of a new project on the overall risk of the firm’s when combined with the existing portfolio of projects. Mean-variance Portfolio Measures Holding period return = Ending value – Beginning value + cash flow Beginning value Covariance (A,B) m = pi[RA,i - E(RA)][RB,i - E(RB)] i=1 Correlation (rA,B) = A,B/(AB) Beta (A,B) = A,B/B2 Interpretation of Risk Measures Covariance is mathematically important for portfolio construction, but does not have a simple interpretation Correlation measures the proportion of variance in returns explained by covariance. +1 or -1: if we know the return on asset B, we can predict the return on A with perfect accuracy. 0: knowing the return on asset B is of no help in predicting return on asset A Interpretation of Risk Measures: Beta A beta of 2 says that if return on B rises 10%, we expect return on A to rise 20%. A negative beta says returns move in opposite directions. Correlation measures the strength of that relationship. A beta of 2 and correlation of .01 says that while we expect A to rise 20% on average if B rises 10%, the relationship is so weak as to be of little use in practical predictions. Two-asset Portfolio Expected return (E(Rp)) = E(Rp) = WAE(RA) + WBE(RB) Standard deviation p = WA2A2 + WB2 B2 + 2 WAWBA,B Contribution to Company Performance A new capital investment will improve the company’s reward to risk ratio if [E(RA) – Rf]/ A,C > [E(RC) – Rf] Where E(RA) = Expected return on the asset Rf = risk-free rate A,C = beta of the asset in relation to the company’s existing portfolio of investments E(Rc) = Expected return on the company’s existing portfolio of assets Problems in Applying Mean-variance Model to Capital Budgeting Indivisibility of assets Holding period choice problem Defining borrowing-lending rates Data needs Other Selection Techinques Skewness-based models Growth-optimal (geometric mean) model State-preference models Sensitivity-related Company Portfolio Risk Analysis Develop financial planning model Model the company under various economic environments With the proposed project Without the proposed project Use measures such as Cash flow Return on equity