Excess Returns and Beta: Deriving the Security Market Line

advertisement

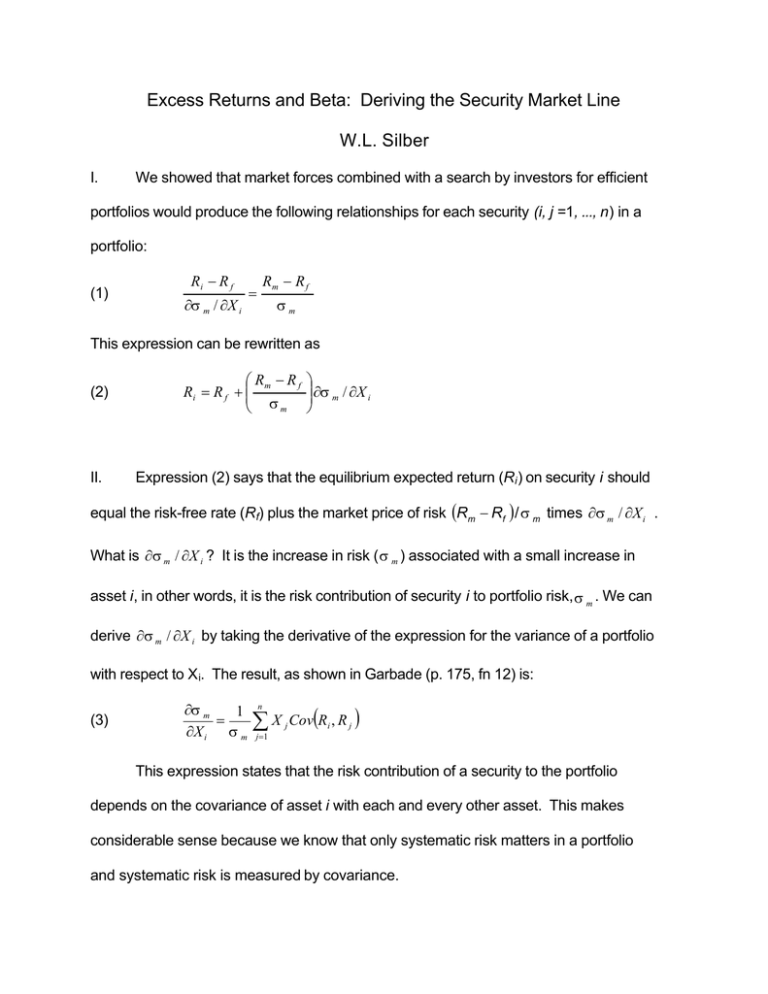

Excess Returns and Beta: Deriving the Security Market Line W.L. Silber I. We showed that market forces combined with a search by investors for efficient portfolios would produce the following relationships for each security (i, j =1, ..., n) in a portfolio: (1) Ri − R f ∂σ m / ∂X i Rm − R f = σm This expression can be rewritten as (2) II. Rm − R f Ri = R f + σm ∂σ m / ∂X i Expression (2) says that the equilibrium expected return (Ri ) on security i should equal the risk-free rate (Rf) plus the market price of risk (Rm − Rf ) / σ m times ∂σ m / ∂X i . What is ∂σ m / ∂X i ? It is the increase in risk ( σ m ) associated with a small increase in asset i, in other words, it is the risk contribution of security i to portfolio risk, σ m . We can derive ∂σ m / ∂X i by taking the derivative of the expression for the variance of a portfolio with respect to X i. The result, as shown in Garbade (p. 175, fn 12) is: (3) ∂σ m 1 = ∂X i σ m n ∑X j =1 j Cov(Ri , R j ) This expression states that the risk contribution of a security to the portfolio depends on the covariance of asset i with each and every other asset. This makes considerable sense because we know that only systematic risk matters in a portfolio and systematic risk is measured by covariance. 2 III. The problem with expression (3) above is that it is not operational; there are too many covariances needed to measure the risk of security i. We can simplify the measurement problem by recalling the regression equation (security characteristic line) relating the return on an individual security, Ri, to the return on an index, Rm, consisting of all other securities in the market. In particular, we have: Ri = α i + β i R m + ei (4) Note that Rm is defined as the weighted average return on all securities in the market: n (5) Rm = ∑ X j R j . j =1 From statistics we know that the definition of the regression coefficient in expression (4) is given by: (6) βi = Cov (Ri , R m ) σ m2 This means that we can take the expression for Rm in (5) and substitute it into expression (6) to get the following: (7) n Cov R i , ∑ X j R j i =1 βi = σ m2 Expression (7) can be simplified as follows: ∑ X Cov (R n j (8) βi = (9) βi = j =1 i, Rj ) σ m2 1 σm 1 n ⋅ ⋅ ∑ X j Cov (R i , R j ) σ m j =1 3 Notice that the expression inside the brackets in (9) is identical to the expression for ∂σ m / ∂X i in (3). Thus, we can use expression (3) to rewrite (9), as follows: βi = (10) IV. 1 ⋅ ∂σ m / ∂X i σm Finally, we can produce the result we want. We can use expression (10) to simplify expression (2), which is where we started, and make it operational. From (10) we have ∂σ m / ∂X i = β i σ m (11) We can then substitute (11) into (2), which produces R − Rf Ri = Rf + m σm (12) ⋅ β i σ m Which gives us the security market line Ri = Rf + (Rm − Rf )β i (13) V. The security market line says that, in equilibrium, the return on security i is equal to the risk-free rate (Rf) plus the excess return on the market portfolio times the beta of security i.