Societe Bonlieu Vincent G. Tenchavez m987z251 Julia Vassiljeva

advertisement

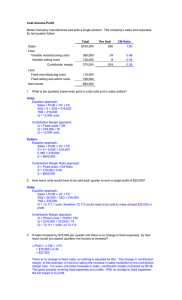

Societe Bonlieu Vincent G. Tenchavez m987z251 Julia Vassiljeva m987z202 Outline • • • • Background Carpentry Shop The Products Accounting System – Job Order System • Income Statement • Calculation of Costs • Consultant’s Advice – New Accounting System Outline • • • • • • Accounting System – New vs. Old New System Pros and Cons Change Prices? 12 More Staircases Our Advice Financial Situation Background • This case is set in a carpentry shop in Grenoble, France in 1956. • It was during the midst of the post WWII construction boom. • The owner of the business was Mr. Bonlieu and he specialized in producing and selling desks and staircases. The Carpentry Shop • The plant consisted of a lumber warehouse, a kiln (drying oven) a drafting room, a machine shop, and an assembly shop. The Products – Desks • Mr. Bonlieu felt he was in danger of losing sales of desks. • Desks made up half of the business. • The prices of the desks were too high. • But the margin on these desks was really low. The Products - Staircases • Mr. Bonlieu was accused of selling staircases below cost. • Yet the margin on staircases was apparently good. The Accounting System • These anomalies in the high price of desks and low price of staircases, when compared to margin, led Mr. Bonlieu to have concerns regarding his accounting system. • The accounting system then in use was a simple “job order” system. Job Order System Costs Charge to Direct Labor actual labor costs incurred on each job in the drafting, machine and assembly shops Supplies (screws, varnish, etc.) each job on the basis of actual consumption. Overhead expenses percentage allocation of the labor cost charged to the job Selling expenses each job in proportion to sales value Income Statement • In the quarter ended September 1956: Direct Labor 1,266,000 Other Wages & Salaries 1,734,000 Total Wages & Salaries 3,000,000 Other Expenses Total Costs 1,932,000 4,932,000 Income Statement • In the quarter ended September 1956: Total Cost 4,932,000 Selling Price 5,472,000 Profit 540,000 Profit Margin 9.8% Calculation of Costs • The overhead costs were significantly high in relation to labor costs, • Labor was carefully recorded and assigned, but overhead expenses which were very large, were allocated with very basic and simple rules. • This caused distortions in the charging of costs to various jobs. • It also made a lot of discrepancies in the prices. Consultant’s Advice • Set up eight cost centers: – Five Production Centers • Warehouse • Drying Oven • Drafting Shop • Machine Shop • Assembly Shop Consultant’s Advice – Two Overhead Centers • Administration • Indirect Labor – One Selling Expense Center Consultant’s Advice • Where possible, costs would be assigned directly to the center in which they were incurred. Consultant’s Advice • Allocation of cost are as follows: Costs Allocation to Cost Center Coal Power 100% to the oven 100% to the machine shop Car Expenses Building Expenses 100% to selling (based on floor space used) 20% to the warehouse 30% to the drying oven 10% to drafting 15% to machining 25% to assembly Consultant’s Advice Costs Allocation to Cost Center Office Expense Allocated on the basis of wage and salary costs Depends on which center equipment was used ffr300,000 ffr430,000 Depends on which center purchased the item ffr8,600,000 ffr4,800,000 ffr600,000 Depreciation of Equipment Oven Machine Interest Expense Machine Oven Delivery Truck Consultant’s Advice Costs Allocation to Cost Center Administrative Expense 25% to Selling Expense 75% to production departments based on direct labor Indirect Labor 5 production departments based on direct labor Reclassified as direct labor Warehouseman / Oven Attendant Consultant’s Advice • Costs were also assigned in the remaining 6 cost centers based on the activity measures: Cost Center Activity Measures Warehouse m3 of lumber used Oven Drafting Machinery Assembly m3 of lumber dried Direct labor hours Direct labor hours Direct labor hours Selling Sales value Accounting system NEW vs OLD Old system: DESKS price - too high margin - too low STAIRCASES price - too low margin - too high New system: DESKS margin - high enough STAIRCASES margin - negative Accounting system NEW vs OLD NEW ACCOUNTING SYSTEM Order 28 staircases Order 32 – desks Warehouse 137,7 43,0 Oven Drafting 414,9 37,2 129,6 208,3 Machinery 285,6 1 038,5 Assembly 108,4 252,9 Supplies 48,0 30,0 Selling exp. 114,0 251,2 Total costs 1 145, 7 Selling Profit (1000 ffs) Profit margin OLD ACCOUNTING SYSTEM Order 28 staircases Order 32 – desks Drafting 18,0 100,8 Machining 101,8 370,0 Assembly 48,0 112,0 Overhead 423,1 1 469,4 Supplies 48,0 30,0 1 953,6 Selling exp. Total cost 61,9 700,7 136,3 2 218,6 1 026,0 2 261,0 Selling price 1 026,0 2 261,0 -119,7 307,4 325,3 42,4 -11,67% 13,60% 31,7% 1,9% (1000 ffs) Profit Profit margin New system pros and cons • Pros – Reveals the products that actually bring loss – Allocates costs quite equally and fairly • Cons – Is not that simple in use as the “job order” system Mr. Bonlieu should adopt the new accounting system as it seems to allocate the costs more fairly than the old system. Moreover, it brings product costs closer to the market level (Mr. Bonlieu was accused of selling staircases below the cost). Change prices? • Mr. Bonlieu should increase price for the staircases, as profit margin is too low (negative) and competitors sell it at a much higher price. • Mr. Bonlieu should keep desks’ prices the same, as there is market demand for such price. However, he is afraid of losing sales because of a too high price. In this case he could either provide some discounts for loyal customers/big size orders or lower the price a bit if he is sure it will increase the demand. What if... • ... Mr. Bonlieu had the opportunity to sell 12 more staircases at the same unit price. Should he accept or not? YES! He should • Assuming that fixed costs for 16 staircases are the same as for 4, and the capacity can be accommodated, the profit margin will significantly increase. 12 more staircases... Thousand ff Fixed costs Order 28 (new) – 16 staircases 408 Variable costs 2 951 Total costs 3 359 Selling 4 104 Profit 745 Profit margin 18,15% Fixed costs: Building expenses Depreciation Interest Advice • Mr. Bonlieu is a sub-contractor for furniture dealers and manufacturers. He could put some expenses onto the customers (such as delivery) • Also, instead of buying new equipment, he could consider renting it, as interest on equipment loans and depreciation are quite high (19% of total costs). This will help keep some liquid assets (bank deposit, stocks, etc) that would earn some interest and could be easily converted into cash if needed. • He should search for the opportunities to use the total capacity of the equipment in order to increase profitability of his products. Financial situation • The data presented in the case study is not sufficient to talk about Mr.Bonlieu’s financial situation • However, we can assume, that it is good enough as: 1) Mr. Bonlieu was able to take a bank loan, which shows his credibility 2) Total profit margin is 9.8% for this quarter.