Strengthening seed systems to meet the challenges of food security

advertisement

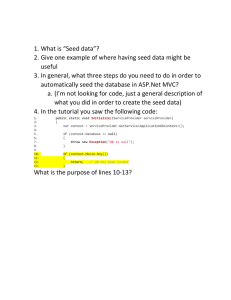

Strengthening seed systems to meet the challenges of food security M. Larinde, P. Le Coënt, R.G. Guei & T. Osborn Austria Room, 9 July 2009 Presentation outline World Food security and hunger Overview of global seed industry issues FAO’ s Contribution to strengthening seed systems in developing countries: Seed policy, strategy and programmes formulation or review Strengthening local seed production and supply systems Food security challenges Nine billion people to feed in 2050 in the face of limited resources and climate change. FAO’s food price index in March 2009 was still 23 % higher than 2005 Food security challenges There is a need to improve agricultural productivity and food security in poor rural communities. Functional and efficient seed delivery systems is critical to sustainable production intensification and productivity increase Overview of global seed industry issues Estimated size of global seed markets Billion US$ ASIA 10 NAFTA 9,5 EU -27 9 CENTRAL & SOUTH AMERICA 3,5 AFRICA 1,1 REST OF THE WORLD 3,4 TOTAL 36,5 DISTRIBUTION OF SEED MARKET IN AFRICA Market share in Million US$ (source ISF) UGANDA, 10 MALAWI, 10 TANZANIA, 15 ZAMBIA, 20 LIBYA, 25 REST OF AFRICA, 115 SOUTH AFRICA, 300 ZIMBABWE , 30 TUNISIA, 45 KENYA, 60 MOROCCO, 140 ALGERIA, 70 NIGERIA, 120 EGYPT, 140 Seed systems development: Key issues Policy and legislation ( norms, taxes, subsidy, laws, IPR, international and regional cooperation) Science (genetics, technology, physiology, entomology, pathology, agronomy, biodiversity....) Economy (management, marketing, investment, finance, credit) Culture and social (livelihoods, traditions, indigenous knowledge) Formal Versus Informal sectors Business competitiveness and return to investment Higher value crops with higher profit margin (hybrid maize, hybrid millet and sorghum, vegetables) Vs lower value crops - Self pollinated (rice, millet, sorghum, cowpeas), open pollinated and vegetative propagated crops (cassava, Plantain, yam ..) Most companies deal with hybrid Maize South Africa About 47 Distinct Seed Companies. Zimbabwe Tanzania Uganda 70% have maize seed. Zambia 15 large seed companies in ESA, most of which are in Southern Africa. Kenya Swaziland Malawi Mozambique Angola Ethiopia Botswana Lesotho 0 2 4 6 8 10 12 14 Number of Maize Seed Companies Cimmyt, 2006 16 Cost of seed production and distribution and the need for heavy investment in: People Land Equipment Infrastructure (drying, storage, treatment, bags) Transport Services (registration, certification, IPR) FAO’ s contribution to strengthening seed systems in developing countries Assist countries and regions on request to formulate conducive, flexible, coherent, comprehensive, and integrated seed sector development policies, strategies and programmes in line with the IT and the GPA; Trends in countries requests There is an increasing request for seed policy and legislation reform by countries and regions From 2005-2009, 62 % of AGP projects including emergencies have seed components or seed officers as LTO ISFP projects with strong seed components (AGPS-LTU) 79 TCPs ( $29,998,000) 23 OSRO/GCP/UTP ( $52,359,414) EC food Facility: Afghanistan, Burkina Faso,CAR, DRC, Guinea Bissau, Liberia, Mozambique, Nepal, Pakistan, Zimbabwe TOTAL : about $130,000,000 + about 10 projects in finalization Trends in countries requests Countries want to improve the use of quality seed and improved varieties Productivity increase Mitigate negative impact of the food crisis Climate change adaptation. Need to invest in local seed production Local varieties more adapted and strategically important for the national food security. FAO’s work: Seed policy and legislation reform Main Constraints Non conducive Government policies and regulatory frameworks Import-export controls, tax, financial services National segmentation IPR (PVP) Overregulation in some countries not adapted to farming structure Low level of agricultural development (rainfed agric) Limited or no access to market Main Constraints Poor infrastructure Cost of transport, utilities Small Market Size Low effective demand Small, dispersed clients Inefficient diffusion of technical knowledge to end users Statistics on farming profiles and seed markets not reliable Market disturbance due to seed donations Seed Policy Development Process Identification of national priorities and problems through, assessment, stakeholders consultation/ field visits Joint work with national counterparts for elaboration of policy or legal texts Endorsement of policy or legal text by national policy makers Elements of a Seed Policy Establishment of institutional arrangements (NSC, Seed Fund, Seed observatory) Definition of roles of the various actors to avoid unfair competition and maximize efficiency Definition of measures, rules and regulations for tax incentives, seed IPR, other measures to improve seed trade Elements of a Seed Policy Setting of national interests Compulsory certification vs. true-tolabel approach Acceptance of landraces in national lists of varieties Elements of a Seed Policy Definition of measures or standards Production-conditioning-storage-distributionmarketing Import and Export, Standards for certification Requirements for variety release Support to credit Achievements National level: Seed policy reform in: Afghanistan, Iran, Sierra Leone, The Gambia, Congo DRC, Cote D’ Ivoire, Burkina, Cameroon.. Lead to seed industry development in Afghanistan and Iran improvement in seed quality control in Burkina and Cameroon national seed association and stronger seed institutions in Cote D’ Ivoire Achievements Regional level Seed policy and programmes: West and central Africa (1998); Near East & North Africa (1999); Asia and the pacific (1999); Latin America and the Caribbean (2000); Central and Eastern Europe (2001) Achievements Regional seed programme for Central Africa (CEMAC) – adopted in 2009 Africa wide: African seed and biotechnology programme (ASBP) for the African Union- adopted in 2007 Achievements Harmonizing seed rules and regulations Harmonization of seed rules and regulations in Africa West Africa (ECOWAS/UEMOA/CILSS) (Adopted in 2008); Southern Africa (SADC); Eastern Africa (ASARECA/EAC) Central Africa (CEMAC) COMESA ( being initiated) Harmonization in Central Asia ( Economic Community Organization (ECO) Key areas of harmonization Variety release regulation Plant breeder’s rights Quarantine pest lists- an phytosanitary measures Seed trade regulations Seed certification and standards Harmonizing in Africa COMESA (19) ECOWAS 15 countries CEMAC (6) EAC/ASARECA (6 ) SADC (14) 30 Strengthening local seed production and supply systems Presentation overview – Current state of seed systems – FAO strategy to strengthen local seed production and supply systems. – Examples of FAO projects to support local seed production and supply State of seed systems In countries with market oriented agriculture • Seed sector is dominated by the formal seed system. • Huge development of the private seed sector since 1950 (variety development, seed production and distribution) • Consequence: farmers are using high quality seed of improved varieties and agricultural productivity is high. State of seed systems In countries dominated by subsistence agriculture • Farmers’ seed systems largely dominate. • Predominance of landraces and old varieties (in Africa less than 20% of the land is planted with improved varieties) and a variable seed quality. • In these countries, formal seed systems are weak : • Limited private sector involvement • Public sector involved in early generation seed multiplication, sometimes certified seed multiplication with poor results • Inefficient seed quality control systems and extension services. State of seed systems In countries dominated by subsistence agriculture This situation is mainly due to: • Limited investments in seed sector development • Limited market for seed because : • Most staple crops are self pollinated, vegetatively propagated or dominated by open pollinated varieties • Weak connection of farmers with output markets which limits their revenues and capacity to invest in inputs • Lack of access to credit • Limited access to information • Limited farmers’ use of improved varieties and low agricultural productivity. Shifting paradigm of seed sector development Constant objective: improve farmers’ access to quality seed of adapted varieties. • FAO Seed Industry Development Programme umbrella: strong investment in public sector seed production. • System failed because too costly. Transfer to the private sector, but in many countries the private sector never developed. • Current strategy is to facilitate the development of local private sector seed enterprises Elements to be considered to develop a national seed production and supply system Farmers’ seed system Formal seed system Variety development and variety release Seed multiplication Seed policy and regulation Seed processing and transportation Seed distribution Seed Market Output market Elements to be considered to develop a national seed production and supply system • Strategy must be adapted to the type of crop and to the agricultural system in place. • Low volume – high value crops (Hybrid Maize, vegetables...). High profitability of seed activities Seed production for this type of crop can be easily managed by the private sector • High volume - low value crops (wheat, rice, groundnut, cassava...). Low profitability of those activities. – Importance of public sector involvement in plant breeding, early generation seed multiplication and quality control – Limit overhead costs and develop community based seed entities. – Improve connections between seed producers, farmers and the food industry to increase investment capacity of farmers. Examples of seed production and supply projects Ethiopia • Objective : Strengthening the “Farmer Based Seed Production and Marketing Scheme” in the Oromiya region. • Principle: formal public system is not able to meet seed demand. Improve farmer’s seed systems to ensure local seed production. • Main crop : wheat Examples of seed production and supply projects : Ethiopia Principles: • Providing basic seed of improved varieties and inputs to farmers groups on a credit basis • Seed production by farmers groups • Seed collected by cooperatives, processed and sold to farmers on a credit basis. • Quality control and technical support from local extension service Project activities: • Linkages with research and make variety demonstrations • Training of farmers on seed production technologies • Provide equipment to farmers’ cooperatives • Training and equipment to local extension services to improve technical support to seed production activities and seed quality control Examples of seed production and supply projects : Ethiopia Strengths • Farmers involvement, knowledge and work in a high potential region • Strong grain cooperatives need seed activities to improve overall profitability • Active extension services at the community level • Demand for quality seed and improved varieties • Market for wheat. Weaknesses • Limited quantities of basic seed available • Limited profits from seed production = limited interest of cooperatives. • Weak seed quality assurance system • Weak seed policy Examples of seed production and supply projects : Afghanistan Since 2003, FAO seed programme focuses on the development of the national seed sector. Activities : • • • • • Seed policy and seed legislation Variety testing and variety maintenance Early generation seed multiplication Quality assurance systems Support to private seed enterprises Examples of seed production and supply projects : Afghanistan • Principle: Private entrepreneurs buy raw seed from contracting seed growers and then process and sell seed • A critical problem for seed enterprises is the cash need to purchase seed from seed growers at harvest time Grain sales Growing season n +1 Growing season n November Basic seed June Inputs Seed Sales Seed processing November June Examples of seed production and supply projects : Afghanistan To tackle this problem, an innovative approach is being undertaken in Afghanistan: • Principle: make loan funds available to eligible enterprises for buying raw seed from growers • enterprises payback all loans received for procuring raw seed; and • repaid loans deposited in a special fund of the Afghanistan National Seed Association (ANSA). Examples of seed production and supply projects : Sierra Leone Seed project in Sierra Leone: an input / output approach • Weak seed demand is a major reason for the lack of sustainability of seed production projects. • Farmers are able to buy seed if they can market their crops at a better price • Principle: vertical integration of seed production activities and activities to improve value addition of crop outputs • In the Sierra Leone project: create rice milling facilities in the seed enterprise. What the examples illustrate? • Ethiopia: Strengthening farmer’s seed system can be an efficient way to establish a sustainable seed production system for self pollinated crops if appropriate support services are available. • Afghanistan: Access to credit is a critical issue for the development of seed enterprises. • Sierra Leone: Integrated input/ouput approach is a way to increase seed demand and strengthen seed production activities. General conclusion • Formulation and implementation of national and regional seed policies and regulations are key to the development of seed systems in developing countries • Both the public and the private seed sectors need to be supported • Investing in small scale seed enterprises, including farmer organizations with an input/ouput market approach • Development strategies must be adapted to the type of crops, market opportunities, ie specific country conditions • Importance of linking farmer’s seed systems with formal seed systems • Strengthening seed systems is part of sustainable production intensification. Develop irrigation facilities Technology transfer and good extension approaches Upgraded farmer’s Development of the input supply sector technical knowledge Increased input access and use (seed, fertilizer,water) Better infrastructure FARMERS Vibrant input supply sector Support to the seed Improved food production Investment capacity production sector Better income Improve credit access Improve storage capacity and access to markets More structured food marketing sector Improved food availability Lower food prices Strengthening local seed production and seed supply systems Contract Grower Contract Grower Seed Enterprise Seed Buying Farmer Grain Market (Transport, processing, etc.) ($ 230) $103 (61%) Cost Price ($168) 13% 18% 31% $103 (38%) Raw Seed Price ($271) Cost Price ($374) ($420)