Further Alterations to the London Plan

advertisement

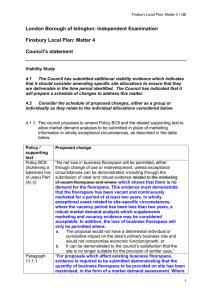

Further Alterations to the London Plan 2014 Consultation draft Purpose of the Further Alterations to the London Plan (FALP) • Develop concept of the Plan as the ‘London expression of the National Planning Policy Framework’; • Provide robust, interim planning framework to address the key housing and employment issues arising from a substantial increase in population and to support recession recovery, until the long term implications of these are clear • Minor changes in terms of fact; changes in national policy; support for the Mayor’s Housing and other strategies and where relevant address other advice to the Mayor eg from the Outer London Commission. London’s demographic challenge • London population 2001 (revised):7.34 mil • London population 2011 (Census):8.17 mil = 83,000 pa increase BUT London Plan 2011 – 2031 assumes 51,000pa AND new GLA trend projection 2011 – 2036 suggests 76,000 pa, and over 100k in earlier years…. London’s demographic challenge Population growth 1971 - 2036 London’s demographic challenge Age structure change 2011 - 2036 London’s demographic challenge Distribution of population growth 2011 - 2036 London’s employment growth Distribution of employment growth The office policy review process • Trends and emerging market issues NB recession: structural cf cyclical changes • Quantum of growth • Nature of growth • Distribution of growth • Key issue: CAZ and competing land uses • Key issue: Outer London - managing consolidation and PD rights • Other policy issues eg ‘mega-schemes • Market testing • Plan, monitor and manage Market data: supply and demand Office starts, Central London, 1984-2011 Market data: supply and demand Availability and take-up, Central London, 1990-2011 Market data: supply and demand Central London office rents, 1980–2011 (2011 prices) Market data: benchmark 1 Ratio: permissions to average previous three years starts Market data: benchmark 2 City availability ratio versus headline rent, 1986-2011 Employment and floorspace forecasts Office employment forecasts by borough, 2011-2031 Borough London 2011 2031 2011 - 31 2011-31 % change 1,741,382 2,174,478 433,096 25% City 296,577 358,946 62,369 21% Westminster 317,967 370,319 52,352 17% Camden 134,257 179,887 45,630 34% Tower Hamlets 127,374 162,424 35,051 28% Southwark 106,474 136,943 30,469 29% Islington 98,751 127,243 28,491 29% Hackney 30,620 39,959 9,339 31% Employment and floorspace forecasts London needs an additional five million sq m by 2031 Borough London 2011-31 floorspace (Sq m NIA) 2011-31 floorspace (Sq m GIA) 5,098,405 6,454,862 City 734,203 929,541 Westminster 616,291 780,258 Camden 537,161 680,075 Tower Hamlets 412,616 522,394 Southwark 358,685 454,116 Islington 335,401 424,637 Hackney 109,941 139,191 Prospects for non-CAZ office centres London office stock change, 2000-12 Concentration of growth in Tower Hamlets and the City is clear. Fringe boroughs of Camden, Southwark and Islington increased by c 200,000 sq m. Relatively low growth in Westminster. Outer London’s demise is clear. Croydon and Harrow each experienced a loss of over 100,000 sq m. Prospects for non-CAZ office centres Office floorspace completions in Outer London, 2000-08 In 2008, no new office buildings were built in nine of 20 Outer London boroughs. In any of the five years leading up to 2008, between 10 and 13 Outer London boroughs delivered no new office construction. The picture was particularly acute in the East London boroughs. Workstyles and occupation densities Occupancy densities, BCO research 2013 Sector Corporate Professional Public TMT Financial 2.5 million sq m; 381 properties; 1,331 floors Mean: 10.9 sq m Density sq m NIA 13.1 12.3 12.1 10.5 9.7 London’s mega schemes: first generation London’s mega schemes: second generation Office to residential London floorspace losses 2009-2012 Stage Number of sites B1 floorspace losses (sq m) Residential units Completed 767 -505,800 11,400 Started 379 -515,100 13,200 Not started 1,019 -654,700 14,400 Total 2,165 -1,675,600 39,000 Office to residential Loss of B1 to residential - % of total London losses Borough Westminster Tower Hamlets Croydon City Lambeth Kensington & Chelsea Camden Islington Southwark Hammersmith & Fulham London (sq m) % of B1 floorspace losses Completed Started Not started 31 19 7 5 8 8 2 2 4 8 2 11 5 5 3 4 2 3 3 1 -505,800 -515,100 16 12 4 9 3 2 4 6 7 6 -654,700 Total (sq m) -361,500 -138,200 -104,600 -82,700 -77,700 -77,200 -76,600 -73,000 -69,500 -62,500 -1,675,600 Hybrid office/industrial activity Audio-visual equipment installation Cash and carry Design and manufacture of applied arts E-trading Event catering Freight forwarding Graphic design Maintenance contractor Manufacturer of sweets Oriental food supplier Recording equipment repair Short-run digital printing Specialist provider of gift wrapping Wine importer Production Assembly Craftwork Customisation Design Engineering Food preparation Graphic design Maintenance Packing Printing Repair Storage & consolidation Support Management and administration Goods dispatch/receipt Customer support (call centre) Customer consultation Demonstration Retail & wholesale sales Sales & marketing Technology Training Software development Showroom Entertainment and hospitality Conclusions from LOPR 12 Occupiers • Structural slowdown in office economy = lower demand growth. • Changes to business process + workstyles = spaceless growth. • Public sector rationalisation. Business geography • Looser business geography, with shifting and emerging clusters. • Further concentration of business activity in mega schemes. • Less demand in Outer London? Less demand in West London? Workplace • Working practices: flexible working styles; utilisation. • Diversity of stock (quality, size, location) for a diverse occupier base. • Loose fit buildings: economic, lower spec, flexible space. Conclusions from LOPR 12 Property market • Implications of the mega scheme pipeline: plenty of capacity. • Outer London: further decline? 1960s/1970s stock a lost cause? • More refurb and less new build? Spatial planning policy • Capacity is not the issue: issue is more sensitive spatial policy. • TMT: you can’t plan creativity! • Mixed use space and how to integrate office space. The known unknowns • Employment forecasts and economic change? • Hub airport strategy: potentially huge impact on west London offices? • The impact of resi values on marginalising commercial activity? Retail policy review process • Trends and emerging market issues NB ‘austerity’, population, multi channel • Quantum and nature of growth: independent assessment • Distribution of growth • Key issue: town centres first – London approach • Key issue: retail and resi - integrated action • Other policy issues eg out of centre, PD rights • Market testing • Plan, monitor and manage The drivers of change: assessing the balance between retail supply and shopping demand SUPPLY DEMAND Improved Retail space efficiency Loss to Internet Major Retail development nodes Economic growth Pipeline of Retail developments Population growth Existing Retail supply Existing demand population and spend “Special forms of trading” assumptions – projected share of non-store retail sales Demand - residential spend by centre 2011 Demand - tourist spend by centre 2011 Demand - commuter spend by centre 2011 Supply - current floorspace provision Supply - current vacancy Supply - current pipeline ….and also in the wider city region (nb ‘Duty to Cooperate’) Experian scenarios = ‘what if?’ …. and, for example, adding in 4 (or 8) major development nodes Brent Cross+ 40% Stratford +40% Westfield +25% Romford +25% Uxbridge +40% Kingston+ 25% Croydon+ 25% Bromley +25% Growth scenarios Scenario 2011 £18.6 bll. 2036 £bll: Gross floorspace requirement 2011 – 2036 mll sq m Net floorspace requirement 2011 – 2036 mll sq m Baseline £39.2 2.2 0.94 Pipeline £39.5 1.6 0.37 4 Nodes £39.6 1.6 0.40 8 Nodes £39.8 1.7 0.48 Quality adjustments £39.7 1.7 0.48 …gives, at LB level, for the ‘Pipeline’, a net balance of… …or for the ‘8 Nodes’ scenario, a net balance of ….. … or for the ‘Quality Adjustment’ scenario, a net balance of… …. also available at centre level eg if all pipeline constructed and 4 nodes …. Brent Cross, Westfield, Westfield Stratford & Croydon Base spend 2036 top shopping centres Croydon gains It impacts Kingston, Bromley, Sutton and Bexleyheath Westfield Stratford It impacts Stratford and Ilford The 2011 Plan town centre network: is a network based approach still the best to achieve the Mayor’s objectives? “How should the town centre network respond to changing levels and patterns of consumer expenditure” • Do these scenarios reflect what might actually happen? Alternatives? • Retain existing ‘town centre first’ policy • How far can we go with existing policies/SPG in addressing these challenges? • Are the challenges so great that we need to change existing policy through FALP? • If so, how and over what timescale? How can the housing potential of town centres be realised? Existing policy… • Accommodating residential development in town centres • Housing from surplus offices (redevelopment / conversions) • Implementation of mixed use and housing • Housing density …and average household size increasing from 2.3 to 2.5…. • 2011 London Plan assumed household size would decline from 2.34 to 2.19 persons to 2031 • approximated to 34,000 extra (and generally small) households pa •BUT • 2011 Census shows 2.47 average across London with a lot of local variation • GLA projection suggests c40,000 pa more households 2011 – 2026 …and housing requirement could be 49 62k pa •General housing implications: higher overall requirement with more small households in some places, more big (over crowded?) ones elsewhere? ….what role can town centres have in addressing this need? • Great uncertainty over long term future pop and hhld growth • Must plan responsibly/sustainably: considerable capacity already therefore not GB development/new town • Emerging SHLAA suggests conventional approach may find capacity for +32k pa • BUT how to fill the gap between this and need: key roles for town centres and Opportunity/ Intensification Areas …..possible policy approaches and mechanisms for town centre intensification • Link with response to reconfiguration of town centre economic/social roles • Retail and office floorspace contraction; social, service and civic expansion? • Varies by centre type - and local circs • …. and with PTAL • Flexibility to go to the top of the density range (and above in some circs?) • How to reconcile with local character objectives • How to enhance quality of the centres themselves – for C21st • What partnership/funding arrangements required? The policy response…. Consultation draft Further Alterations to the London Plan The office policy response: Further Alterations to the London Plan • “where justified by local and strategic office demand and supply assessments and in areas identified in the LDF as having a particular need for local office provision, provide protection for small scale offices (under 500sqm) within the CAZ.” • “where justified by local and strategic office demand assessments and in areas identified in LDF as having a particular need for local office provision, require residential proposals within the CAZ which would otherwise result in the loss of office space to make a proportionate contribution to provision of new office space within, or nearby, the development.” The retail/ town centres policy response: Further Alterations to the London Plan • Update retail need figures taking account of changes in consumer expenditure behaviour • Net comparison need 0.4 – 1.6 mll sq m cf 1.3 – 2.2 mll sq in 2011 Plan • Strong cross ref to Policy 2.15 on different approaches to development in small, medium sized and larger centres • Links London Plan policy to proposed retail PD rights criteria • Planning criteria to help manage ‘negative clusters’ eg of betting shops, takeaways Town centre network Potential future changes to the town centre network FALP Timetable 12 week public consultation from 15 January to 10 April 2014 FALP launch event at City Hall on 31st January 2014 at 2pm Series of consultation events with voluntary sector, business sector, POS event, the wider South East, 5 London sub region. EIP late summer 2014 Final publication spring 2015 Questions?