BE SURE TO WRITE YOUR NAME ON YOUR ANSWER SHEET!! IMPORTANT

advertisement

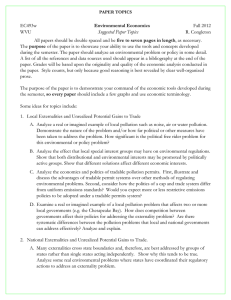

BE SURE TO WRITE YOUR NAME ON YOUR ANSWER SHEET!! IMPORTANT: MAKE ALL ERASURES COMPLETELY - IT IS YOUR RESPONSIBILITY TO CLEARLY INDICATE YOUR CHOSEN ANSWER. RESPONSES THAT ARE NOT COMPLETELY ERASED WILL BE COUNTED AS INCORRECT. THIS EXAM IS WORTH 100 POINTS. Temple College Government 2301/2302 Spring, 2000 Final Exam MULTIPLE CHOICE. INSTRUCTIONS: Answer each of the following multiple-choice questions by marking the letter on your scan-tron form that corresponds to the BEST response. 40 questions/2.5 points each/100 points total. 1. According to the videotaped program on public goods, which of the following constituted a public good and therefore justified government involvement? a. providing flood control and navigation improvements on the Great Tennessee River in the 1930s b. preventing further contamination of Lake Superior from tailings disposals by the Reserve Mining Company in the 1970s c. improving trade relations with the People’s Republic of China in the 1970s d. removing lead from gasoline in the 1970s 2. Which government agency was given the primary responsibility for providing the public good referred to in the previous question? a. the Environmental Protection Agency b. the Department of Commerce c. the United States Coast Guard d. the Tennessee Valley Authority 3. According to the videotaped program on public goods, Proposition 13 a. was the tax rollback initiative that occurred in California in the late 1970s. b. the name given to the national health care proposals introduced during the Truman Administration. c. was the code name given to Nixon’s trip to China in the early 1970s. d. was the Environmental Protection Agency’s plan to reduce lead in gasoline. 4. According to the videotaped program on public goods, the debate over Proposition 13 illustrates a. why citizens should not become involved in the political process. b. why the free-rider problem cannot be applied to real world situations. c. how people disagree sharply over the extent to which government should provide public goods. d. why businesses cannot be forced to “internalize” pollution costs. 5. A condition that exists when a private market fails to capture all of the social costs associated with the production and consumption of a good or service is known as a. a negative externality. b. a positive externality. c. adverse selection. d. the free rider problem. 6. What policy responses might government attempt to counter the condition described in question #5? a. subsidize the good or service b. provide the good or service c. regulate the market d. all of the above 7. Which good or service is most likely to have associated with it the kind of condition described in #5? a. higher education b. childhood immunizations c. automobiles d. public libraries 8. Which of the following is an example of a pure public good/service? a. airplane travel b. higher education c. national defense d. all of the above 9. Which of the following are the defining characteristics of a pure public good or service? 1. divisible and excludable 2. non-divisible and non-excludable 3. divisible and non-excludable 4. always provided by government 5. paid for through voluntary contributions a. 1 and 5 b. 1, 4, and 5 c. 3 and 4 d. 2 only 10. Which term is used to describe the phenomenon in which a rational person has no incentive to reveal his maximum willingness to pay for a public good? a. free-rider problem b. free-loader problem c. free-floater problem d. free-wheeler problem 11. Which of the following is NOT a type of market failure discussed in class? a. public goods b. externalities c. asymmetrical information d. bankruptcy 12. A city council bans smoking in all public places in the city. Fines are levied against violators. Why has the city council enacted this policy? a. This is an example of adverse selection -- non-smokers are adversely affected by second-hand smoke. b. This is an example of government providing a public good -- it is doing what is good for the public. c. This is an example of a negative externality -- the market for cigarettes fails to capture all of the social costs associated with the production and consumption of cigarettes. d. none of the above. 13. Which of the following are among the factors of production discussed in class? a. capital b. labor c. natural resources d. all of these 14. The human effort applied to the production of goods and services is a. capital b. labor c. natural resources d. none of these 15. Goods that have been produced for use in the producing other goods are a. capital b. labor c. natural resources d. none of these 16. A production possibilities curve illustrates the basic principle that a. the production of more of any one good will over time require smaller and smaller sacrifices of other goods. b. an economy will automatically seek the level of output at which all of its resources are employed. c. if all the resources available to an economy are in use, more of one good can be produced only if less of another good is produced. d. an economy’s capacity to produce increases in proportion to its population. 17. The economy depicted by the production possibilities curve to the right can produce which combinations of goods X and Y? 1. E 2. C 3. B 4. A 5. D a. A only b. A, B, C, and D c. B, C, and D d. E only 18. In the above graph, which point indicates that the economy is under-employing its factors of production? a. A, B, or C b. A c. E d. D or E 19. The linear production possibilities curves for two countries’ economies (A and B) are presented in the graph to the right. Assume these two countries can produce only two goods, food and shelter. We can conclude that a. the different value systems in each country make it impossible to compare the opportunity costs in the two countries. b. the opportunity cost of shelter is greater in B than in A. c. the opportunity cost of food is greater in A than in B. d. the opportunity cost of shelter is greater in A than in B. 20. If an economy has comparative advantage in producing a particular good then a. it is the only economy that is allowed to produce the good under international trade agreements. b. it has the lowest cost for producing that good. c. it will likely specialize in the production of that good or service. d. b and c. 21. The tendency for interest groups to try to persuade government officials to enact trade barriers to protect domestic producers from foreign competitors is known as a. politicking. b. dumping. c. campaigning. d. rent-seeking. 22. According to the videotaped program on free trade, the practice of British and German steel companies of selling steel in American markets at prices below their costs of production was called a. smelting. b. dumping. c. underbidding. d. protectionism. 23. According to the videotaped program on free trade, how did the American government respond to the practice of the British and German steel companies described in the previous question? a. by enacting new tariffs on foreign steel b. by subsidizing domestic steel producers c. by conducting investigations into unfair trade practices whenever the selling price dipped below the costs of production for Japanese steel companies d. by negotiating a trade deal with Canada and Mexico to export American steel. 24. According to the videotaped program on free trade, the American policy response indicated by the correct answer to the previous question was called the a. TPM (trigger price mechanism). b. DSM (Domestic Steel Subsidy). c. GATT (General Agreement on Tariffs and Trades). d. NAFTA (North American Free Trade Agreement). 25. Which of the following represents a possible policy response to a negative externality? 1. direct controls (regulations) 2. taxes 3. prohibition 4. subsidies 5. litigation a. 1, 3, and 5 b. 2, 4, and 5 c. 1, 2, 3, and 5 d. 1, 2, 3, and 4 26. Which of the following outcomes was observed in our analysis of the Lawn Ornament experiment (negative externalities)? 1. the pollution tax effectively reduced pollution damages 2. the pollution permits effectively reduced pollution damages 3. both policies produced more efficient outcomes than the private market 4. the pollution tax produced a more efficient outcome than the pollution permits 5. the pollution permits produced a more efficient outcome than the pollution tax a. 1, 2, and 3 b. 2, 3, and 4 c. 2, 3, and 5 d. 1, 3, and 5 27. Suppose one week before the final exam a company takes out an advertisement in the school newspaper offering “failure insurance” to college students such that if a student policy holder fails a course, the company will pay the student policy holder a benefit of $500. Federal law prevents professors from telling the company the students’ grades. Which of the following seems to be a likely outcome? 1. only students who have a high probability of failing a course will buy the insurance 2. holding a policy provides students with a disincentive to study 3. the company will pay out claims to a high percentage of policy holders 4. to make a profit , the company will have to charge a premium that exceeds the benefit it pays out to a policy holder 5. the private market for “failure insurance” will fail to produce an efficient outcome a. all of the above b. 1, 2, 3, and 4 c. 2, 3, 4, and 5 d. 1, 3, and 5 28. In the “failure insurance” example, the tendency for students who have a high probability of failing to buy the insurance is known as a. the moral hazard problem. b. the adverse selection problem. c. a negative externality. d. none of these. 29. In the “failure insurance” example, the tendency for students who buy the insurance to devote less effort to passing the class is known as a. the moral hazard problem. b. the adverse selection problem. c. a negative externality. d. none of these. 30. In which of the following cases will there likely be asymmetric information? 1. medical insurance 2. life insurance 3. automobile insurance 4. buying used cars 5. applying for jobs and hiring decisions a. 1, 2, and 3 b. 4 and 5 c. 1 and 2 d. all of these 31. In which of the following cases would the demander likely have an information advantage? 1. medical insurance 2. life insurance 3. automobile insurance 4. buying used cars 5. applying for jobs and hiring decisions a. 1, 2, and 3 b. 4 and 5 c. 1 and 2 d. all of these 32. In which of the following cases would the supplier likely have an information advantage? 1. medical insurance 2. life insurance 3. automobile insurance 4. buying used cars 5. applying for jobs and hiring decisions a. 1, 2, and 3 b. 4 and 5 c. 1 and 2 d. all of these 33. Markets that produce spillover benefits (benefits to 3rd parties) are said to have a. positive externalities. b. negative externalities. c. an adverse selection problem. d. free-rider problem. 34. Examples of the markets that have spillover benefits would include a. childhood immunizations. b. higher education. c. trimming tree limbs away from power lines d. all of these. 35. How might government attempt to counter the spillover benefits that result from the market(s) indicated by the answer to the previous question? a. tax the activity b. regulate the activity c. subsidize the activity d. prohibit the activity 36. According to the videotaped program on negative externalities, which analytical technique was used by the Environmental Agency to determine whether a rule mandating the removal of lead from gasoline should be adopted? a. cost effectiveness study b. cost-benefit analysis c. cost efficiency study d. none of these 37. According to the videotaped program on negative externalities, the experience of the Environmental Protection Agency’s efforts to reduce smog in Los Angeles primarily illustrates the principle a. that people will make significant sacrifices to have cleaner air. b. that the government really doesn’t know what it is doing when it comes to pollution control. c. that cleaner air has become a valued commodity and therefore has a “price.” d. The air in Los Angeles was as clean as was technologically possible so government control were unnecessary. 38. According to the videotaped program on negative externalities, when determining how much we want to reduce pollution, we should continue to reduce pollution a. until the marginal (additional) costs of cleaning up a unit of pollution begin to exceed the marginal (additional) benefits. b. we have eliminated pollution entirely. c. the government determines that the socially optimal level of pollution has been achieved. d. none of these 39. According to the videotaped program on negative externalities, the fact that Reserve Mining Company dumped their “tailings” into Lake Superior illustrates the principle that a. capitalism is inherently evil. b. the nation’s water resources are abundant and resilient and can be used as receptacles for industrial waste without risk of environmental damage. c. private businesses have no rational incentive to take the social costs of their production processes into account. d. pollution permits do not work in practice. 40. Examine the graph below indicating the government’s response to an externality problem. Which of the following statements is true? 1. The government has imposed a tax on the suppliers. 2. The government is providing a subsidy to the demanders. 3. The private market is over-allocating resources to this good (producing more than the socially-optimal amount). 4. The private market is under-allocating resources to this good (producing less than the socially-optimal amount). 5. The private market has failed to produce an efficient outcome because it does not take into considerations all of the social costs associated with this good. a. 1, 2, and 4 b. 3, 4, and 5 c. 1, 3, and 4 d. 1, 3, and 5