Investments

advertisement

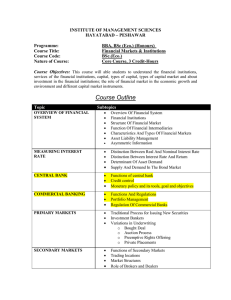

Investments Thomas E. Nolan, MD, MBA Abe Mickal Professor and Chair of Obstetrics and Gynecology Director, Women’s and Newborn Services LSU-Health Science Center New Orleans Objectives – Understand the relationship of risk and reward of different financial vehicles – Have fundamental appreciation of why and how to diversify a portfolio – Considerations to take when saving for college, retirement – Taxation and estate planning (and impact of divorce) – Understand different investment vehicles – Pitfalls Starting Out • Debt management – School loans – Automobiles – House • Cash reserves – 3-6 months of net income in cash, money market or short term bond fund School Loans • Consolidate high interest loans – Most banks will provide the service – Consider a 10 year time period to pay off loans so that other funds can be vested in retirement plans – Make sure there is no penalty to prepay the loans • Look for “forgiveness” programs – Rural and minority programs Starting Out • Level of debt that bankers and lenders use as a benchmark – Monthly housing costs (principal, interest, taxes, fees and insurance) should be no more than 28% of gross income – 20% of net income (after tax) Starting Out • The good old days of banks giving doctors big breaks is essentially gone, except in rural areas • Debt pitfalls early in career – Too much house (you may move!!!) – Too much car (you don’t deserve it) – Too much credit card debt (restaurant, vacation, furniture) Smart Debt • Mortgage debt is tax deductible and hopefully your home will appreciate • Once the mortgage debt is established, then home equity debt, if available in your state, (also tax deductible) can be used for large ticket purchases such as cars, furniture and collectables Percent Stock/Bond/Cash 0/90/10 10/80/10 20/70/10 30/60/10 40/50/10 50/40/10 60/30/10 70/20/10 80/10/10 90/0/10 Percent Return Reward versus Risk 1926-1997 14 12 10 8 6 4 2 0 Investments • • • • • • Equities Bonds Cash Real Estate Collectibles Precious Metals Investments • Where doctors have traditionally made mistakes – Live off cash flow or “pay as you go” rather than saving for goals – Love tax schemes and limited partnerships – Recent trends—Offshore trusts—The IRS never lets an American Dollar loose Investments-Equities Slide from 2/14/2000 • Primarily common stock • In past 18 years, it has been the place to be (especially in a low inflationary environment) • Dividends have become less important • Is the most volatile investment (greatest risk, greatest rewards) Investments-Equities • Primarily common stock • From 1982-2001 the market was returning ~ 14.5% (Dow >11,000, NASDAQ >5000), but after bubble burst, returned to ~11% • Delayed many retirements, need consistent long term view Investments-Equities • Dividends have become more important because of tax consequences (15%) • Is the most volatile investment (greatest risk, greatest rewards) Investments-Equities • Is where the young physician should be, because there is time to “ride out” down markets • Problem: the market has was too good for too long. Remember 1929 1987 and 2001—They are real (and I have very vivid memories of 1987 and 2001) Investments-Equities • Types of Stocks – Growth—fast growing companies, may have limited equity, but rapidly increasing cash. Amazon, Google, Sirius radio – Value—older companies, may have dividends, not currently in favor. General Electric – Equity income—Usually have good dividends, stable companies. Altria (do you know the company?), Utilities Investments-Equities • Mid cap funds: Primarily companies found in the Fortune 100-500. Definitions may change, but not at the level of GE, Microsoft, Dell, etc. • Small cap funds: Usually defined as having market capitalization of < 2 billion dollars, usually more volatile, but may have longer term growth Investments-Equities 2/14/2000 • Best performance over the past decade have been large capitalization growth stocks (lagged since 2001) • Historically they have returned ~11% annually • Overtime small caps have done better ~12.5%, but have done poorly last decade (outperformed since 2001) Investments-Equities • Hedge funds: Use exotic instruments for investments, tend to short markets and use leverage to increase return • Did very well during the bubble bursting, but can be “squeezed” if markets turn against them • High net worth individuals that can afford loss and expense (managers take first 20% of profit) Bonds • Historically have returned ~5.5-6% • May be more volatile than common stock if less than investment grade or in rapidly changing interest markets • Credit grade affects price and return (i.e., Treasury have highest grade and traditionally lower return, while start up companies have low grade and highest return—Junk bonds (i.e., risk) Bonds • Are affected by multiple risks (interest rate risk, reinvestment rate risk, default risk and purchasing power risk, i.e., inflation risk) • Trading bonds can be more risky than stocks (remember, a stock usually has a product or service, not a promise to repay!) Bonds • Most bonds are in one of three categories: – Short term: 1 year or less – Intermediate: 2-10 years – Long term: > 10 years • Common bond strategy is to “ladder bonds,” a portfolio of bonds with varying maturities or “duration” 3 Duration 30 year 25 year 20 year 15 year 10 year 5 year 3 year 1 year 6 month 3 month Yield Yield Curve (Appoximately 2000) 7 6.5 6 5.5 5 4.5 4 3.5 Bonds • The higher yield for the longer bond is because of default risk, inflation risk and general time value of money (TVM) • TVM is the erosion of purchasing power over time and is important in rating bonds, considering retirement and general money management Effect of Martket Interest Rate on Bond Price (6% coupon, 20 year bond) $140.00 Bond Price (as reported) $120.00 $100.00 $80.00 Coupon Prem/Discount $60.00 $40.00 $20.00 $0.00 Actual Interest Rates (4.5-7.5%) Municipal Bonds • Primarily issued by local authorities for projects • Are tax free at the Federal Level (except for individuals at the Alternative Minimum Tax level) • If you live in the state of issue, they are probably tax free at state level. These are called “double tax free” Municipal Bonds • Tax effective yield: – Divide the yield of the bond by 1 minus your marginal (highest tax rate) tax rate – 6% / (1-.28) = 6% / .72 = 8.34% – 6% / (1-.35) = 6% / .61 = 9.23% • Primarily used by investors in high tax brackets Money Markets • Return is low (currently ~2.2%) but the risk is negligible • Most funds consist of U.S. treasury issues and AAA corporate securities • Have a maturity < 270 days • Considered as liquid as cash Real Estate • Your home (usually a first investment) • Rental property (can be a real headache unless professionally managed) • Limited partnerships (watch out unless you know the market well) • REIT (Real estate investment trusts) – May be equity or mortgage based Real Estate • REIT can be used to diversify a portfolio • By definition, they must pay out 90% of the annual income • Can be a dividend play (current cash) or capital gain (long term appreciation) • Vanguard and others have indexes and mutual fund options (the mutual funds, however, may be in common stock, etc.) Collectibles • Limited market, hence “spread” (difference between what you pay and what it cost to dealer) • Markets can be extremely volatile • Requires special knowledge (antiques, art, coins, etc.) • Probably should be a hobby and not retirement planning (barred from 401 (k)’s etc.) Precious Metals • Prior to 1974 (Brenton Woods agreement), gold was a significant factor in international currency stability • Free global markets have replaced the gold standard. Many countries have been dumping their gold in response • Other metals (platinum and silver) are commodities rather investment vehicles How to Invest? • Depends on the level of involvement and level of sophistication – Internet has changed investing forever – Individual accounts (on-line investors) – Stock brokers (individual funds, family of load mutual funds) – Mutual funds, self directed – Trust companies, banks, etc. How to invest • Level of involvement is key concept – Individual stocks, bonds, etc. – ETF (baskets of fixed stocks) that can be traded – Broker—family of vehicles – On line trading, etc. Mutual Funds • Have professional full time managers • Professional diversification • Have numerous vehicles for investment (stock, bonds, money market, international, emerging market, REITs and annuities) • Low cost to get started Mutual Funds • Evaluating funds: – Morningstar, New York Times, Forbes – Consider companies that have mutual ownership rather than company – Look at families of funds (able to transfer to different funds easily) – Consider long term returns rather than the hottest at the moment Mutual Funds • Different types: – Load funds: charge a “load” or expense when buying (front load or A class), selling (back load or B class, usually decreases by 1% annually, starting at 6%) and 12-1(b) (C Class) which is assessed annually – Mostly sold by stock brokers, a source of income for them. Average load is 5.75%, decreases with amount invested Mutual Funds • B funds have come under very close scrutiny because brokers make the most money on them (SEC consider eliminating them as vehicle) • Make sure you know the “break” points (load drops to 0 at 1,000,000) • Also evaluate turnover, expenses Mutual Funds • Low load funds: – Usually front loads and average 3%. – Also sold by brokers – May be used by certain mutual fund companies for “hot funds”—Fidelity • No load funds: no up front costs, usually distributed by mail or internet, have become increasingly popular Mutual Funds • Load versus no load: – Arguments abound on this issue—may depend on investor comfort level – Management fees for some no loads may be as high as 2% annually, while load funds may be <1% – Most experts prefer no load funds, but there are some sound arguments on both sides Mutual Funds • Probably the most important aspect of investing is to have a reasonable mix of funds (index, large cap, mid cap, small cap, growth, international and bonds) and to invest for the long term. Stay away from trends, and keep your discipline • The sun don’t shine on the same dog all day long Mutual Funds • Young investor – Invest primarily in growth and small cap stocks and if closely involved consider speculative areas—sector funds – Income generation is not important, but long term growth of capital – Key concept: Keep the long view!!!! – Don’t over react Mutual Funds • After a good base is funded – Add other investments such as large cap value, mid-caps, international stocks and bonds – The concept is that not all markets move together and diversification decreases overall volatility Mutual Funds • Older investor: usually defined as 5 or less years to retirement – Increase fixed income such as bonds and mortgage backed securities – Lots of controversy to “equity risk” – 100 – age = Equity exposure – Does not factor in risk tolerance, income needs Mutual Funds • Latest products are so-called lifestyle funds • You select either an age or year of retirement and the fund company will alter the mix as you get older (stock: bond: international stock: money markets) • Companies vary greatly on the mix and investment vehicles Exchange Traded Funds (ETF) • Similar to mutual funds—basket of securities, but traded on exchanges • Bundled into a single “stock” that is traded on an exchange as any equity • Maybe wave of the future—debates rage in WSJ, etc. on suitability for long term investing vs. mutual funds Summary • Know your risk tolerance and needs • Investment advice and advisors come in all flavors • Recognize the limitations that any one group have to offer • Do something!! And monitor results!