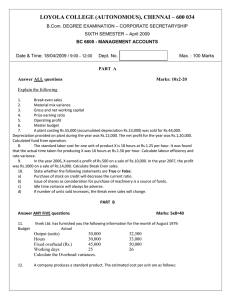

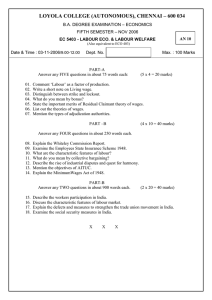

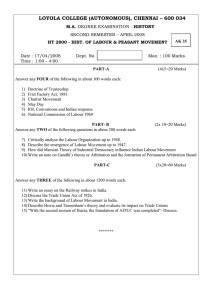

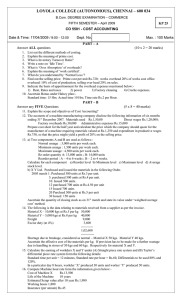

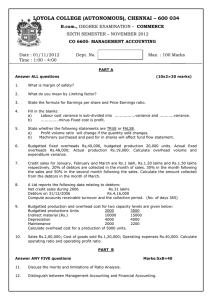

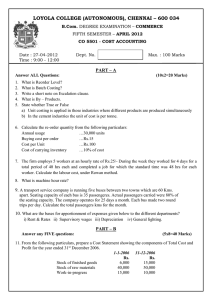

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

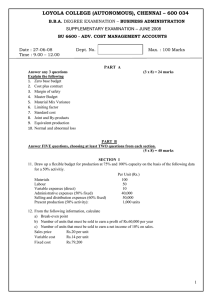

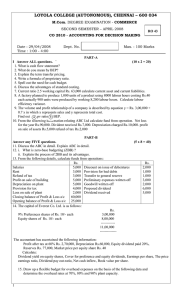

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.B.A. DEGREE EXAMINATION – BUSINESS ADMINISTRATION SUPPLEMENTARY EXAMINATION – JUNE 2009 BU 6603 - MANAGEMENT ACCOUNTING Date & Time: 25/06/2009 / 10:00 - 1:00 Dept. No. Max. : 100 Marks PART A Answer ALL questions: Marks:10x2=20 Explain the following: 1. Break Even Point 2. Current Ratio 3. Fund From Operations 4. Zero Based Budget 5. Labour Mix Variance 6. Debt Equity Ratio 7. From the following date calculate Labour Rate and Efficience Variance. Standard Labour cost per unit 10 hours at Rs. 0.50 per hour. During a week 500 units were produced, 6500 hours were worked and Rs.2400 wages were paid. 8. From the following data calculate PV ratio and Profit: Sales Rs.20,000; Fixed expenses Rs.4,000; Break even sales Rs.10,000 9. Ascertain change in Working Capital from the following: Increase in current assets Rs.12,000 Decrease in current assets Rs.9,000 Increase in current liability Rs.10,000 Decrease in current liability Rs.12,000 10. From the following calculate current Assets and Current Liabilities: Current ratio 3.5 Liquid ratio 2.5 Working capital Rs.1,00,000 PART B Answer ANY FIVE questions Marks: 5x8=40 11. “Marginal costing is a valuable aid in decision making”. Explain. 12. What is Variance Analysis? Explain the various Labour Variances. 13. A Ltd plans to sell 50,000 units of product M in the next year. Two kinds of raw materials A and B are required to manufacture the product. Each unit of M requires 2 units of A and 3 units of B. The estimated opening and closing balances of the next year are as follows: Opening balance Closing Balance M 8,000 units 6,000 units A 12,000 units 13,000 units B 15,000 units 16,000 units Prepare a Purchase Budget for the next year. 14. From the following data, calculate GP ratio, Operating Profit Ratio, Operating Ratio, Interest Coverage Ratio: Sales Rs.20,00,000 Cost of Goods sold Rs.12,00,000 Office Expenses Rs.60,000 Selling Expenses Rs.40,000 Interest Received Rs.5,000 Loss on sale of Assets Rs.4,000 Interest on debentures Rs.70,100 15. From the following data, calculate Overhead Variances: Budgeted Fixed Overheads Rs.1,00,000 Budgeted Production 50,000 units Actual Production 54,000 units Actual Fixed Overheads Rs.1,20,000 16. From the following information prepare a Balance Sheet: a) Current ratio 2.5 b) Liquidity ratio 1.5 c) Fixed assets to proprietor’s fund 0.75 d) Working capital Rs.60,000 e) Reserves and surplus Rs.40,000 f) Bank overdraft Rs.10,000 g) There is no long-term loan or fictitious asset. 17. From the following data compute Fund From Operations: Gross profit Rs.2,15,000 Administration expenses Rs.25,000 Selling expenses Rs.16,000 Depreciation Rs.26,000 Loss on sales of asset Rs.6,000 Goodwill written off Rs.5,000 Discount on issue of Debentures Rs.2,000 Interest on investment Rs.5,000 Profit on sale of machine Rs.4,000 18. R. Ltd produces two products X and Y. Labour is in short supply. The following date relates to the year 2008: X (Rs.) Y(Rs.) Material per unit 40 60 Labour at Rs.2 per hour 20 12 Variable overheads 10 6 Selling price 100 120 Assuming that the maximum labour hours available is 36,000 and a minimum of 900 units of each product has to be produced, what is the most profitable production mix? PART C Answer any TWO questions Marks:2x20-40 19. The sales turnover and profit for 2 years are as follows: Year Sales(Rs) Profit (Rs.) 2007 1,40,000 15,000 2008 1,60,000 20,000 Calculate a) PV ratio b) Fixed cost c) Break even sales d) Sales to earn a profit of Rs.40,000 e) Profit when sales are Rs.1,20,000. 20. From the following information calculate Material variances: Standard material cost for the job: Material X 20 kgs at Rs.5 per kg Material Y 16 kgs at Rs.4 per kg Material Z 12 kgs at Rs.3 per kg Actual material cost for the job: X 24 kgs at Rs.4 per kg Y 14 kgs at Rs.4.50 per kg Z 10 kgs at Rs.3.25 per kg 21. The Balance Sheet of AB Ltd. as on 31/12/2007 and 31/12/2008 are given below: 2007 (Rs.) Equity capital 1,00,000 P/L a/c 30,000 General Reserve 30,000 12% Debentures 1,00,000 Creditors 60,000 Tax provision 60,000 ---------3,80,000 a) b) c) d) e) 2008 (Rs.) 1,50,000 70,000 40,000 1,80,000 40,000 90,000 ----------5,70,000 Fixed assets Investments Stock Debtors Bank 2007 (Rs.) 2008 (Rs.) 2,00,000 30,000 60,000 50,000 40,000 3,50,000 60,000 40,000 60,000 60,000 ---------4,00,000 ---------6,70,000 Depreciation provided on fixed assets during the year 2008 was Rs.60,000 Investments costing Rs.10,000 was sold during the year for Rs.15,000 Tax paid during the year Rs.75,000 Interim dividend paid during the year Rs.20,000 During the year Fixed Assets costing Rs.50,000 (Accumulated depreciation Rs.30,000 ) was sold for Rs.20,000 Prepare statement showing sources and application of funds. *****