LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

advertisement

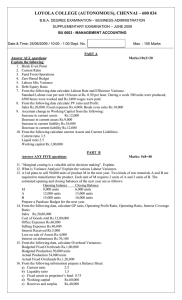

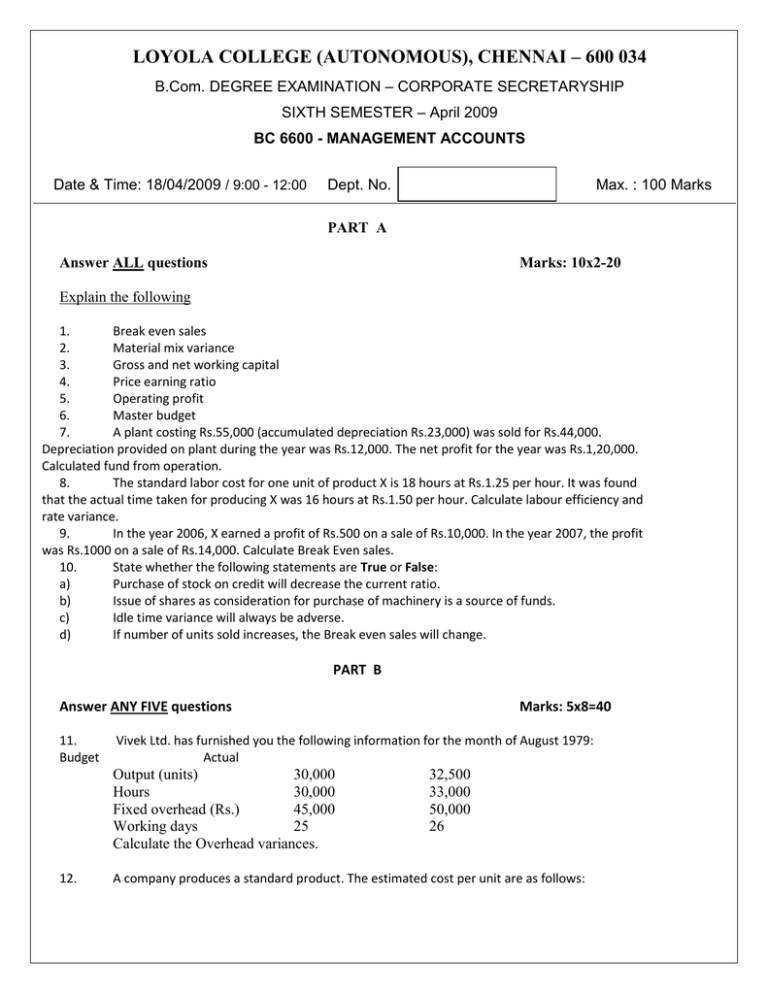

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.Com. DEGREE EXAMINATION – CORPORATE SECRETARYSHIP SIXTH SEMESTER – April 2009 BC 6600 - MANAGEMENT ACCOUNTS Date & Time: 18/04/2009 / 9:00 - 12:00 Dept. No. Max. : 100 Marks PART A Answer ALL questions Marks: 10x2-20 Explain the following 1. Break even sales 2. Material mix variance 3. Gross and net working capital 4. Price earning ratio 5. Operating profit 6. Master budget 7. A plant costing Rs.55,000 (accumulated depreciation Rs.23,000) was sold for Rs.44,000. Depreciation provided on plant during the year was Rs.12,000. The net profit for the year was Rs.1,20,000. Calculated fund from operation. 8. The standard labor cost for one unit of product X is 18 hours at Rs.1.25 per hour. It was found that the actual time taken for producing X was 16 hours at Rs.1.50 per hour. Calculate labour efficiency and rate variance. 9. In the year 2006, X earned a profit of Rs.500 on a sale of Rs.10,000. In the year 2007, the profit was Rs.1000 on a sale of Rs.14,000. Calculate Break Even sales. 10. State whether the following statements are True or False: a) Purchase of stock on credit will decrease the current ratio. b) Issue of shares as consideration for purchase of machinery is a source of funds. c) Idle time variance will always be adverse. d) If number of units sold increases, the Break even sales will change. PART B Answer ANY FIVE questions 11. Budget Vivek Ltd. has furnished you the following information for the month of August 1979: Actual Output (units) 30,000 Hours 30,000 Fixed overhead (Rs.) 45,000 Working days 25 Calculate the Overhead variances. 12. Marks: 5x8=40 32,500 33,000 50,000 26 A company produces a standard product. The estimated cost per unit are as follows: Raw material Rs.4; WagesmRs.2; Variable overhead Rs.5 The semi-variable costs are: Indirect materials Rs.235; Indirect labour Rs.156; Repairs Rs.570 The variable costs per unit included in semi-variable are: Indirect materials Re.0.05; Labour Re.0.08 and Repairs Re.0.10 The fixed costs are: Factory Rs.2,000; Administration Rs.3,000; Selling and distribution Rs.5,000 The above costs are for 70% of normal capacity producing 700 units. The selling price is Rs.30 per unit. Prepare flexible budget for 80% of normal capacity, showing cost per unit, total cost and profit. 13. The following particulars are taken from the records of a company engaged in producing two products X and Y. Product X Product Y (Rs./unit) (Rs./unit) Sales 125 Material cost (Rs.25.50 per kg) 25 62.50 Direct labour (Rs.1.50 per hour) 37.50 75 Variable overheads 12.50 25 Comment on the profitability of each product, when: 250 i) Raw material is in short supply ii) Labour hours is limited iii) When total raw material available is 20,000 kgs and the maximum sales potential of each product is 1000 units, calculate the most profitable profit mix and the maximum profit for that product mix, assuming fixed costs are Rs.50,000 14. Using the information below, prepare a cash budget showing expected cash receipts and disbursements for the month of June and balance expected on June 30,2009: Budgeted cash balance June 1, 2009 Rs.1,20,000. Budgeted sales and purchases are as follows: Month Sales(Rs.) Purchases (Rs.) April 12,00,000 6,00,000 May 15,00,000 8,00,000 June 16,00,000 10,00,000 Half the sales are collected in the month of sale, 40% in the next month and 10% in the third month. 40% of purchases are paid in the month of purchase and 60% paid in next month. Wages payable in June Rs.1,76,000 Annual insurance premium payable in June Rs.4,000. Other expenses payable in June Rs.88,000, including depreciation for the month of June Rs.4,000 Accrued taxes for June, payable in December Rs.12,000. Fixed deposit receipts due June 15 – Rs.3,50,000 plus Rs.20,000 interest. A computer costing Rs.35,000 is to be purchased in June. Cash down Rs.10,000 is to be paid on delivery and the balance in 3 monthly installments of Rs.10,000 each, payable at the end of each month. 15. Cookwell Ltd manufactures pressure cookers, the selling price of which is Rs.300 per unit. Currently the capacity utilization is 60% with a sales turnover of Rs.18,00,000. The company proposes to reduce the selling price by 20% but desires to maintain the same profit position by increasing the output. Assuming that the increased output could be made and sold, determine the level at which the company should operate to achieve the desired objective. The following further data are available: i) Variable cost per unit Rs.60 ii) Semi variable cost (including a variable element of Rs.10 per unit) Rs.1,80,000 iii) Fixed cost Rs.3,00,000. 16. A company has the following transactions during the year ended 30th June 2008: Rs. Increase in stock Profit before tax Decrease in receivables Increase in paid up capital Dividend payment Rs. 4,500 Depreciation 3,000 12,000 Decrease in creditors 1,500 4,500 Increase in long term loan 7,500 3,000 Increase in cash balance 4,500 6,000 Decrease in marketable investments 1,500 Purchase of fixed assets 12,000 Payment of taxes Prepare Funds Flow statement for the year 2007-08 3,000 17. How is marginal costing useful in decision making? 18. What is zero based budgeting? Explain its merits and limitations. PART C Answer ANY TWO questions 20=40 19. The following are the Balance Sheets of ABC Ltd as on 31st March 2006 and 31st March 2007. 31/3/2006 31/3/2007 Rs. Rs. Share capital 3,00,000 3,50,000 Fixed Assets P/L Account 4,90,000 6,96,000 Investments Long-term loans 5,00,000 2,00,000 Stock Creditors 70,000 58,000 Debtors Tax provision 86,000 1,02,000 Bank Proposed Dividend 24,000 30,000 Cash 14,70,000 a) b) c) d) e) Marks: 2 x 14,36,000 31/3/2006 31/3/2007 Rs Rs. 13,36,000 12,78,000 20,000 20,000 24,000 38,000 56,000 50,000 48,000 6,000 30,000 14,70,000 14,36,000 Depreciation provided on Fixed Assets Rs.1,00,000 Fixed Asset whose book value was Rs.50,000 was sold for Rs.40,000 Tax paid during the year Rs.80,000 The proposed dividend of 2006 was paid in 2007 Investments were sold at a profit of Rs.2000 Prepare Fund Flow Statement. 20. S.V.Ltd manufactures a product, the standard mix of which is: Material A 60% at Rs.20 per kg Material B 40% at Rs.10 per kg Normal loss in production is 20% of input. Due to shortage of material A, the standard mix was changed. Actual results for March 1989 were: Material A 105 kg at Rs.20 per kg Material B 95 kg at Rs.9 per kg Input 200 kgs Less: Loss 35 kg Output 165 kgs Calculate: (i) Material price variance; (ii) Material usage variance; (iii) Material mix variance and (iv) Material yield variance. 21. Using the following data, complete the balance sheet below: Gross profit ratio 20% Current ratio 1.8 Stock turnover ratio 4 times Debt collection period (360 days per year) 20 days Long-term debt to shareholders’ equity 40% Total assets turnover 0.3 times Credit sales to total sales 80% Gross profit Rs.1,08,000 Shareholders’ equity Rs.12,00,000 @@@