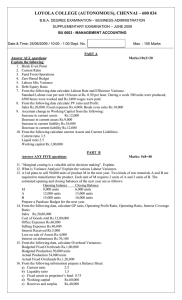

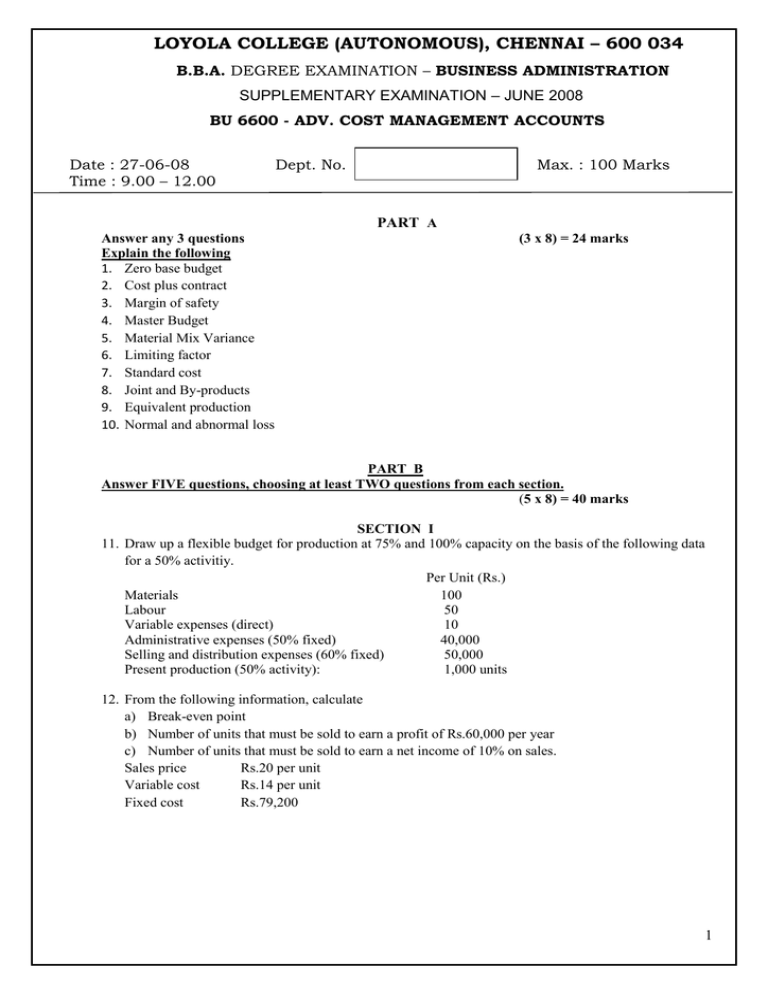

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 – JUNE 2008 SUPPLEMENTARY EXAMINATION

advertisement

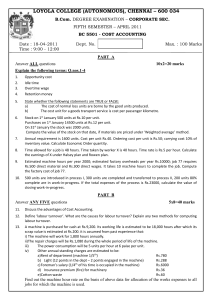

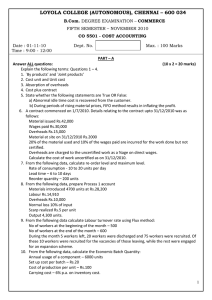

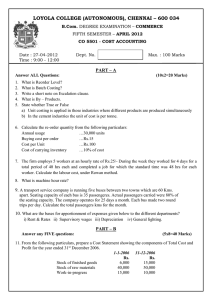

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034 B.B.A. DEGREE EXAMINATION – BUSINESS ADMINISTRATION SUPPLEMENTARY EXAMINATION – JUNE 2008 BU 6600 - ADV. COST MANAGEMENT ACCOUNTS Date : 27-06-08 Time : 9.00 – 12.00 Dept. No. Max. : 100 Marks PART A Answer any 3 questions Explain the following 1. Zero base budget 2. Cost plus contract 3. Margin of safety 4. Master Budget 5. Material Mix Variance 6. Limiting factor 7. Standard cost 8. Joint and By-products 9. Equivalent production 10. Normal and abnormal loss (3 x 8) = 24 marks PART B Answer FIVE questions, choosing at least TWO questions from each section. (5 x 8) = 40 marks SECTION I 11. Draw up a flexible budget for production at 75% and 100% capacity on the basis of the following data for a 50% activitiy. Per Unit (Rs.) Materials 100 Labour 50 Variable expenses (direct) 10 Administrative expenses (50% fixed) 40,000 Selling and distribution expenses (60% fixed) 50,000 Present production (50% activity): 1,000 units 12. From the following information, calculate a) Break-even point b) Number of units that must be sold to earn a profit of Rs.60,000 per year c) Number of units that must be sold to earn a net income of 10% on sales. Sales price Rs.20 per unit Variable cost Rs.14 per unit Fixed cost Rs.79,200 1 13. The following details relate to Product X during the month of March 2009. You are required to compute the material and labour cost variances. Standard cost per unit Material 50 kgs @ Rs.40 per kg Labour 400 hrs at Re.1 per hour Actual cost for the month Material 4,900 kgs @ Rs.42 per kg Labour 39,600 hours @ Re.1.10 per hour Actual production 100 units 14. “Marginal costing is a valuable aid for managerial decisions”. Explain SECTION II 15. A contractor obtained a contract for Rs.6,00,000 on 1st Jan.1988. the expenses incurred during the year ended 31st Dec.1988 were as under: Rs. Materials 1,80,000 Wages paid 1,60,000 Wages accrued 10,000 Other expenses 25,000 The plant, specially installed for the contract, worth Rs.45,000 was returned to the stores subject to a depreciation of 20%. Materials at site on 31.12.88 were valued at Rs.24,000 The contractor had received Rs.3,60,000 in cash upto 31.12.88 representing 80% of the work certified. Work uncertified was estimated at Rs.4,000. Prepare the contract account. 16. A by product B is obtained in the course of manufacturing Product A. The By product is further processed for sale. From the following data prepare a statement showing the cost per kg of Product A and By Product B. Joint expenses Separate expenses (Rs.) A(Rs.) B (Rs.) Material 10,000 6,000 500 Labour 7,000 5,000 2,000 Overheads 2,500 1,500 600 100 kgs of A and 50 kgs of B were produced. The selling price of B was Rs.120 per kg and the profit earned was 20%. 17. A transport company is running 4 buses between two towns which are 50 kms apart. The seating capacity of each bus is 40 passengers. The following particulars were obtained from their books for April 2008: Wages of driver, conductors etc. Rs.2,400 Office salaries Rs.1,000 Diesel Rs.4,000 Repairs Rs. 800 Road tax and insurance Rs.1,600 Depreciation Rs.2,600 Garage rent Rs.2,000 Actual passengers carried by 75% of the seating capacity All the four buses ran on all the days of the month. Each bus made one round trip per day. Calculate the cost per passenger per km. If the company wants a profit of 25% on cost, what should be the fare per passenger per km? 18. Distinguish between ‘Job costing’ and ‘Process costing’. 2 PART C Answer both questions (2 x 20)=40 marks 19a.From the following data forecast the cash position at the end of April, May and June 1998. Month Sales(Rs.) Purchase(Rs.) Wages(Rs.) Sundry expenses(Rs.) 1998 February 1,20,000 80,000 10,000 7,000 March 1,30,000 98,000 12,000 9,000 April 70,000 1,00,000 8,000 5,000 May 1,16,000 1,03,000 10,000 10,000 June 85,000 80,000 8,000 6,000 Further information: 10% of sales are for cash Balance equally realized in two subsequent months. Purchases: Creditors are paid in the month following the month of supply. Wages: 20% paid in arrears in the following month. Sundry expenses paid in the month itself. Income tax Rs.20,000 payable in June. Dividend Rs.12,000 payable in June. Income from investments Rs.2,000 received half-yearly in March and September. Cash balance on hand as on 1.4.98 Rs.40,000. OR 19b. the sales turnover and profit during 2 years were as follows: Year Sales(Rs.) Profit(Rs.) 2006 1,50,000 20,000 2007 1,70,000 25,000 Assuming that selling price per unit, variable cost per unit and the total fixed cost for the two years remain the same, calculate: a) PV ratio b) Break even sales c) Sales to earn a profit of Rs.40,000 d) Profit when sales are Rs.2,50,000 e) Margin of safety when profit is Rs.50,000 f) Variable cost in 2007 20a. From the following data ascertain the profit as per cost accounts and financial accounts and reconcile the two profits. a) No. of units produced and sold 2000 units b) Direct material Rs.10 per unit c) Direct wages Rs.5 per unit d) Selling price Rs.40 per unit e) The works overhead is charged at 80% of direct wages, office overheads at 25% on works cost and selling overheads at 10% on works cost. The actual works expenses were Rs.4,500, office overheads Rs.3,900 and selling overheads Rs.2000. f) The following items were included in financial accounts: Loss on sale of assets Rs.1000; Dividend received Rs.500 OR 20.b A company produces a product which passes through three processes A, B and C. 20000 units are introduced in processing at a cost of Rs.1 each. Other details are as follows: A B C Materials consumed (Rs.) 10,000 8,000 4,000 Direct wages 8,000 6,000 3,000 Factory expenses 1,000 1,000 1,500 Normal loss (%age on input) 2% 5% 10% Sale value of loss per unit (Rs) 0.25 0.50 1 Output in units 19,500 18,800 16,000 Prepare Process Accounts. ***** 3